For many families, supporting the next generation in buying real estate has become both a dream and a challenge. Housing prices keep climbing, down payments feel heavier than ever, and traditional financing doesn’t always offer the flexibility people need. This is where a little-known tool can make a big difference: using a reverse mortgage as a form of living inheritance.

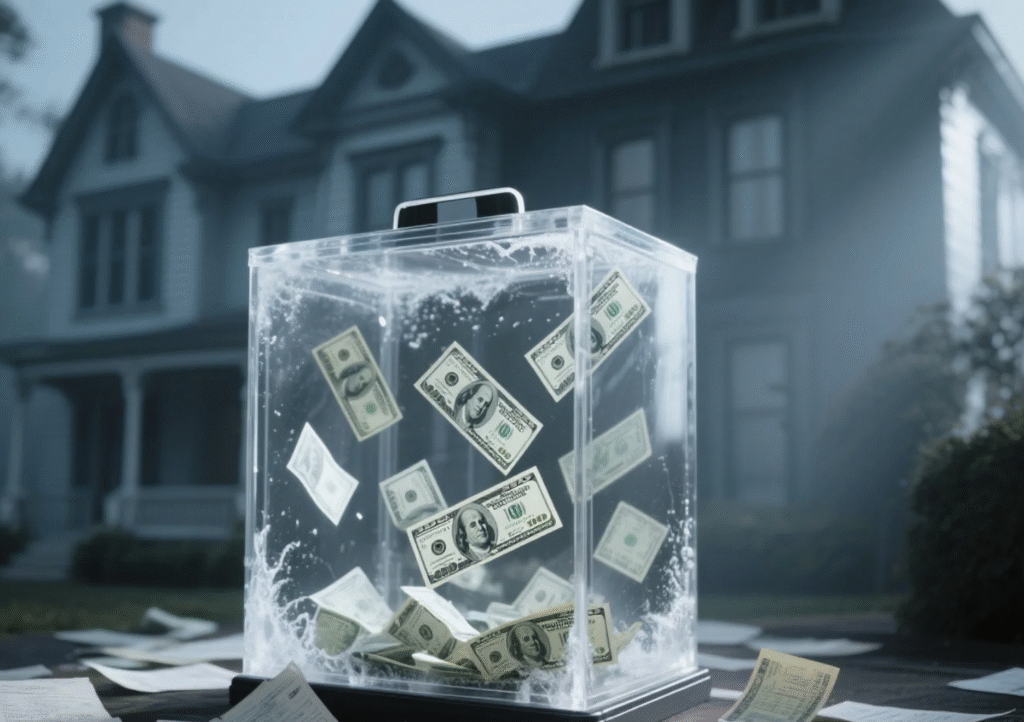

A living inheritance simply means parents or grandparents provide financial support while they are still alive, instead of waiting until an estate is transferred. For families, this approach can be life-changing. Imagine helping your child secure the down payment for a first home, or giving them the freedom to invest in a property they couldn’t otherwise reach—without needing to sell your own investments or create an unexpected tax bill.

Here’s how it works. Many homeowners are asset-rich but cash-poor. They may not have liquid assets, or may not qualify for a traditional mortgage or a home equity line of credit (HELOC). A reverse mortgage opens another door: it allows homeowners to release equity directly from their primary residence. The funds are tax-free and, most importantly, payment-optional. That means no mandatory monthly principal and interest obligations, keeping financial stress low.

Why does this matter? Because gifting from taxable investments often triggers capital gains tax and reduces long-term savings. By borrowing against the home, families can often lower their overall cost while still passing on meaningful support. It’s not about spending the house; it’s about using existing equity as a financial tool, so parents can help their children today while still enjoying the home they love.

This strategy is increasingly seen as a way to balance personal retirement needs with the desire to give. Instead of selling off investments or downsizing too soon, a reverse mortgage can act as a flexible, cost-efficient cushion that aligns family goals with financial reality.

For those curious about practical examples, the concept is explored further in Reverse mortgages: 55+? A cushion against the rising cost of living,

When it comes to real estate decisions—whether buying, selling, or planning financing options—it helps to know all the tools available. MorningLee.ca is where knowledge and opportunity meet.