Mortgage Morning, Realty Lee – Profits Dawn with Me

Realtor, Mortgage Broker, Business Consultant

As a licensed Realtor and Mortgage Broker, with 30+ years experiences in business, real estate, and mortgage, definitely I can help you achieve your goal regarding Realty Mortgage and business.

Morning Lee – Investor / Profit Coach

Mortgage

We have different services for different requirement

Real Estate

We have different Programs For Different Situations.

- Sell Vancouver Residential Property: Single Family Home / Single House, Town House / Town Home, Apartment / Condo, Duplex / Triplex / Fourplex

- Sell Vancouver Commercial Property: Warehouse, Office, Retail Store, Industrial, Plaza / Strip Mall, Multi-Family Building, Office Building

- Sell Vancouver Business

- Buy Vancouver Residential Property

- Buy Vancouver Commercial Property

- Buy Vancouver Business

Business

Our business Consulting service focus on the following

Contact Us here if you need any help for Mortgage, Realty & Business

-

Has Your Business Missed Out on Government Grants of Up to $10 Million Due to the US-China Trade War?

If more than 25% of your business revenue comes from the U.S. or China, you’ve likely felt the strain from the ongoing tariff battles. The volatility of trade policies and the uncertainty of the global landscape have put many import-export businesses in a tough spot. But here’s the good news—there’s a government program that might be exactly the lifeline your company needs.

The Tariff Response Initiative is designed specifically for companies like yours. It helps mitigate the negative impacts of tariffs and could provide you with financial support that doesn’t even have to be repaid. Yes, you read that right—eligible companies may receive funding anywhere from $200,000 to $10 million, and some of it may even be non-repayable.

What Are the Basic Requirements?

To be eligible for this program, your business needs to meet the following criteria:

- Employee Size: Your company must have between 10 and 499 full-time employees.

- Incorporation: The program is available to incorporated.

- Operating Duration: Your business must have been operating for at least three years.

In addition, non-profit organizations can also apply, which means more types of organizations can benefit from this initiative.

Why Is This Program So Important for Business Owners?

The uncertainty of tariffs has created significant challenges for many businesses, especially those heavily reliant on the U.S. and Chinese markets. This program aims to offer financial relief, helping companies navigate the obstacles brought on by tariffs. The funding can be used to adjust supply chains, improve production efficiency, or even offset rising operational costs.

More importantly, this initiative gives companies the financial cushion they need to survive in an uncertain environment, enabling them to pivot and continue to grow steadily.

For business owners who are struggling and meet the eligibility criteria, don’t miss out on what could be a lifeline in the form of government funding.

For more details, feel free to contact us.

-

Federal Budget Revamp, FY 2025-2026

Today, Finance Minister François-Philippe Champagne presented his first budget. Mark Carney was elected Prime Minister with a mandate to transform Canada’s economy and reduce its dependence on trade with the United States. The Carney government’s inaugural budget emphasizes structural changes to strengthen the domestic economy and boost non-U.S. exports, and it will be funded by an increase in government debt.

Carney, a former central banker who took office in March, has committed to decreasing reliance on the U.S. by increasing military spending, accelerating infrastructure projects, speeding up housing construction, and enhancing business competitiveness. Given the current large deficits and a rising debt-to-GDP ratio, the government cannot afford higher long-term interest rates. Carney has promised to build a stronger Canada using domestic resources and labour, noting that only 40% of the steel used in Canada is produced domestically, and he intends to change that.

Champagne has cautioned that the public service will need to shrink as the government strives to balance the budget in the coming years. Carney also faces a political challenge in convincing some opposition members to support his budget or at least abstain from voting against it. His Liberal Party caucus is currently three seats short of a majority in the House of Commons, meaning it cannot pass the budget on its own.

Unemployment remains high, economic growth is weak, and exporters, along with business investment, are still struggling due to U.S. tariffs. Carney and Champagne must persuade citizens that jobs, real wages, and living standards will eventually improve if they can stimulate both domestic and foreign investment.

Last week, the Bank of Canada indicated that it is nearing the limit of monetary stimulus it can provide without triggering inflation. Governor Tiff Macklem has consistently stated that he sees fiscal policy as a more effective tool to counter the adverse effects of the trade war, which he perceives as a negative supply shock.

The chart above indicates that Canada not only had the lowest deficit-to-GDP ratio in the G-7 but also among all countries with a triple-A credit rating. However, the rate at which we are issuing net new debt is expected to accelerate over the next year or two. Canada needs to assure the bond market that we will maintain our triple-A credit rating to keep financing costs manageable.

Ottawa has divided the budget into two parts: the operating budget and the capital spending budget. The operating budget covers the costs of running the federal government, which includes salaries, wages, rent, and interest payments on the debt. Carney has urged government leaders to review their operating budgets and eliminate unnecessary costs, which include downsizing the federal workforce.

A similar approach is used in countries like the United Kingdom and New Zealand, as well as by some provinces here at home. In principle, this shift could enhance transparency by allowing a better understanding of how public funds are allocated between day‑to‑day program spending and long‑term investments intended to boost future growth.

The capital spending budget is more complex because it’s harder to determine which expenditures will enhance growth and productivity. For instance, while the government is increasing defence spending to meet our NATO obligations, not all of it will contribute to productivity growth.

Ottawa’s agenda highlights major infrastructure projects, defence initiatives, housing, significant undertakings like pipelines, enhanced ports, and the development of the Ring of Fire. Federal leadership believes there is a role for industrial policy, as well as measures aimed at broad deregulation and tax competitiveness.

This year’s federal budget projects a deficit of $78.3 billion—nearly double the Liberals’ projection a year ago—prioritizing capital project spending over services. The deficit is expected to decrease gradually to $56.6 billion by 2029-30. Only a year ago, the Liberals forecast a 2025 budget deficit of $42.2 billion, but that was before trade uncertainty and tariff inflation hit our shores with the inauguration of Donald Trump last January.

The budget presents both downside and upside scenarios. In the downside scenario, ongoing trade uncertainty could worsen the budgetary balance by $9.2 billion annually, while the upside scenario anticipates a $5 billion annual improvement contingent on easing trade uncertainties.

Finance Minister François-Philippe Champagne emphasized the need for “generational” investments, allocating $25 billion to housing, $30 billion to defence, and $115 billion to infrastructure over the next five years. He criticized proposals to cap the deficit at $42 billion, advocating instead for investments to drive future growth.

The 2025 budget introduces a new format that separates capital and operational spending, with capital investments accounting for 58% of this year’s combined deficit. This shift aims to catalyze $500 billion in private-sector investment. However, we should be skeptical that such animal spirits will materialize quickly, given the immense uncertainty about the future of the Canada-Mexico-US free trade agreement.

The budget pledges to balance operational spending in three years.

Ottawa has been running a “comprehensive expenditure review” to spend less on the day-to-day operations of the federal government. According to the budget, that plan will save $13 billion annually by 2028-29, for a total of $60 billion in savings and revenues over five years.

The budget promises more taxpayer dollars will go toward “nation-building infrastructure, clean energy, innovation, productivity and less on day-to-day operating spending.” This “new discipline” will help protect social benefits, the budget promises.

The public service will see a drop of about 40,000 positions over the coming years. The budget projects it will have 330,000 employees in 2028-29, down from the 368,000 counted last year.

To confront an anemic economic picture, the government says it’s “supercharging growth” and vows to “make Canada’s investment environment more competitive than the U.S.”

To that end, the budget introduces a “productivity super-deduction” tax measure that will allow companies to write off a larger share of capital investments more quickly.

There are also new measures specifically for writing off expenses for manufacturing or processing buildings, as well as a new capital cost allowance for liquefied natural gas (LNG) equipment and related buildings.

Build Baby Build

Fast-tracking nation-building projects: In close partnership with provinces, territories, Indigenous Peoples, and private investors, the government is streamlining regulatory approvals and helping to structure financing.Additional Cuts to Immigration

Selling it as Ottawa “taking back control” over an immigration system that has put pressure on Canada’s housing supply and health-care system, budget 2025 promises to lower admission targets.The new plan proposes to drastically reduce the target for new temporary resident admissions from 673,650 in 2025 to 385,000 in 2026.

The 2026-28 immigration levels plan would keep permanent resident admission targets at 380,000 per year, down from 395,000 in 2025.

Ending Some High-End Taxes

The government is also proposing to undertake a one-time measure to accelerate the transition of up to 33,000 work permit holders to permanent residency in 2026 and 2027.“These workers have established strong roots in their communities, are paying taxes and are helping to build the strong economy Canada needs,” the budget notes.

To fill labour gaps, the Liberals’ plan includes a foreign credential recognition action fund to work with the provinces and territories to improve transparency, timeliness and consistency of foreign credential recognition.

It would also launch a strategy to attract international talent, including a one-time initiative to recruit over 1,000 highly qualified international researchers to Canada.

In addition, there were billions of dollars in increased defence spending, the details of which are still sketchy.

Bottom Line

Nothing in this budget is surprising, as most of it has been telegraphed in recent weeks. The budget asserts that “the global trade landscape is changing rapidly, as the United States reshapes its economic relationships and supply chains around the world. The impact is profound—hurting Canadian companies, displacing workers, disrupting supply chains, and creating uncertainty that holds back investment. This level of uncertainty is greater than what we have seen in recent crises. Budget 2025 makes generational investments while maintaining Canada’s strong fiscal advantage—a foundation that allows us to invest ambitiously and responsibly, and build Canada’s economy to be the strongest in the G-7.”

Canada has the lowest net debt-to-GDP ratio among the G-7 and one of the smallest deficit-to-GDP ratios. Canada and Germany are the only two G-7 economies rated triple-A, a marker of strong investor confidence which helps keep our borrowing costs as low as possible. This is a time for bold actions to bolster Canada’s competitiveness. We have products the world needs. Hopefully, we can salvage a significant part of the trade agreement with the US, but the odds suggest we build the infrastructure necessary to trade our products worldwide.

Dr. Sherry Cooper

-

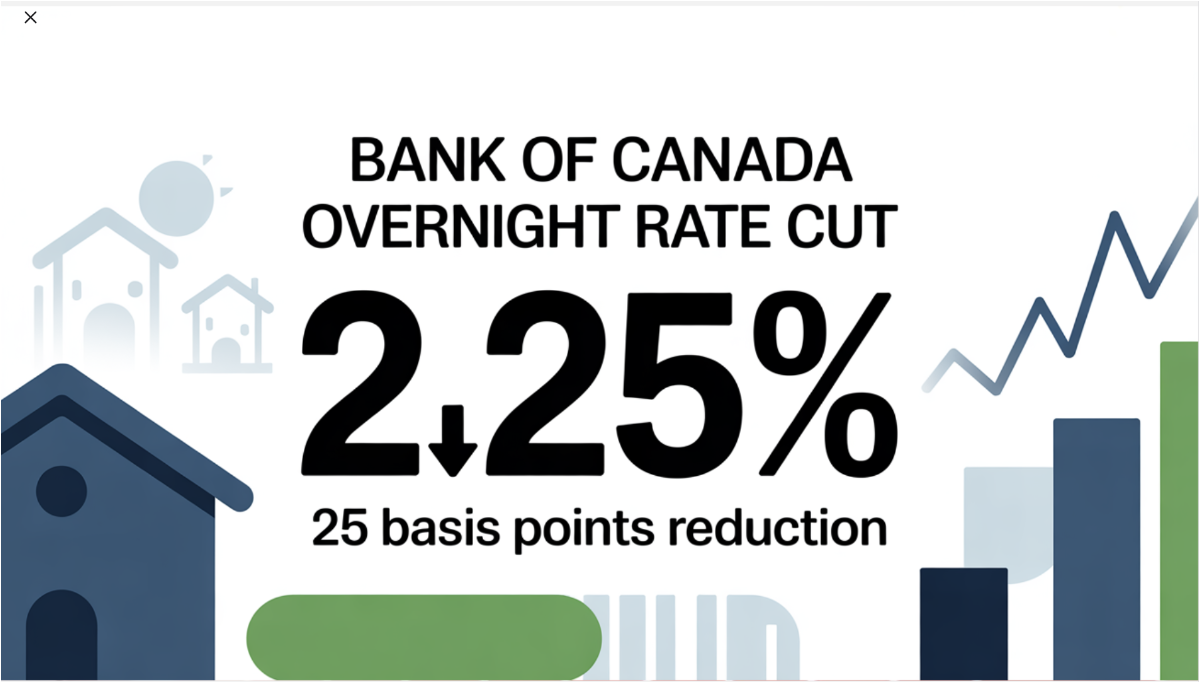

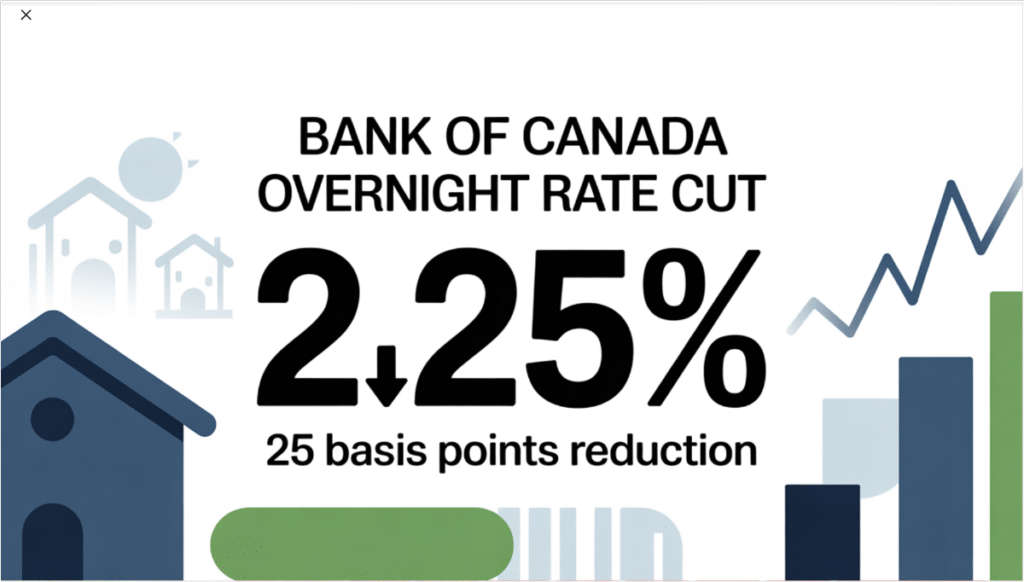

Bank of Canada Lowers Policy Rate to 2.25%

Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.25% as was widely expected. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. The economy will grow at about a 0.5% pace in Q3, causing the Bank to cut rates again at the final meeting this year on December 10. The easing will then end, but rates will remain relatively subdued until more trade uncertainty is alleviated.

The Fed is widely expected to cut rates by 25 bps this afternoon as well.

Today’s Monetary Policy Report suggests that the significant decline in export growth will persist for some time. Layoffs in trade-dependent sectors have already slowed considerably, especially in Ontario, Quebec, and some softwood lumber businesses in several provinces. The central bank acknowledged that “because US trade policy remains unpredictable and uncertainty is still higher than usual, this projection is subject to a wider-than-normal range of risks.”

“In the United States, economic activity has been strong, supported by the boom in AI investment. At the same time, employment growth has slowed and tariffs have started to push up consumer prices. Growth in the euro area is decelerating due to weaker exports and slowing domestic demand. In China, lower exports to the United States have been offset by higher exports to other countries, but business investment has weakened. Global financial conditions have eased further since July and oil prices have been fairly stable. The Canadian dollar has depreciated slightly against the US dollar.”

“Canada’s economy contracted by 1.6% in the second quarter, reflecting a drop in exports and weak business investment amid heightened uncertainty. Meanwhile, household spending grew at a healthy pace. US trade actions and related uncertainty are having severe effects on targeted sectors, including autos, steel, aluminum, and lumber. As a result, GDP growth is expected to be weak in the second half of the year. Growth will get some support from rising consumer and government spending and residential investment, and then pick up gradually as exports and business investment begin to recover.”

Canada’s labour market remains soft, and job vacancies have declined sharply despite the September improvement in job growth. Job losses continue to mount in trade-impacted sectors, and hiring has been weak across the economy. The unemployment rate remained at 7.1%, well above the US rate of 4.3%. Slower population growth translates into fewer new jobs and less inflation pressure. On a per capita basis, the economy is already in a recession.

The Bank projects GDP will grow by 1.2% in 2025, 1.1% in 2026 and 1.6% in 2027. Quarterly, growth strengthens in 2026 after a weak second half of this year. Excess capacity in the economy is expected to persist and be gradually absorbed.

“CPI inflation was 2.4% in September, slightly higher than the Bank had anticipated. Inflation excluding taxes was 2.9%. The Bank’s preferred measures of core inflation have been sticky around 3%. Expanding the range of indicators to include alternative measures of core inflation and the distribution of price changes among CPI components suggests underlying inflation remains around 2.5%. The Bank expects inflationary pressures to ease in the months ahead and CPI inflation to remain near 2% over the projection horizon”.

“If inflation and economic activity evolve broadly in line with the October projection, the Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. If the outlook changes, we are prepared to respond. Governing Council will be assessing incoming data carefully relative to the Bank’s forecast.”

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. While Canada is working hard to establish alternate trade partners, even China cannot replace the US in terms of proximity and cost-effectiveness, given the huge transport costs. China has stepped up its oil purchases to record levels, but larger oil flows east will require additional pipelines to BC. There is no market the size of the US market to replace exports of steel and aluminum. The US will also suffer from the economic impact of stepping away from the Canada-US-Mexico free trade deal. A renegotiation of the contract is likely to come before the end of next year. As of now, the US is signalling their desire to exit the agreement. We can only hope that cooler heads will prevail.

The auto industry is a case in point. Onshoring non-US auto production would require a 75% increase in US production and the construction of $50 billion in new factories. This would take years and significantly reduce the profitability of US auto companies.

Canada is the US’s number one supplier of steel and aluminum, with its competitively low hydroelectric costs. It will take time for the US to create the capacity to replace aluminum imports from Quebec.

Canada is the number one trading partner for 32 American states, many of which are lobbying Washington to end this CUSMA bashing.

It will take time for Canada to adjust to this new reality, which leads us to conclude that another cut in overnight rates is probable at the next decision date on December 10.

Dr. Sherry Cooper

-

Canadian Inflation Stronger Than Expected

The Consumer Price Index (CPI) rose 2.4% on a year-over-year basis in September, up from a 1.9% increase in August. The acceleration in headline inflation from 1.9% in August was also larger than the median projection in a Bloomberg survey of economists, which was 2.2%.

On a year-over-year basis, gasoline prices fell less in September (-4.1%) compared with August (-12.7%) due to a base-year effect, leading to an acceleration in headline inflation. Excluding gasoline, the CPI rose 2.6% in September, after increasing 2.4% in August.

A slower year-over-year decline in prices for travel tours (-1.3%) and a larger increase in prices for food purchased from stores (+4.0%) also contributed to the upward pressure in the all-items CPI in September.

The CPI rose 0.1% month over month in September. On a seasonally adjusted monthly basis, the CPI was up 0.4%.

Gasoline prices fell 4.1% year over year in September after a 12.7% decrease in August. The smaller year-over-year decline was primarily due to a base-year effect. In September 2024, prices fell 7.1% month over month due, in part, to lower crude oil prices amid growing concerns of weaker economic growth, particularly in China and the United States. In September 2025, gasoline prices rose 1.9% monthly following refinery disruptions and maintenance in the United States and Canada, which put upward pressure on prices.

On a year-over-year basis, prices for travel tours fell 1.3% in September following a 9.3% decline in August. Despite typically declining on a month-over-month basis in September, travel tour prices rose 4.6% in the month. This was a result of higher prices for destinations in Europe and some parts of the United States, as significant events in destination cities put upward pressure on hotel prices.

Consumers paid 4.0% more year over year for food purchased from stores in September, following a 3.5% increase in August. Faster price growth was driven by increased prices for fresh vegetables (+1.9% in September, compared with -2.0% in August) and sugar and confectionery (+9.2% in September, compared with +5.8% in August).

Year-over-year grocery price inflation has generally trended upward since its most recent low in April 2024 (+1.4%). Grocery items contributing to the general acceleration included fresh or frozen beef and coffee, both due, in part, to lower supply.

Tuition fees, priced annually in September, increased 1.7% in 2025 compared with a 1.8% increase in 2024. Aside from 2019, the 2025 increase was the smallest since 1976, when the index was unchanged (0.0%).

In 2025, students from Prince Edward Island (+4.7%) experienced the largest price increase. At the same time, students from Nova Scotia (+1.1%) and Ontario (+1.1%) had the smallest increase, coinciding with a freeze on tuition fees in both provinces.

Bank of Canada Deputy Governor Rhys Mendes recently warned that traders may be putting too much emphasis on its two “preferred” core inflation measures, the so-called trim and median gauges.

In September, both CPI-median and CPI-trim came in hotter than economists were expecting. The average of these metrics was 3.15% in September, while the three-month moving average accelerated to 2.7%.

Mendes said the central bank is weighing a broader suite of gauges that suggest underlying price pressures are closer to its 2% target.

Shelter inflation rose 2.6% on an annual basis, while CPI excluding food and energy was 2.4%. CPI excluding eight volatile components and indirect taxes was 2.8%, up from 2.6%.

CPI excluding taxes accelerated to 2.9% from 2.4% the previous month.The share of components within the consumer price index basket that are rising 3% and higher — another key metric that policymakers are watching closely — declined slightly to 38%.

All 10 Canadian provinces saw prices rising at a faster year-over-year pace in September compared with August. Quebec experienced the steepest price growth, reaching 3.3% last month.

Rent prices also accelerated nationally to 4.8%, led by a 9.8% increase in Quebec. Slower rent price growth of 1.8% in British Columbia moderated the national increase, the report noted.

Bottom Line

The report shows that underlying price pressures remain elevated, raising questions about how quickly the central bank can proceed with rate cuts to aid the tariff-hit economy.

Still, the acceleration in headline and most core measures was driven by a gasoline price base-year effect — a possible reason for analysts to look through the print.

Traders in overnight swaps pared bets on a rate cut next week, lowering the odds to about 65% from close to 80% before the report. The loonie jumped to the day’s high against the US dollar. Canadian debt fell across the curve, with the two-year yield rising about three basis points to a session high at 2.38%.

The ongoing trade war with the US drove the Bank of Canada to lower its policy rate by a quarter of a percentage point to 2.5% in September, marking the first cut in six months.

During their deliberations last month, some members of its governing council argued that more support would likely be needed given the softness in the economy, notably if the labour market weakened further.

Bank of Canada Governor Tiff Macklem recently described Canada’s labour market as “soft,” despite data showing the country added 60,400 jobs in September, which only partially reversed a decline of more than 100,000 positions over the previous two months.

The central bank will have to weigh recent economic weakness against concerns about firm core inflation over the past few months. The BoC will cut the overnight policy rate again by 25 bps to 2.25%, responding to its concern for the sectors hardest hit by tariffs, along with a housing market suffering from negative household psychology and overbuilding in the GTA and GVA.

Dr. Sherry Cooper

-

Canadian Home Sales Post Best September In Four Years

Today’s release of the September housing data by the Canadian Real Estate Association (CREA) showed a pullback on the housing front. The number of home sales recorded through Canadian MLS® Systems declined by 1.7% on a month-over-month basis in September 2025. Nevertheless, it was the best month of September for sales since 2021.

The slight monthly decline was the result of lower sales activity in Greater Vancouver, Calgary, Edmonton, Ottawa, and Montreal, which more than offset gains in the Greater Toronto Area and Winnipeg.

“While the trend of rising sales that began earlier this year took a breather in September, activity was still running at the highest level for that month since 2021, and that was true in July and August as well, said Shaun Cathcart, CREA’s Senior Economist. “With three years of pent-up demand still out there and more normal interest rates finally here, the forecast continues to be for further upward momentum in home sales over the final quarter of the year and into 2026.”

New Listings

New supply dropped 0.8% month-over-month in September. Combined with a slightly larger decline in sales activity, the sales-to-new listings ratio eased slightly to 50.7% compared to 51.2% in August. The long-term average for the national sales-to-new listings ratio is 54.9%, with readings roughly between 45% and 65% generally consistent with balanced housing market conditions.

There were 199,772 properties listed for sale on all Canadian MLS® Systems at the end of September 2025, up 7.5% from a year earlier but very close to the long-term average for that time of the year.

“While there are more buyers in the market now than at almost any other point in the last four years, sales activity is still below average and well below where the long-term trend suggests it should be,” said Valérie Paquin, CREA Chair. “As such, we expect things to continue to pick up steadily in the future.

There were 4.4 months of inventory on a national basis at the end of September 2025, unchanged from July and August and the lowest level since January. The long-term average for this measure of market balance is five months of inventory. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

Home Prices

The National Composite MLS® Home Price Index (HPI) was again almost unchanged (-0.1%) between August and September 2025. Following declines in the first quarter of the year, the national benchmark price has remained mostly stable since April.

The non-seasonally adjusted National Composite MLS® HPI was down 3.4% compared to September 2024. Based on the extent to which prices fell off beginning in the fall of 2024, look for year-over-year declines to shrink in the fourth quarter of the year.

Bottom Line

Homebuyers are responding to improving fundamentals in the Canadian housing market. Supply has risen as new listings surged until May of this year. Additionally, the national benchmark average price is 3.5% lower than it was a year earlier. That decrease was smaller than in August.The view is nearly unanimous that the Federal Reserve will cut the overnight policy rate again by 25 basis points when it meets again on October 29.

The jury is out on the Bank of Canada’s next move. Their decision date is also October 29. While the stronger-than-expected labour market report might have dissuaded the Bank from easing, all eyes will be on the next CPI report on October 21.

With the Bank of Canada cutting the policy rate halfway through September and another 25-basis-point reduction expected by January, if not sooner, the CREA forecasts sales to rise by 7.7% in 2026.

“Interest rates were always going to be the thing that brought this thing back to life,” Cathcart said in an interview. “While that long-anticipated recovery has been delayed and dampened by trade uncertainty, the Bank of Canada is getting close to dipping out of the neutral range and into stimulative territory.

Dr. Sherry Cooper

What people say:

“As first-time buyers in Vancouver, we were overwhelmed. Morning Lee didn’t just find us the perfect Kitsilano condo within our budget, she patiently educated us every step of the way. Her negotiation skills were incredible – we got the place below asking in a competitive market! She made a stressful process feel empowering.”

Sarah T.,

Registered Nurse

Arjun P.,“Securing the right location for our expanding tech consultancy was critical. Morning Lee understood our business needs intimately, not just the square footage. She found us a strategic Gastown space with growth potential and expertly negotiated the lease terms. Her dual perspective on business and real estate is invaluable.”

Founder & CEO, NexGen Solutions

Elena R.,“Financing multiple investment properties can be complex. Morning Lee’s mortgage expertise is next-level. She secured us significantly better rates and terms than we thought possible, structuring the financing perfectly for cash flow. She doesn’t just get mortgages; she builds wealth strategies.”

Real Estate Investor

David L.,“I almost launched my e-commerce platform with costly mistakes. Morning Lee’s ‘Risk Free Startup Success’ framework (PRISMs Method) was my blueprint. Her consulting helped me validate my idea, set up efficient ops, and create a killer digital marketing launch plan. We hit profitability in Month 6 – her guidance was the game-changer.”

E-commerce Entrepreneur

Marcus W.,“We needed to refinance our manufacturing facility AND improve our bottom line. Morning Lee tackled both seamlessly. She secured optimal commercial financing, freeing up capital, then her profit consulting identified clear operational inefficiencies. Implementing her strategies boosted our profit margin by 30% within a year. A true business partner.”

Operations Director, Cascade Manufacturing

Priya S.,“Scaling my team felt chaotic until I worked with Morning Lee. Her consulting, rooted in the principles from ‘From Leadership to Success,’ transformed our culture. She helped define clear roles, implement effective communication channels, and develop a strategic roadmap everyone aligns with. Productivity and morale have soared. Essential leadership wisdom.”

Marketing Director, Bloom Creative Agency