Commercial Mortgage Broker Vancouver | Expert Financing for Warehouses, Offices, Retail, Hotel & Multi-Family | Morning Lee

Leading commercial mortgage broker securing loans for warehouses, offices, retail, plaza, stripe mall, hotels & multi-family properties. Get tailored financing solutions with competitive rates.

Vancouver’s Premier Commercial Mortgage Broker

*Funded for Industrial, Retail & Hospitality Properties*

Why 87% of Vancouver Investors Choose a Specialized Commercial Mortgage Broker

Navigating commercial financing requires expertise in:

- Asset-Specific Underwriting: Warehouse clearance heights vs hotel occupancy metrics

- Market Cycle Timing: Capitalizing on cap rate fluctuations

- Complex Deal Structuring: CMHC-insured multi-family vs conventional industrial loans

- Zoning-Driven Valuations: Industrial vs mixed-use premiums

Commercial Property Financing Solutions

Tailored Mortgage Structuring by Asset Class

Warehouses & Industrial Facilities

Financing for last-mile logistics, manufacturing & distribution

- Clearance height premium financing

- Power supply infrastructure loans

- Cross-dock facility specialized programs

Office Buildings

Downtown core towers to suburban flex spaces

- Tenant improvement allowance financing

- Green building certification incentives

- Vacancy rate bridge solutions

Retail Stores & Shopping Centers

Anchor tenant-dependent financing strategies

- Pad site construction loans

- Renovation financing during tenant turnover

- Sales volume-based underwriting

Multi-Family Buildings

*5+ unit apartment building expertise*

- CMHC-insured refinancing

- Value-add repositioning loans

- Rent roll analysis optimization

Hotels & Hospitality

Occupancy-driven financing solutions

- RevPAR-based underwriting

- Renovation PIP financing

- Seasonal cash flow accommodations

Plaza and Strip Malls

Financing anchored retail centers and neighborhood plazas

- Anchor tenant credit analysis (national vs local)

- Pad site acquisition and development loans

- Renovation financing for tenant retention

- Vacancy rate bridge solutions during repositioning

- Sales volume-based loan covenants

- Outparcel financing opportunities

- CAM cost recovery underwriting

Special Purpose Properties

Unique asset financing

- Automotive service centers

- Self-storage facilities

- Gas stations/C-stores

The Commercial Mortgage Broker Advantage

Why Developers & Investors Partner With Us

Access to 1100+ products / Lender Channels

- Big 6 Banks

- Credit Unions

- Private Funds

- CMHC Providers

Deal Engineering Expertise

Rate Negotiation Mastery

- Average 0.92% lower rates than direct bank offers

- 30-120 day rate hold guarantees

- Pre-approval leverage for off-market acquisitions

Our Commercial Mortgage Process

Four-Phase Approval Framework

- Asset Strategy Session

- Property type-specific underwriting assessment

- Cash flow optimization analysis

- Lender Matchmaking

- institution pre-screening

- Loan scenario modeling (term, amortization, covenants)

- Submission Crafting

- Bank-grade proposal packaging

- NOI enhancement documentation

- Closing Coordination

- Legal/tax specialist integration

- Draw administration for construction loans

Why Vancouver’s Top Developers Trust Our Commercial Mortgage Broker Team

Quantifiable Expertise

- 30+ years team financing Vancouver commercial real estate

- High approval rate on complex deals

- Portfolio financing for many business owners and investors

Client Protection Framework

- No upfront broker fees

- Full lender fee transparency

- Ongoing rate monitoring

- Refinancing advantage alerts

Start Your Commercial Financing Journey

Step 1: Property Assessment

Step 2: Lender Matching

Book Asset Strategy Call

Step 3: Loan Structuring

“While banks see property types, we see potential. Let us unlock your asset’s financing power.”

— Commercial Mortgage Broker Morning Lee

Resources:

-

Good News on the Inflation Front Will Keep the BoC on the Sidelines

The Consumer Price Index (CPI) held steady at 2.2% year over year in November, as core inflation continued to ease. Accelerating costs for food and some other goods were offset by slowing price growth for services.

In November, prices for services rose 2.8% year over year, compared with a 3.2% increase in October. Prices for travel tours declined 8.2% last month following a 2.6% increase in October. Monthly, these prices fell 12.0%, as lower demand for destinations in the United States put downward pressure on the index.

Prices for traveller accommodation fell to a greater extent on a year-over-year basis in November (-6.9%) than in October (-0.6%). The most significant contributor to the lower prices was Ontario (-20.2%), partially due to a base-year effect from a swift monthly increase in November 2024 (+11.0%), which coincided with a series of high-profile concerts in Toronto.

Lower prices for travel tours and traveller accommodation, in addition to slower growth for rent prices, put downward pressure on the all-items CPI.

Offsetting the slower growth in services on an annual basis were higher prices for goods, driven by increases in grocery prices and a smaller decline in gasoline prices. Excluding gasoline, the CPI rose 2.6% for the third consecutive month.

The CPI rose 0.1% month over month in November. On a seasonally adjusted monthly basis, the CPI increased 0.2%.

Grocery Price Inflation Highest Since the end of 2023Prices for food purchased from stores rose 4.7% year over year in November after increasing 3.4% in October. The increase in November was the largest since December 2023 (+4.7%). The main contributors to the acceleration in November 2025 were fresh fruit (+4.4%), led by higher prices for berries, and other food preparations (+6.6%).

In November, prices for fresh or frozen beef (+17.7%) and coffee (+27.8%) remained significant contributors to overall grocery inflation on an annual basis. Higher beef prices have been driven, in part, by lower cattle inventories in North America. Adverse weather conditions in growing regions have affected coffee prices, which have risen amid American tariffs on coffee-producing countries, contributing to higher prices for refined coffee.

On a monthly basis, grocery prices rose 1.9% in November, the largest month-over-month increase since January 2023.

Acting as a bit of a counterweight, shelter costs—the earlier inflation villain—continue to moderate. Owned accommodation expenses are now up just 1.7% y/y, the slowest pace in almost a decade amid sagging home prices. Rent inflation remains sticky, but did tick down to 4.7% y/y last month. Keep an eye on electricity prices, which have been a major issue in the US, where AI data centers consume large amounts of electricity. The cost of electricity jumped 1.5% in the month and is now up 3.4% y/y. Telephone services have also leapt recently, after falling heavily the past two years; they are now up 11.7% y/y, the fastest increase since 1982.

The good news is that inflation will average just over 2% for all of 2025, down from 2.4% last year and the lowest annual tally in five years. The less-good news is that this moderation was mainly due to the removal of the consumer carbon tax, which alone shaved about half a point off the annual average.

The main core inflation measures decelerated in November, with the BoC’s two measures both easing two ticks to 2.8% y/y (and both up just 0.1% m/m in seasonally adjusted terms). And, ex food & energy prices also rose just 0.1% m/m, cutting the annual rate three ticks to a moderate 2.4% y/y pace.

Bottom Line

This report confirms the Bank’s hold on the policy rate. Aside from food prices, inflation seems to be dissipating. The overall economy is in better-than-expected shape as the upward revisions in GDP since 2022 were largely the result of better than expected productivity growth–long a big concern for the Canadian economy.

The backdrop of better growth and lower inflation will keep the Bank of Canada on hold for most of 2026, as the next move in rates is likely to be a hike, but not until late next year. In the meantime, the biggest loser in the past year has been the housing market.

Today’s release of existing home sales by the Canadian Real Estate Association suggests particularly weak activity in Ontario, the region hardest hit by the tariff uncertainty. A cautious Bank of Canada will monitor the effect of rapidly rising food prices on inflation expectations. With any luck at all, core inflation will continue to decelerate, keeping the Bank on the sidelines for much of next year.

Hopefully, greater clarity on the Canada-Mexico-US agreement will be forthcoming in the New Year. Reduced uncertainty is the key ingredient required for a rebound in housing activity, particularly in the regions of Ontario and Quebec hardest hit by the tariffs.

Dr. Sherry Cooper

-

Bank of Canada Holds Policy Rate Steady

The Bank of Canada held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation between 2.5% and 3%, the Governing Council sees the current overnight rate as “about right.”

According to the press release, “The Bank expects final domestic demand to grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no market the size of the US market to replace exports of steel and aluminum.

The US will also suffer economic impacts from withdrawing from the Canada-US-Mexico free trade deal. A renegotiation of the contract is likely to come before the end of next year. As of now, the US is signalling their desire to exit the agreement. We can only hope that cooler heads will prevail.

These are challenging times, the surprisingly strong economic data notwithstanding. Consumer and business confidence is down, and the housing market is still weak, especially in the Greater Goldeen Horseshoe.

In this environment, market-driven interest rates have risen sharply. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement.Dr. Sherry Cooper

-

Canadian headline inflation slowed to 2.2% y/y in October, down from 2.4% in September.

The Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in October, down from 2.4% in September. The all-items CPI decelerated largely due to gasoline prices, which fell at a faster year-over-year pace in October (-9.4%) than in September (-4.1%). Excluding gasoline, the CPI rose 2.6% in October, matching the September increase. This was not enough of a decline to move the Bank of Canada off the sidelines, particularly given the recent strength in manufacturing sales, which surged 3.3% in September (estimated at 2.7%). Wholesale trade also surprised to the upside, 0.6% (estimated at 0.0%).

Slower growth in grocery prices further contributed to the CPI’s deceleration in October, which was moderated by surging cellular phone plan prices. Though grocery prices decelerated in October, prices remained elevated and have exceeded overall inflation for nine consecutive months.

Consumers paid more year over year in October for homeowners’ and mortgage insurance (+6.8%) and passenger vehicle insurance premiums (+7.3%). Among the provinces, prices rose the most in Alberta for both measures, with a 13.7% increase in homeowners’ home and mortgage insurance and a 17.8% increase in passenger vehicle insurance premiums.

Since October 2020, homeowners’ insurance and mortgage insurance prices have risen 38.9% nationally, while passenger vehicle insurance prices have risen 18.9%.The index for property taxes and other special charges, priced annually in October, rose 5.6% year over year, down from 6.0% in 2024.

The CPI rose 0.2% month over month in October. On a seasonally adjusted monthly basis, the CPI was up 0.1%.

In October, both the CPI median and the CPI trimmed mean came in cooler than economists had expected. The average of these metrics was 2.95% in October.The old measure of core—prices excluding food and energy—rose 0.3% m/m on an adjusted basis, boosting the yearly rate three full ticks to 2.7% y/y. A pop in cellular services was a significant driver there; in fact, the 7.9% y/y rise in all telephone services was the largest yearly increase since 1982. Still, a pullback in grocery prices, perhaps in part due to the rollback of retaliatory tariffs, helped moderate the Bank of Canada’s core measures. Median prices edged up just 0.1% m/m (s.a.), trimming the annual rate to 2.9%, while trim eased a tick to 3.0% y/y.

Rent perked up again to 5.2% y/y (from 4.8%), and remains the single most significant driver of inflation due to its heavy weight in the index.

Bottom Line

This report does little to change the BoC’s view that underlying inflation remains close to 2-1/2%; but, if anything, most underlying metrics have been stuck a bit above that, or have just crept up there. In other words, this report is just another reason to believe the Bank is moving to the sidelines in December.

Dr. Sherry Cooper -

How Many Credit Cards Should I Have?

When it comes to managing your credit cards, there’s no one-size-fits-all answer. However, many financial experts suggest that maintaining two to three active credit cards is a smart approach, especially when combined with other forms of credit like student loans, auto loans, or mortgages.

But why is that the case? Let’s break it down.

Why Two to Three Credit Cards?

The number of credit cards you have plays a role in your credit score, but it’s not just about quantity. It’s about how well you manage your credit. Typically, having two or three credit cards can help improve your credit mix — a key factor that influences your credit score. When you manage these accounts responsibly, it signals to lenders that you understand how to handle borrowing effectively.

Moreover, the right mix of credit types — including credit cards, loans, and a mortgage — is what most lenders prefer to see. It shows that you can manage different kinds of debt, which is vital when applying for significant loans or mortgages.

How Do Multiple Credit Cards Affect Your Credit Score?

Multiple credit cards can actually help boost your credit score, primarily by lowering your credit utilization ratio. This ratio is the amount of credit you’re using compared to your total available credit. For example, if your total credit limit is $10,000 and you have $2,000 in debt, your credit utilization rate is 20%.

Most experts suggest keeping your utilization below 30%. If you’re above that threshold, it can harm your credit score. By opening a new credit card, you increase your total available credit, which lowers your utilization rate — potentially improving your score.

However, the key here is how well you manage your spending. Ensure that you’re making timely payments and not just paying the minimum balance. This will help you avoid late fees, high-interest rates, and debt accumulation.

The Risks of Having Too Many Cards

While having multiple credit cards can be beneficial, there are risks. It’s easy to fall into the trap of overspending. With each additional card comes a new set of due dates, interest rates, and fees, which can quickly become difficult to manage. This could lead to missed payments and a high credit utilization rate, both of which can negatively impact your credit score.

If you’re considering opening a new card, be sure that you can handle the extra responsibility. Keep track of your spending patterns, set up reminders for payments, and make sure you can meet the monthly obligations without going over your budget.

How Often Should You Apply for a Credit Card?

Applying for too many credit cards in a short period can hurt your credit score. When you apply for a new credit card, the lender performs a hard inquiry on your credit report. Too many hard inquiries within a short time frame can suggest to lenders that you’re overextending yourself and taking on too much debt, which could lower your credit score.

Therefore, only apply for a new credit card when it fits into your overall financial plan and you’re confident that it will be manageable.

When Is It Too Much?

While having two or three credit cards is typically recommended, some people might handle more without issue, especially if they have a clear strategy in place. However, for many people, more than three credit cards can become overwhelming and harder to manage.

The most important thing to remember is not how many cards you have, but how responsibly you use them.

Key Tips for Managing Multiple Credit Cards

- Monitor Your Balances: Keep track of how much you owe on each card. This will help you avoid missing payments or exceeding your credit limit.

- Pay On Time: Late payments can result in fees and damage your credit score. Set up automatic payments or reminders to make sure you’re never late.

- Pay in Full When Possible: Paying off your balance in full each month is the best way to avoid paying interest and to maintain a good credit score.

- Check Your Credit Report Regularly: Understand what lenders see when they pull your credit report. This gives you a better idea of how to improve your score.

What About Your Mortgage?

Managing your credit cards wisely is important, especially when you’re planning for larger financial goals like buying a home. Whether you’re a first-time buyer or looking to refinance, understanding your credit score is essential. The right financial tools can make all the difference in securing a mortgage that works for you.

For those of us facing rising living costs or looking for ways to maximize our home equity, reverse mortgages can offer financial relief. If you’re 55 or older, this may be an option worth exploring. A reverse mortgage can provide the financial cushion you need, allowing you to stay in your home while tapping into its equity.

Want to know more?

Reverse mortgages: 55+? A cushion against the rising cost of livingWhen it comes to managing your finances, it’s important to stay on top of your credit card usage. If you’re ready to take the next step in your financial journey, remember that MorningLee.ca is here to help with a range of mortgage and loan services designed to fit your needs.

-

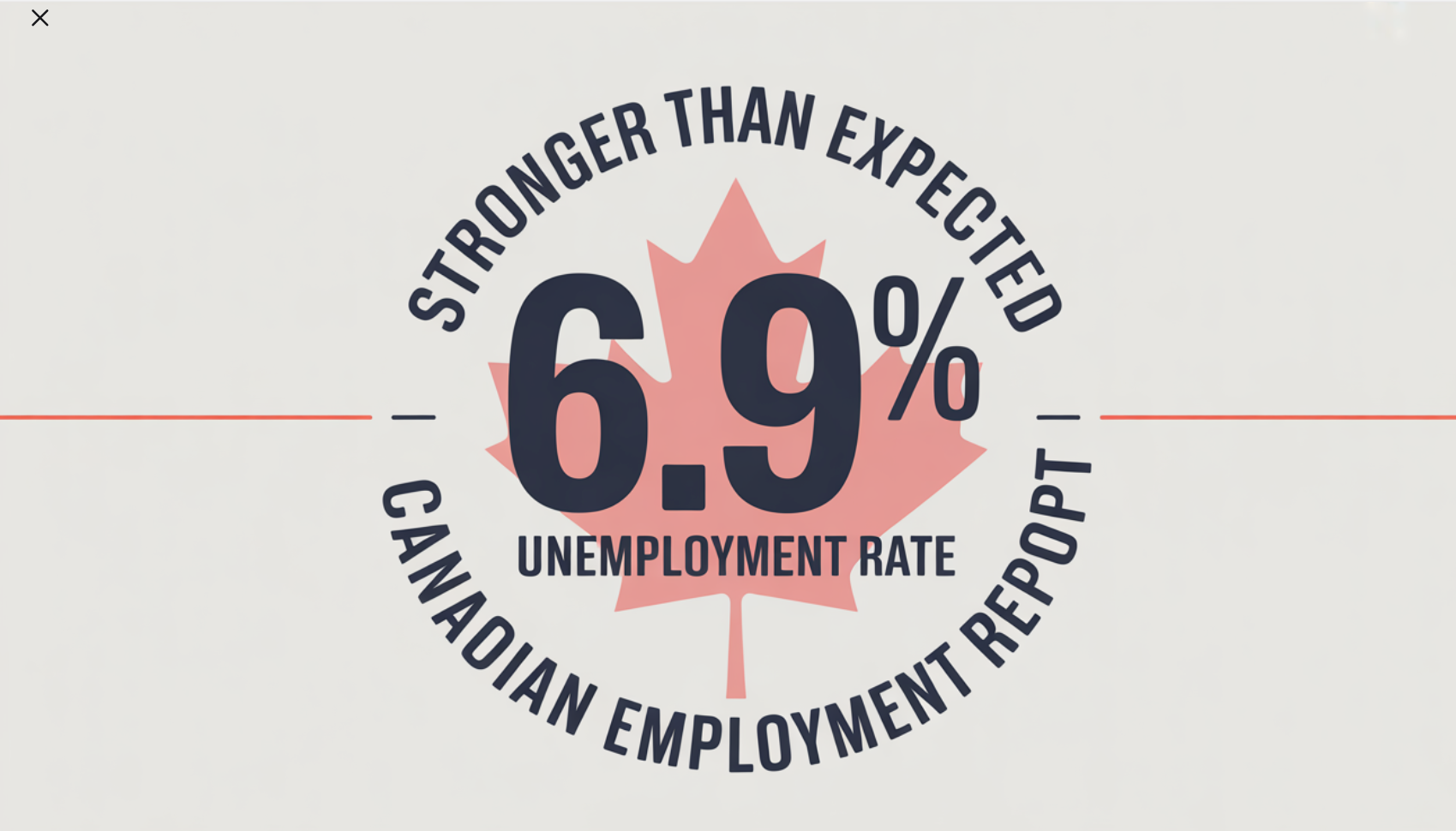

December BoC Rate Cut? October Labour Force Survey Much Stronger Than Expected

Labour Force Survey for October showed a stronger-than-expected net employment gain of 66,600, on the heels of September’s upside surprise. Cumulative gains in September and October (+127,000; +0.6%) have offset cumulative declines observed in July and August (-106,000; -0.5%).

Even more unexpected was the dip in the jobless rate from 7.1% in August and September to 6.9% last month. The Bank of Canada had already suggested that the overnight policy rate, at 2.25%, was low enough to spur growth and mute inflation.

The employment rate rose to 60.8%. The employment rate in October was unchanged year over year but remained below the recent high of 61.1% recorded in January and February 2025.

There were more people working in wholesale and retail trade (+41,000; +1.4%), transportation and warehousing (+30,000; +2.8%), information, culture, and recreation (+25,000; +3.0%), and utilities (+7,600; +4.6%). On the other hand, employment in construction declined by 15,000 (-0.9%).

Employment increased in Ontario (+55,000; +0.7%) and in Newfoundland and Labrador (+4,400; +1.8%), while it declined in Nova Scotia (-4,400; -0.8%) and Manitoba (-4,000; -0.5%).

Average hourly wages among employees increased 3.5% (+$1.27 to $37.06) on a year-over-year basis in October, following growth of 3.3% in September (not seasonally adjusted).

The employment increase in October was driven by part-time work (+85,000; +2.3%). This follows an increase in full-time work in September (+106,000; +0.6%). On a year-over-year basis, employment was up in both full-time work (+199,000; +1.2%) and part-time work (+101,000; +2.7%).

Private sector employment rose by 73,000 (+0.5%) in October, the first increase since June. There was little change in the number of public sector employees or self-employed workers in October.

Despite the employment increase in October, total actual hours edged down (-0.2%) in the month as an elevated number of employees lost work hours due to labour disputes occurring during the Labour Force Survey reference week (October 12 to 18).

An estimated 87,000 employees across the provinces lost work hours due to labour disputes during this period (not seasonally adjusted). This was particularly notable in Alberta, where a teachers’ strike and a subsequent lock-out led to the closure of most elementary and secondary schools in the province.

On a year-over-year basis, total actual hours were up 0.7% in October.

Even with the latest jobs report, the Canadian economy remains vulnerable to the unsettling US attitude towards the free trade agreement, which is slated to be renegotiated by July 2026. But Governor Tiff Macklem has said that fiscal stimulus would be more effective than monetary stimulus in response to tariff-generated weakness. Judging from this week’s federal budget 2025 announcements, fiscal stimulus will take considerable time to impact the overall economy.

The unemployment rate fell 0.2 percentage points to 6.9% in October. Prior to this decline, the unemployment rate had reached 7.1% in August and September, the highest level since May 2016 (excluding 2020 and 2021 during the COVID-19 pandemic).

Nearly one in five (19.8%) unemployed people in September had found work in October. This proportion (referred to as the job finding rate) was up from 12 months earlier (16.5%) but was lower than the average for the same months from 2017 to 2019 (24.6%) (not seasonally adjusted).

Bottom Line

The Bank of Canada has made it clear that it will focus on inflation and will leave closing the output gap to fiscal policy. By early next year, it will be clear to the Bank of Canada that fiscal stimulus in the form of significant capital spending projects is just too slow. I expect the Bank of Canada to take the overnight rate down to 2.0% in early 2026.Dr. Sherry Cooper