Imagine Investor A, holding seven properties with a total value $10+ million. They spot a rare opportunity: sellers urgently offloading prime real estate at below-market price. But when they approach traditional banks for a loan, they hit a wall.

The Dilemma

Despite looking like a financial winner, reality bites:

- Self-employment income nearly zero due to market changes

- Loans only $2 million, net assets $8 million

- Primary residence worth $2.2 million, mortgage $200k

- Rental income covers mortgage with positive cash flow, but after daily expenses and maintenance, disposable cash is limited

- Excellent credit score and history

Yet, major banks refused their applications. Why? Income too low, debt too high, and unable to pass standard stress tests.

Breaking the Gridlock

Investor A came to us, and we break it through by thinking differently. While banks focus on regular income, we realized Investor A’s wealth was “locked in walls.” Six solutions emerged by us:

1. Reverse Mortgage (Primary Residence, Age 55+)

- Benefits:

- No income verification.

- Flexible credit requirements.

- No down payment required.

- Access up to ~50% of your home equity.

- Funds received as monthly payments, lump sum, or instalments.

- Minimal fees, almost none.

- Fast approval.

- Drawbacks:

- Only available for primary residences (not investment properties).

- Maximum Cash Available: ~$1 million

2. “Enhanced” Reverse Mortgage (Primary Residence, No Age Requirement)

- Benefits:

- No age requirement.

- No income verification.

- Flexible credit requirements.

- No down payment required.

- Access up to 60% of your home equity.

- Funds received as monthly payments, lump sum, or instalments.

- Fast approval.

- Cancel anytime without penalty.

- Drawbacks:

- Only available for primary residences (not investment properties).

- Higher fees.

- Maximum Cash Available: ~$1.2 million

3. First Mortgage Home Equity Line of Credit

- Benefits:

- Access up to 75% of home equity.

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Pay interest only on amounts drawn; no payment if unused. Access funds freely and flexibly.

- Drawbacks:

- Higher fees.

- Requires terminating existing first mortgage.

- Maximum Cash Available: ~$6 million

4. First Mortgage Home Equity Mortgage

- Benefits:

- Access up to 75% of home equity.

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Lower fees than a First Mortgage HELOC.

- Drawbacks:

- Requires terminating existing first mortgage.

- Monthly payments required.

- Maximum Cash Available: ~$6 million

5. Second Mortgage Home Equity Line of Credit

- Benefits:

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Access up to 75% of home equity.

- Pay interest only on amounts drawn; no payment if unused. Access funds freely and flexibly.

- Does not require terminating existing first mortgage.

- Drawbacks:

- Higher fees.

- Maximum Cash Available: ~$6 million

6. Second Mortgage Home Equity Loan

- Benefits:

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Access up to 75% of home equity.

- Does not require terminating your existing first mortgage.

- Lower fees than a Second Mortgage HELOC.

- Drawbacks:

- Monthly payments required.

- Maximum Cash Available: ~$6 million

Investor A opted for a mix of all six, leveraging each solution’s strengths while minimizing drawbacks according to the banks policies and his own situation like title, balance, interest rate, etc .

The Result

Investor A secured a $5 million credit line with two remarkable features:

- Off loaded the cash pressure— and interest applies only when money is used

- Ready to close good deals any time and immediate access to funds when needed – won’t miss any good opportunities to build up more wealth.

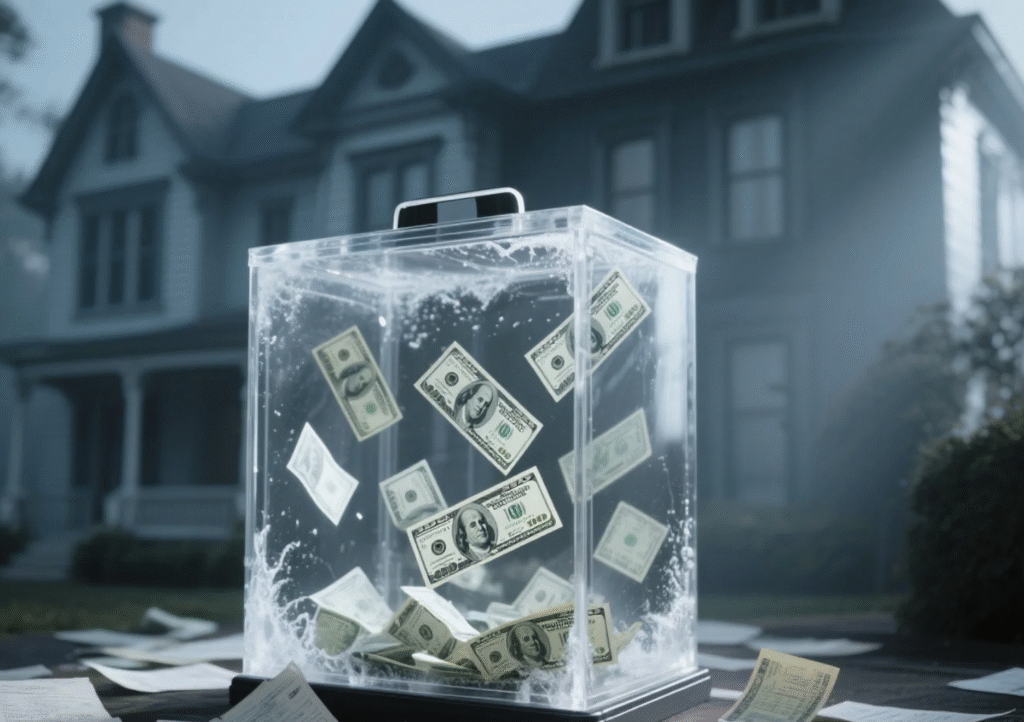

From nearly depleted cash reserves, Investor A now had millions ready to seize undervalued properties, paying cash instantly. No income verification, no stress tests, no mandatory monthly payments—like turning their property into a giant credit card that only charges when used.

Practical Impact

Opportunities came faster than expected. Sellers in a slow market offered below-market prices with room to negotiate. While others waited for bank approvals, Investor A could pay in cash, creating a competitive edge. The secret wasn’t having money—it was unlocking dormant assets to capitalize on timing and market gaps.

Key Takeaway

Banks have rules, but asset value is undeniable. When income-based paths fail, check the “walls” you’ve built—every brick could be emergency cash or a lever to unlock opportunities. Investor A’s transformation? From chasing bank loans to letting assets speak for themselves.

Assess your own available funds immediately: Evaluate available credit limit.

For buyers, sellers, or anyone navigating property financing, understanding alternative funding strategies can make the difference between watching opportunities slip away or seizing them confidently.

Explore more insights and strategic approaches at MorningLee.ca:Case Study: How Debt Restructuring Can Save You Thousands

For a safer, smarter property purchase, conduct real estate due diligence for comprehensive property inspections and risk assessments.

Leave a Reply