Today’s release of December housing data by the Canadian Real Estate Association (CREA) showed the market ended 2025 with declining sales and prices due to ongoing economic uncertainty.

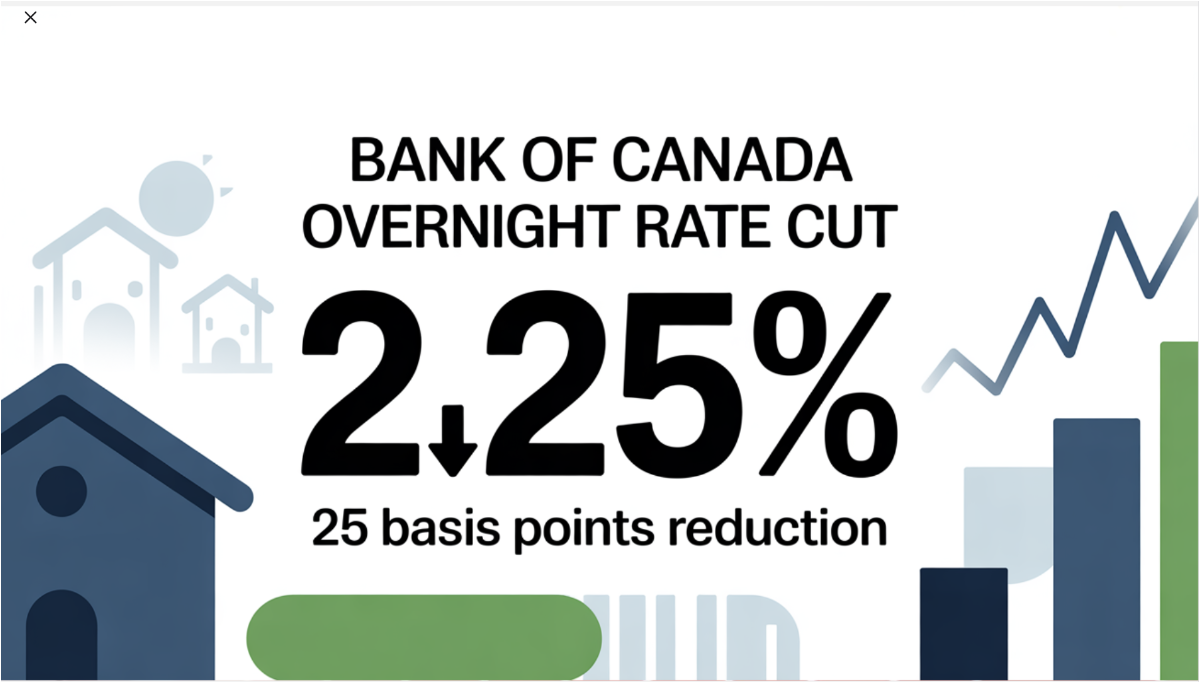

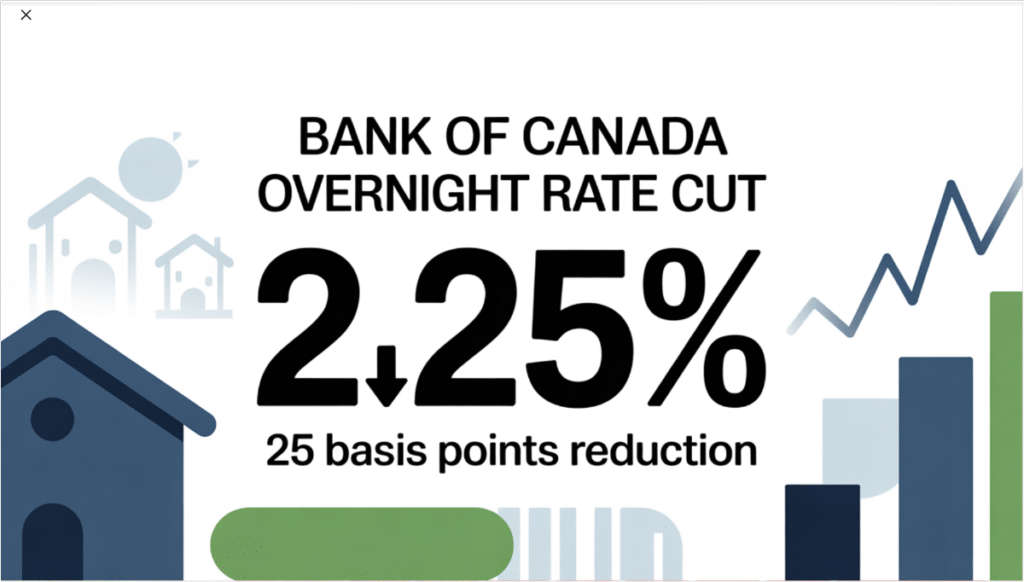

The number of home sales recorded over Canadian MLS® Systems declined 2.7% m/m in December. On an annual basis, transactions totalled 470,314 units last year, a 1.9% decrease from 2024, despite a series of Bank of Canada rate cuts.

“There doesn’t appear to have been much rhyme or reason to the month-over-month decline in home sales in December, which was simply the result of coincident but seemingly unrelated slowdowns in Vancouver, Calgary, Edmonton, and Montreal,” said Shaun Cathcart, CREA’s Senior Economist. “For that reason, it would be prudent for market observers to resist the temptation to trace a line from the end of 2025 into 2026. Rather, we continue to expect sales to move higher again as we get closer to the spring, rejoining the upward trend that was observed throughout the spring, summer, and early fall of 2025.”

New Listings

New supply declined by 2% on a month-over-month basis in December, marking a fourth straight monthly drop. Combined with a slightly larger decrease in sales activity in December, the sales-to-new-listings ratio eased to 52.3% from 52.7% in November. This remains close to the long-term average national sales-to-new listings ratio of 54.9%. Readings roughly between 45% and 65% are generally consistent with balanced housing market conditions.

There were 133,495 properties listed for sale on all Canadian MLS® Systems at the end of December 2025, up 7.4% from a year earlier but 9.9% below the long-term average for that time of year. Inventories have been falling since May 2025 owing to the mid-year rally in demand, meaning active listings could be back posting year-over-year declines around the time this year’s spring market gets going.

“While we remain in the quiet time of year for a little while longer, the spring market is now just around the corner, and it is expected to benefit from four years of pent-up demand, and interest rates that at this point are about as good as they are going to get,” said Valérie Paquin, CREA Chair. “Barring any further major uncertainty-causing events, that means we should see a more active market this year.”

There were 4.5 months of inventory on a national basis at the end of December 2025, up slightly from 4.4 months, which had been the measure since August. The long-term average for this measure of market balance is 5 months of inventory. Based on the measure of one standard deviation above and below that long -term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

|

Home Prices

The National Composite MLS ® Home Price Index (HPI) fell by 0.3% between November and December 2025. It was similar to the dip recorded in November and could reflect some sellers making price concessions to sell properties before the end of the year. Most of the overall price softening in December came from markets in Ontario’s Greater Golden Horseshoe region, which was hit hard by US tariffs.

The non-seasonally adjusted National Composite MLS® HPI was down 4% from December 2024. Under the surface, year-over-year declines are larger for condo apartments and townhomes, and smaller for one- and two-storey detached homes.

Bottom Line

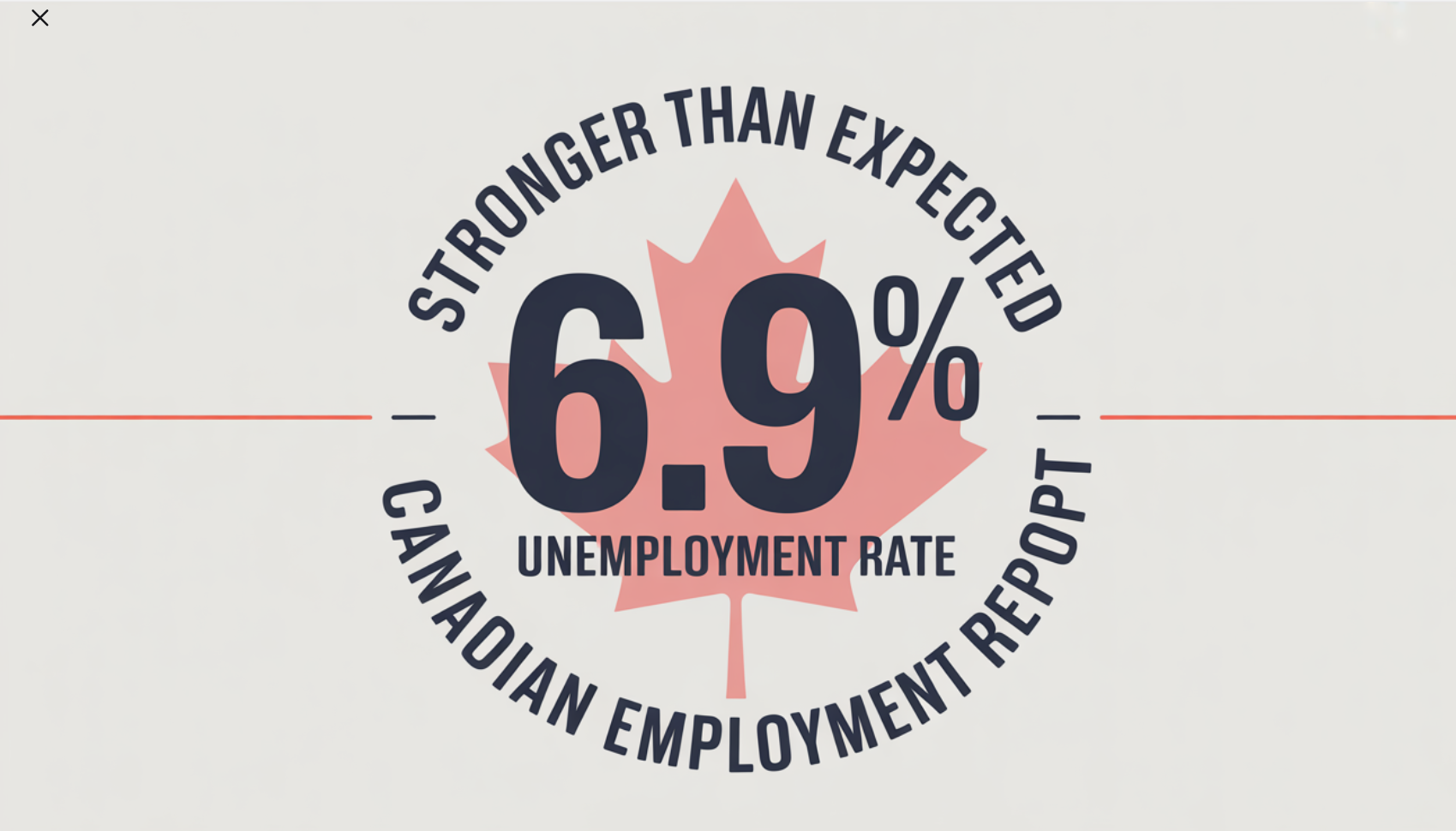

Today’s data end a year that saw house prices drift lower despite falling interest rates, as a simmering trade war with Canada’s largest trading partner caused higher unemployment and considerable job uncertainty. Though US tariffs apply to a limited volume of Canadian goods, and the economy didn’t tip into a recession, the unpredictability of President Donald Trump’s trade policy has stoked a sense of economic insecurity.

In some regions, the price decline has now wiped out a sizable proportion of the gains homeowners saw during the torrid Covid market from 2020 to 2022, when overnight interest rates were reduced to a record-low 25 basis points. Back then, ultralow interest rates caused home prices to surge, particularly in smaller cities to which remote workers fled to take advantage of a lower cost of living.

Vancouver and Toronto remain by far the most expensive large cities. The benchmark price in Greater Vancouver was C$1.14 million in December. In the Toronto region, it was C$962,300 – down about 6% from a year earlier.

With many regional markets soft, sellers are now pulling back. New listings dropped 2% in December from the previous month, the fourth straight monthly decline. But the total number of homes on the market last month was still 7.4% higher than the previous year. That’s the equivalent of about 4.5 months of inventory.

We concur with the view that there is considerable pent-up demand among potential first-time buyers who will likely dip their toe in the market once winter passes. This year, we also see a record volume of refinances and renewals, which will increase monthly mortgage payments and dampen household purchasing power.

Dr. Sherry Cooper