Refinancing Experts | Residential & Commercial Mortgage Solutions | Morning Lee

Expert refinancing solutions for homeowners and businesses. Lower rates, access equity, and consolidate debt. Get personalized refinancing strategies today.

Unlock Your Property’s Financial Potential Through Strategic Refinancing

What Is Refinancing?

Refinancing replaces your existing mortgage with a new loan, typically to:

- Secure lower interest rates

- Access home/property equity

- Consolidate high-interest debt

- Change loan terms (amortization period)

- Switch from variable to fixed rates (or vice versa)

Real Example: Commercial landlord accessed $1.2M equity to acquire adjacent property through refinancing

Why Consider Refinancing?

Residential Benefits

- Rate Reduction: Save 0.5-2.5% on current market rates

- Debt Consolidation: Combine credit cards/loans into lower-interest mortgage

- Renovation Funding: Access up to 80% of current home equity

- Mortgage Optimization: Adjust amortization for cash flow needs

Commercial Advantages

- Portfolio Restructuring: Consolidate multiple properties into single loan

- Value-Add Capital: Fund renovations to increase NOI

- Cash Flow Relief: Extend amortization periods

- Bridge Financing: Secure funds for new acquisitions

Our Process

*4-Step Framework for Optimal Results*

- Equity & Savings Analysis

- Current valuation assessment

- Break penalty calculation

- Rate comparison across lenders

- Solution Architecture

- Debt consolidation planning

- Cash-out refinancing structuring

- Term optimization strategy

- Lender Negotiation

- Rate discount securing

- Fee waivers (appraisal, legal)

- Covenant flexibility

- Seamless Transition

- Legal coordination

- Payout management

- Post-refinance rate monitoring

Why Choose Morning Lee for Refinancing?

Rate Reduction Mastery

Equity Access Expertise

- Residential: Up to 100% loan-to-value

- Commercial: Up to 100% LTV loan to value

- Portfolio: Cross-collateralization strategies

Break Cost Mitigation

- High success rate in penalty negotiation/reduction

- Blended rate solutions

- Portability strategies

Specialized Solutions

- Commercial:

- NOI improvement refinancing

- Zoning change value capture

- Anchor tenant lease leveraging

- Residential:

- Credit repair refinancing

- Rental property cash flow optimization

- Construction draw management

When Refinancing Makes Strategic Sense

| Scenario | Residential Solution | Commercial Solution |

|---|---|---|

| Rates Drop 0.75%+ | Rate term reduction | Interest cost arbitrage |

| Property Value Rises | Equity access for renovations | Portfolio expansion capital |

| Credit Score Improves | Prime rate qualification | Covenant requirement reduction |

| Business Needs Change | N/A | Equipment financing roll-in |

Start Your Equity Taking Out Journey

Step 1: Savings Assessment

Calculate Your Refinancing Savings

Step 2: Strategy Session

Book 15-min Refinancing Audit

Step 3: Application Process

*”We’ve optimized many people through strategic refinancing – let our expertise unlock your property’s financial potential.”*

— Mortgage Expert – Morning Lee

-

Rental Property at a Crossroads? Navigate Rising Rates and Secure Your Investment’s Future

Is your mailbox filling with mortgage renewal statements that feel more like unsettling forecasts?

You’re not alone. Countless Canadian rental property owners are facing a perfect storm: interest rates have climbed significantly, and the era of ultra-low monthly payments is behind us. This squeeze on cash flow can turn a reliable investment into a source of constant stress, especially as renewal dates loom.

But this isn’t just a challenge—it’s a critical juncture to reassess your strategy. Proactive planning with a specialist can transform this pressure into an opportunity to strengthen your financial position for the long term.

🏠 The Landlord’s Dilemma: Renewal Reality vs. Cash Flow Crunch

When you initially financed your rental property, the math likely worked perfectly. Today, the equation has changed. Renewing at a significantly higher rate with a traditional bank could mean absorbing a monthly payment increase of hundreds or even thousands of dollars. This directly eats into your profit margin and can jeopardize the viability of your investment.

Simply accepting the posted renewal offer from your current lender is rarely the only—or best— course of action. The market has evolved, and so have the solutions.

💡 Your Strategic Advantage: Bespoke Mortgage Solutions for Investors

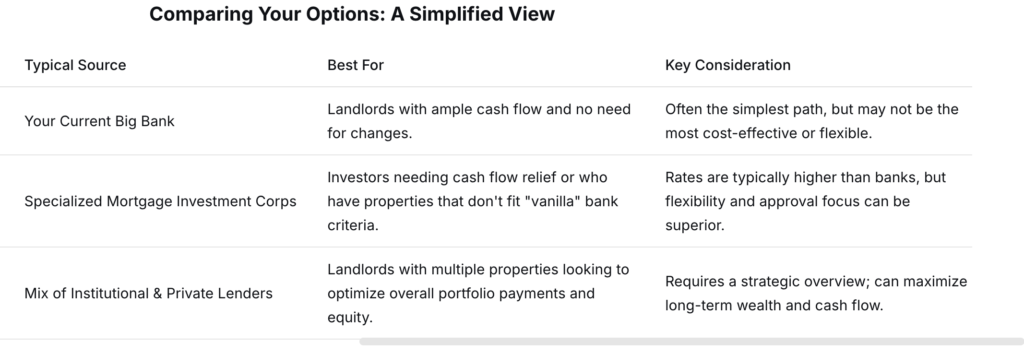

This is where specialized mortgage brokerage makes all the difference. We don’t work for a single bank; we work for you, accessing a wide network of lending partners, including institutional lenders, credit unions, and private lenders that cater specifically to real estate investors.

Our goal is to find a financing structure that aligns with your investment goals and current reality.

Here are a few strategies we can explore:

• Strategic Refinancing: Unlock your property’s equity to consolidate higher-interest debt or create a cash reserve for emergencies or future investments.

• Alternative Lender Solutions: Access lenders who evaluate deals based on the property’s merits and potential rental income, often with more flexibility than traditional banks, especially for unique properties or portfolios.

• Creative Structures: Utilize tools like interest-only payments for a short term to dramatically lower monthly outlays or arrange hold mortgages to bridge gaps during renovation or repositioning phases.

Comparing Your Options: A Simplified View

📊A Real-World Scenario: Turning Pressure into Strategy

Consider a landlord with a duplex carrying a $500,000 mortgage coming up for renewal. Their old rate was 2.9%, with a monthly payment of about $2,045. A straight renewal at today’s higher bank rate could push that payment over $3,000.

Our Action Plan:

1. Analysis: We reviewed the entire portfolio, not just this one property. The duplex had substantial equity and strong rental income.

2. Solution: We facilitated a refinance with an alternative lender at a competitive rate, but with an interest-only payment period for the first year. This kept monthly payments manageable during the rate transition. The cash flow is much better.

3. Result: The landlord accessed $75,000 in equity to pay off a high-interest personal line of credit used for upgrades. Their cash flow improved immediately, and they used the remaining capital for strategic updates to increase rent.

🛠Your Next Step: A Confidential Portfolio Review

The best solution starts with a clear understanding of your unique numbers. Before you make any

decision, let’s conduct a no-obligation review of your situation.

In a brief consultation, we will:

• Analyze your current mortgage statements and renewal notices.

• Assess the rental income and expenses for each property.

• Explore multiple lender options side-by-side with clear, understandable terms.

• Map out a 1-3 year strategy to protect your cash flow and investment.

Don’t let a market shift undermine years of hard work and investment. By exploring alternatives and crafting a smart strategy, you can navigate this period of higher rates with confidence.

Ready to explore your options? Reach out today to schedule your confidential Portfolio Pressure Test. It’s time to move from worrying about your renewal to securing your investment’s future.

-

Higher Rates, Tighter Cash Flow?How Rental Property Owners Can Regain Control Before Renewal

By Morning Lee, Mortgage Broker

For many rental property owners, the past few years were smooth sailing. Low interest rates kept mortgage payments manageable, cash flow steady, and long-term planning simple.

Now, as mortgage renewals approach in a higher-rate environment, many landlords are facing a difficult reality:

Payments are going up — but rents and expenses don’t always move with them.

If you own one or more rental properties and your renewal is coming soon, this is the moment that matters most.

Renewal Is No Longer “Just a Renewal”

In today’s market, renewal is not automatic and it is not neutral.

A higher rate at renewal can mean:

•Hundreds (or thousands) more in monthly payments

•Reduced or negative cash flow

•Pressure on personal finances

•Tough decisions made under time constraints

For owners with multiple properties, one renewal can affect the entire portfolio.

Doing nothing — or simply accepting the first renewal offer — can quietly lock you into years of unnecessary stress.

The Real Problem Isn’t the Rate — It’s Cash Flow

Many landlords focus only on interest rates.

But what actually keeps an investment alive is monthly cash flow.

At renewal, the right mortgage structure can:

•Reduce monthly payment pressure

•Improve stability across your portfolio

•Buy time to adjust rents, expenses, or strategy

•Protect your long-term investment plan

The wrong structure can do the opposite — even at a “reasonable” rate.

Strategic Options Many Rental Owners Overlook

Depending on your situation, there may be solutions that are not always obvious:

✔ Restructuring the Mortgage

Adjusting amortization, payment terms, or structure can significantly improve monthly cash flow — especially in a high-rate cycle.

✔ Using Equity More Efficiently

If your rental property has grown in value, equity can sometimes be structured to:

•Support cash flow

•Offset higher payments

•Create flexibility without selling assets

✔ Consolidating High-Cost Debt

Lines of credit, short-term financing, or fragmented loans can quietly drain cash flow. Proper consolidation can simplify and stabilize your finances.

✔ Planning Before Renewal Pressure Hits

Time equals options. The earlier you plan, the more control you have.

Why Work With Morning Lee

In a higher-rate market, experience and strategy matter more than ever.

With Morning Lee, the focus is not just on getting a mortgage — it’s on building a financing

solution that works with your rental portfolio, not against it.

What clients value most:

•A clear understanding of cash-flow challenges

•Portfolio-level thinking, not one-property decisions

•Access to multiple financing strategies

•Straightforward explanations, no lender bias

•Planning that looks beyond this renewal

The goal isn’t just approval.

The goal is sustainability and control.

Every Rental Portfolio Is Different — Your Solution Should Be Too

Some owners need:

•Lower monthly payments

•Short-term relief with long-term planning

•Flexibility for future renewals

•A bridge strategy while rents or income adjust

There is no one-size-fits-all solution — and that’s exactly why a proper review matters before renewal.

Final Thought

Higher rates don’t mean rental investing no longer works.

They mean financing decisions matter more than ever.

If your renewal is approaching and cash flow feels tighter than before, this is the time to review your options calmly — before pressure forces rushed decisions.

Morning Lee helps rental property owners navigate renewals with clarity, structure, and a long-term view.

-

Bank of Canada Holds Policy Rate Steady

The Bank of Canada once again held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation falling to 2.5%, the Governing Council sees the current overnight rate as appropriate, “conditional on the economy evolving broadly in line with the outlook published today. Inflation was 2.1% in 2025, and the Bank expects inflation to stay close to the 2% target over the projection period, with trade-related cost pressures offset by excess supply.”

According to the press release, “Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism. In the projection, consumer spending holds up, and business investment gradually strengthens, with fiscal policy providing some support. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The Fed stood pat today, but is expected to cut rates three times in the second half of this year. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Data released yesterday showed that US consumer confidence plummeted in January to the lowest level in 12 years on more pessimistic views from Americans worried about the nation’s economy, inflation and a weakening labour market.

The Conference Board gauge decreased to 84.5 from an upwardly revised 94.2 last month, data released Tuesday showed. The figure was the lowest since May 2014 and fell short of all estimates in a Bloomberg survey of economists.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no single market the size of the US market to replace exports of steel and aluminum.“Employment weakened in the first half of 2025 as sectors hit hard by U.S. tariffs cut production and jobs,” Macklem said. “In recent months, overall employment has risen, led by hiring in services like health care, and slowing population growth is reducing the number of new entrants into the labour market.”

US tariffs have had a significant negative impact on Canadian exports. While the push for trade diversification is welcome, export growth is expected to be modest over the next two years.

“This restructuring, including more diversified trade and a more integrated internal market, will support some recovery in our productive capacity,” Macklem said. “But it will take some time.”

As outlined in its Monetary Policy Report (MPR), the top risk to the outlook is the CUSMA review. The bank highlights that Canada currently has an effective US tariff rate of 5.8%, thanks to the exemptions under the North American trade pact. It warned that an unfavourable outcome to negotiations could make Canadian exports less competitive.

“Faced with weaker demand, exporters would reduce production, investment and hiring,” the report said. “This would spill over into the broader economy, weighing on sectors such as services and putting Canadian GDP on a lower path.”

“Government spending on infrastructure is projected to rise, mainly reflecting commitments in provincial budgets,” the report said. “Additional federal capital transfers will also bolster infrastructure investment.”

In this environment, market-driven interest rates have risen. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement. In the meantime, PM Carney will continue to encourage trade deals in non-US countries.

Dr. Sherry Cooper

-

Good News on the Inflation Front Will Keep the BoC on the Sidelines

The Consumer Price Index (CPI) held steady at 2.2% year over year in November, as core inflation continued to ease. Accelerating costs for food and some other goods were offset by slowing price growth for services.

In November, prices for services rose 2.8% year over year, compared with a 3.2% increase in October. Prices for travel tours declined 8.2% last month following a 2.6% increase in October. Monthly, these prices fell 12.0%, as lower demand for destinations in the United States put downward pressure on the index.

Prices for traveller accommodation fell to a greater extent on a year-over-year basis in November (-6.9%) than in October (-0.6%). The most significant contributor to the lower prices was Ontario (-20.2%), partially due to a base-year effect from a swift monthly increase in November 2024 (+11.0%), which coincided with a series of high-profile concerts in Toronto.

Lower prices for travel tours and traveller accommodation, in addition to slower growth for rent prices, put downward pressure on the all-items CPI.

Offsetting the slower growth in services on an annual basis were higher prices for goods, driven by increases in grocery prices and a smaller decline in gasoline prices. Excluding gasoline, the CPI rose 2.6% for the third consecutive month.

The CPI rose 0.1% month over month in November. On a seasonally adjusted monthly basis, the CPI increased 0.2%.

Grocery Price Inflation Highest Since the end of 2023Prices for food purchased from stores rose 4.7% year over year in November after increasing 3.4% in October. The increase in November was the largest since December 2023 (+4.7%). The main contributors to the acceleration in November 2025 were fresh fruit (+4.4%), led by higher prices for berries, and other food preparations (+6.6%).

In November, prices for fresh or frozen beef (+17.7%) and coffee (+27.8%) remained significant contributors to overall grocery inflation on an annual basis. Higher beef prices have been driven, in part, by lower cattle inventories in North America. Adverse weather conditions in growing regions have affected coffee prices, which have risen amid American tariffs on coffee-producing countries, contributing to higher prices for refined coffee.

On a monthly basis, grocery prices rose 1.9% in November, the largest month-over-month increase since January 2023.

Acting as a bit of a counterweight, shelter costs—the earlier inflation villain—continue to moderate. Owned accommodation expenses are now up just 1.7% y/y, the slowest pace in almost a decade amid sagging home prices. Rent inflation remains sticky, but did tick down to 4.7% y/y last month. Keep an eye on electricity prices, which have been a major issue in the US, where AI data centers consume large amounts of electricity. The cost of electricity jumped 1.5% in the month and is now up 3.4% y/y. Telephone services have also leapt recently, after falling heavily the past two years; they are now up 11.7% y/y, the fastest increase since 1982.

The good news is that inflation will average just over 2% for all of 2025, down from 2.4% last year and the lowest annual tally in five years. The less-good news is that this moderation was mainly due to the removal of the consumer carbon tax, which alone shaved about half a point off the annual average.

The main core inflation measures decelerated in November, with the BoC’s two measures both easing two ticks to 2.8% y/y (and both up just 0.1% m/m in seasonally adjusted terms). And, ex food & energy prices also rose just 0.1% m/m, cutting the annual rate three ticks to a moderate 2.4% y/y pace.

Bottom Line

This report confirms the Bank’s hold on the policy rate. Aside from food prices, inflation seems to be dissipating. The overall economy is in better-than-expected shape as the upward revisions in GDP since 2022 were largely the result of better than expected productivity growth–long a big concern for the Canadian economy.

The backdrop of better growth and lower inflation will keep the Bank of Canada on hold for most of 2026, as the next move in rates is likely to be a hike, but not until late next year. In the meantime, the biggest loser in the past year has been the housing market.

Today’s release of existing home sales by the Canadian Real Estate Association suggests particularly weak activity in Ontario, the region hardest hit by the tariff uncertainty. A cautious Bank of Canada will monitor the effect of rapidly rising food prices on inflation expectations. With any luck at all, core inflation will continue to decelerate, keeping the Bank on the sidelines for much of next year.

Hopefully, greater clarity on the Canada-Mexico-US agreement will be forthcoming in the New Year. Reduced uncertainty is the key ingredient required for a rebound in housing activity, particularly in the regions of Ontario and Quebec hardest hit by the tariffs.

Dr. Sherry Cooper

-

Bank of Canada Holds Policy Rate Steady

The Bank of Canada held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation between 2.5% and 3%, the Governing Council sees the current overnight rate as “about right.”

According to the press release, “The Bank expects final domestic demand to grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no market the size of the US market to replace exports of steel and aluminum.

The US will also suffer economic impacts from withdrawing from the Canada-US-Mexico free trade deal. A renegotiation of the contract is likely to come before the end of next year. As of now, the US is signalling their desire to exit the agreement. We can only hope that cooler heads will prevail.

These are challenging times, the surprisingly strong economic data notwithstanding. Consumer and business confidence is down, and the housing market is still weak, especially in the Greater Goldeen Horseshoe.

In this environment, market-driven interest rates have risen sharply. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement.Dr. Sherry Cooper