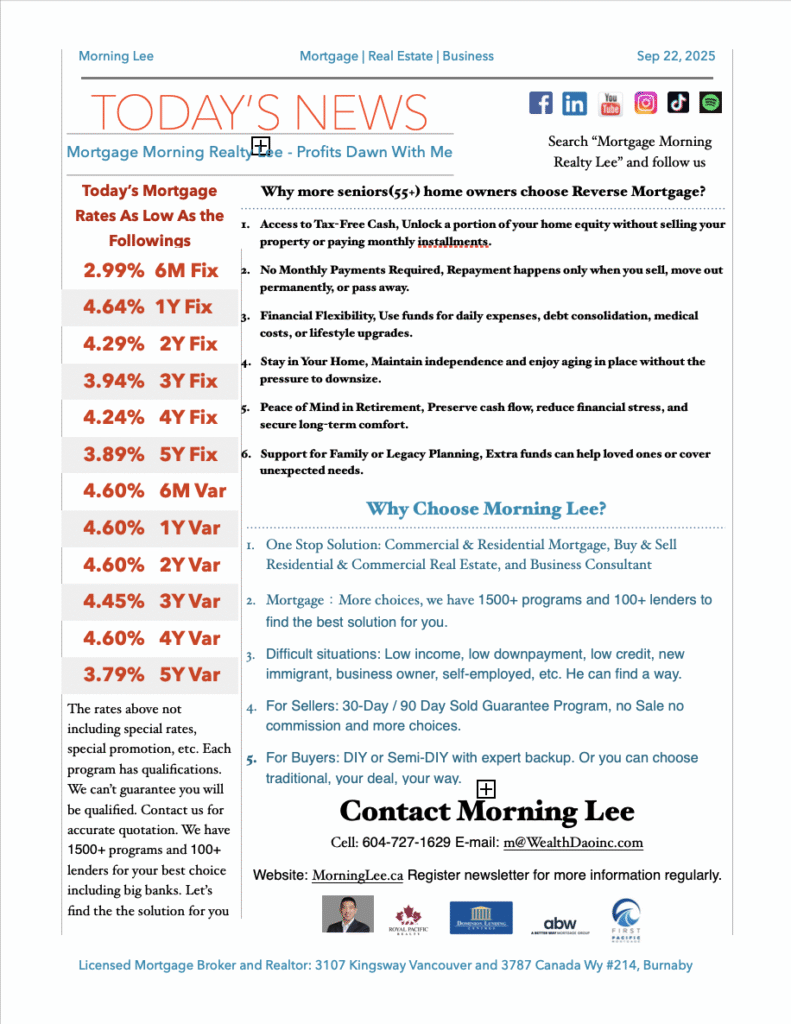

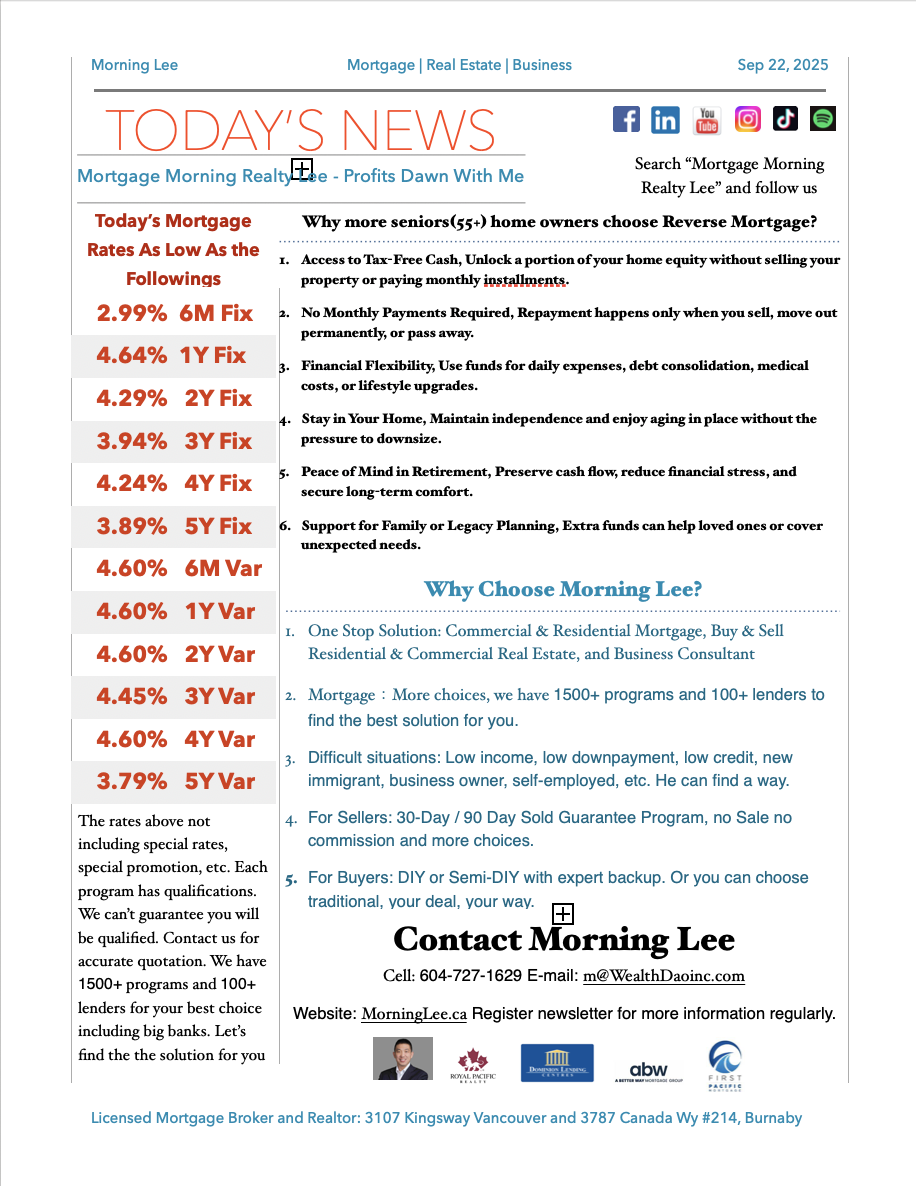

The latest Canadian mortgage rate data shows that mainstream lending products continue to trend lower, with many fixed and variable rates now entering the “3% range.” For example, the six-month fixed rate is as low as 2.99%, the three-year fixed rate stands at 3.94%, and the five-year variable rate has dropped to 3.79%. This creates a wide range of low-cost borrowing options for homeowners.

Against this shifting interest rate backdrop, reverse mortgages are seeing growing interest among homeowners aged 55 and older. This financial solution allows homeowners to convert their home equity into tax-free cash—without selling their property or being required to make monthly payments—while still retaining the right to live in their home.

Leave a Reply