Is your mailbox filling with mortgage renewal statements that feel more like unsettling forecasts?

You’re not alone. Countless Canadian rental property owners are facing a perfect storm: interest rates have climbed significantly, and the era of ultra-low monthly payments is behind us. This squeeze on cash flow can turn a reliable investment into a source of constant stress, especially as renewal dates loom.

But this isn’t just a challenge—it’s a critical juncture to reassess your strategy. Proactive planning with a specialist can transform this pressure into an opportunity to strengthen your financial position for the long term.

🏠 The Landlord’s Dilemma: Renewal Reality vs. Cash Flow Crunch

When you initially financed your rental property, the math likely worked perfectly. Today, the equation has changed. Renewing at a significantly higher rate with a traditional bank could mean absorbing a monthly payment increase of hundreds or even thousands of dollars. This directly eats into your profit margin and can jeopardize the viability of your investment.

Simply accepting the posted renewal offer from your current lender is rarely the only—or best— course of action. The market has evolved, and so have the solutions.

💡 Your Strategic Advantage: Bespoke Mortgage Solutions for Investors

This is where specialized mortgage brokerage makes all the difference. We don’t work for a single bank; we work for you, accessing a wide network of lending partners, including institutional lenders, credit unions, and private lenders that cater specifically to real estate investors.

Our goal is to find a financing structure that aligns with your investment goals and current reality.

Here are a few strategies we can explore:

• Strategic Refinancing: Unlock your property’s equity to consolidate higher-interest debt or create a cash reserve for emergencies or future investments.

• Alternative Lender Solutions: Access lenders who evaluate deals based on the property’s merits and potential rental income, often with more flexibility than traditional banks, especially for unique properties or portfolios.

• Creative Structures: Utilize tools like interest-only payments for a short term to dramatically lower monthly outlays or arrange hold mortgages to bridge gaps during renovation or repositioning phases.

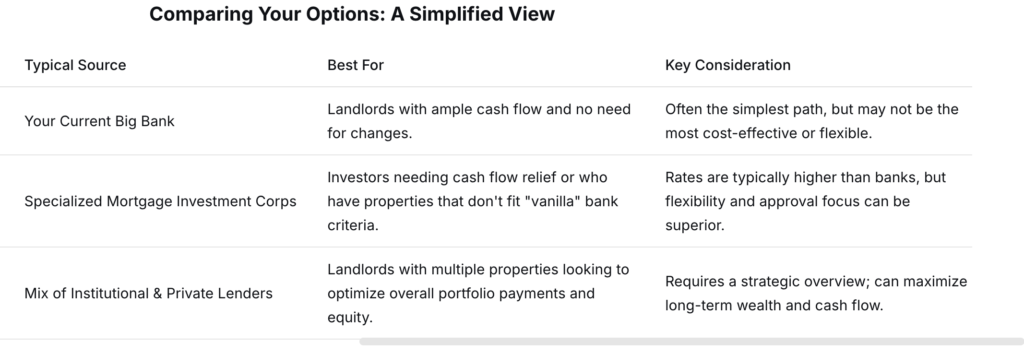

Comparing Your Options: A Simplified View

📊A Real-World Scenario: Turning Pressure into Strategy

Consider a landlord with a duplex carrying a $500,000 mortgage coming up for renewal. Their old rate was 2.9%, with a monthly payment of about $2,045. A straight renewal at today’s higher bank rate could push that payment over $3,000.

Our Action Plan:

1. Analysis: We reviewed the entire portfolio, not just this one property. The duplex had substantial equity and strong rental income.

2. Solution: We facilitated a refinance with an alternative lender at a competitive rate, but with an interest-only payment period for the first year. This kept monthly payments manageable during the rate transition. The cash flow is much better.

3. Result: The landlord accessed $75,000 in equity to pay off a high-interest personal line of credit used for upgrades. Their cash flow improved immediately, and they used the remaining capital for strategic updates to increase rent.

🛠Your Next Step: A Confidential Portfolio Review

The best solution starts with a clear understanding of your unique numbers. Before you make any

decision, let’s conduct a no-obligation review of your situation.

In a brief consultation, we will:

• Analyze your current mortgage statements and renewal notices.

• Assess the rental income and expenses for each property.

• Explore multiple lender options side-by-side with clear, understandable terms.

• Map out a 1-3 year strategy to protect your cash flow and investment.

Don’t let a market shift undermine years of hard work and investment. By exploring alternatives and crafting a smart strategy, you can navigate this period of higher rates with confidence.

Ready to explore your options? Reach out today to schedule your confidential Portfolio Pressure Test. It’s time to move from worrying about your renewal to securing your investment’s future.

Leave a Reply