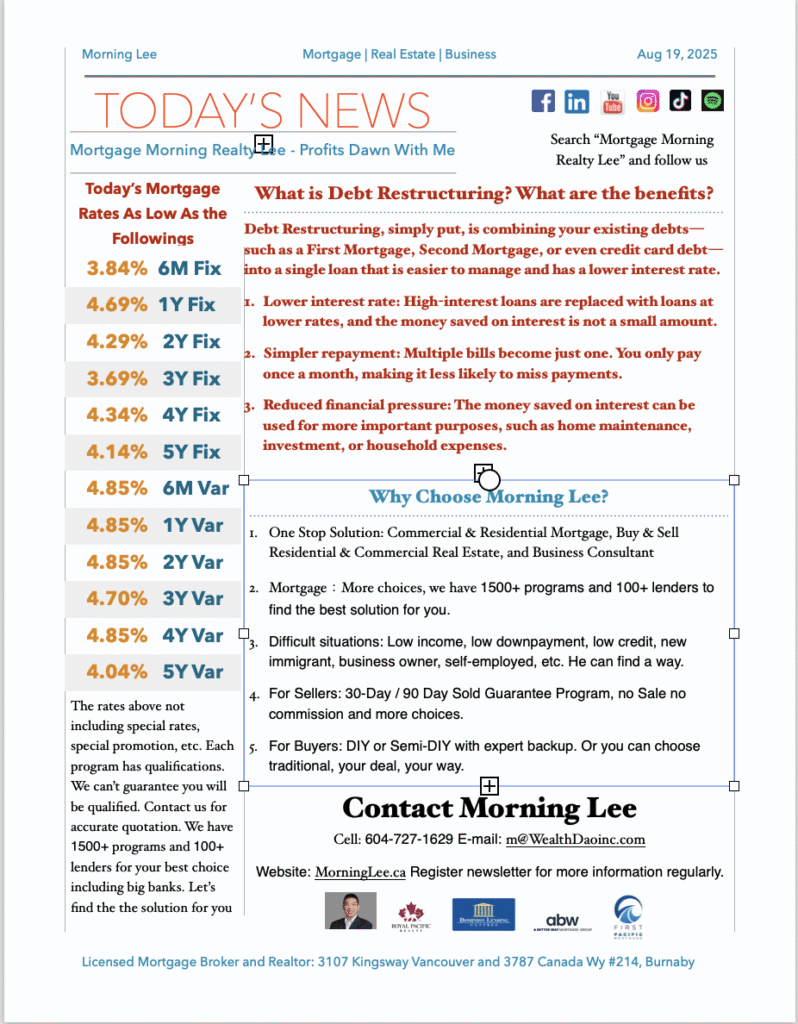

The 3-year fixed rate has hit a new low at 3.69%, but the 5-year lowest fixed rate has gone up. The upward and downward pressures are still fiercely competing.

If you are considering a loan in the near future, you need to pay close attention to rate changes and seize the timing to lock in a contract that is favourable to you.

If your current rate is relatively high, 5% or even over 6%, you need to carefully calculate and compare: the penalty for breaking your current contract versus the money saved by switching to a lower rate — which one is more cost-effective. An extra surprise may even make you scream!

Even banks say no, for low income, low credit, low down pay, Morning will find a way, for you.

Leave a Reply