Mortgage Morning, Realty Lee – Profits Dawn with Me

Realtor, Mortgage Broker, Business Consultant

As a licensed Realtor and Mortgage Broker, with 30+ years experiences in business, real estate, and mortgage, definitely I can help you achieve your goal regarding Realty Mortgage and business.

Morning Lee – Investor / Profit Coach

Mortgage

We have different services for different requirement

Real Estate

We have different Programs For Different Situations.

- Sell Vancouver Residential Property: Single Family Home / Single House, Town House / Town Home, Apartment / Condo, Duplex / Triplex / Fourplex

- Sell Vancouver Commercial Property: Warehouse, Office, Retail Store, Industrial, Plaza / Strip Mall, Multi-Family Building, Office Building

- Sell Vancouver Business

- Buy Vancouver Residential Property

- Buy Vancouver Commercial Property

- Buy Vancouver Business

Business

Our business Consulting service focus on the following

Contact Us here if you need any help for Mortgage, Realty & Business

-

Rental Property at a Crossroads? Navigate Rising Rates and Secure Your Investment’s Future

Is your mailbox filling with mortgage renewal statements that feel more like unsettling forecasts?

You’re not alone. Countless Canadian rental property owners are facing a perfect storm: interest rates have climbed significantly, and the era of ultra-low monthly payments is behind us. This squeeze on cash flow can turn a reliable investment into a source of constant stress, especially as renewal dates loom.

But this isn’t just a challenge—it’s a critical juncture to reassess your strategy. Proactive planning with a specialist can transform this pressure into an opportunity to strengthen your financial position for the long term.

🏠 The Landlord’s Dilemma: Renewal Reality vs. Cash Flow Crunch

When you initially financed your rental property, the math likely worked perfectly. Today, the equation has changed. Renewing at a significantly higher rate with a traditional bank could mean absorbing a monthly payment increase of hundreds or even thousands of dollars. This directly eats into your profit margin and can jeopardize the viability of your investment.

Simply accepting the posted renewal offer from your current lender is rarely the only—or best— course of action. The market has evolved, and so have the solutions.

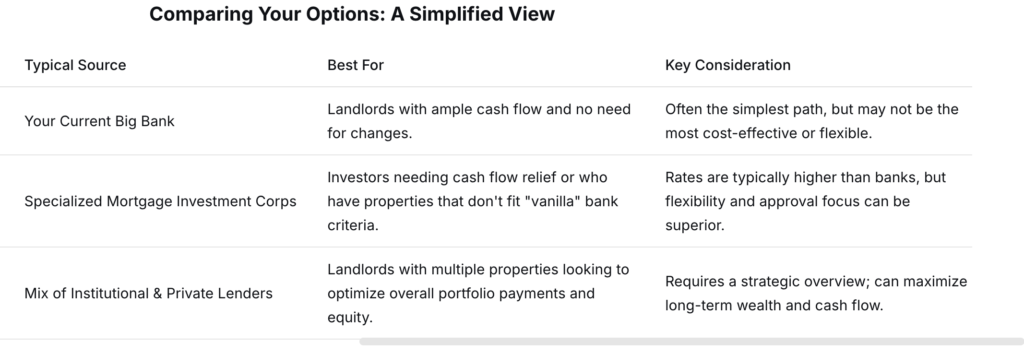

💡 Your Strategic Advantage: Bespoke Mortgage Solutions for Investors

This is where specialized mortgage brokerage makes all the difference. We don’t work for a single bank; we work for you, accessing a wide network of lending partners, including institutional lenders, credit unions, and private lenders that cater specifically to real estate investors.

Our goal is to find a financing structure that aligns with your investment goals and current reality.

Here are a few strategies we can explore:

• Strategic Refinancing: Unlock your property’s equity to consolidate higher-interest debt or create a cash reserve for emergencies or future investments.

• Alternative Lender Solutions: Access lenders who evaluate deals based on the property’s merits and potential rental income, often with more flexibility than traditional banks, especially for unique properties or portfolios.

• Creative Structures: Utilize tools like interest-only payments for a short term to dramatically lower monthly outlays or arrange hold mortgages to bridge gaps during renovation or repositioning phases.

Comparing Your Options: A Simplified View

📊A Real-World Scenario: Turning Pressure into Strategy

Consider a landlord with a duplex carrying a $500,000 mortgage coming up for renewal. Their old rate was 2.9%, with a monthly payment of about $2,045. A straight renewal at today’s higher bank rate could push that payment over $3,000.

Our Action Plan:

1. Analysis: We reviewed the entire portfolio, not just this one property. The duplex had substantial equity and strong rental income.

2. Solution: We facilitated a refinance with an alternative lender at a competitive rate, but with an interest-only payment period for the first year. This kept monthly payments manageable during the rate transition. The cash flow is much better.

3. Result: The landlord accessed $75,000 in equity to pay off a high-interest personal line of credit used for upgrades. Their cash flow improved immediately, and they used the remaining capital for strategic updates to increase rent.

🛠Your Next Step: A Confidential Portfolio Review

The best solution starts with a clear understanding of your unique numbers. Before you make any

decision, let’s conduct a no-obligation review of your situation.

In a brief consultation, we will:

• Analyze your current mortgage statements and renewal notices.

• Assess the rental income and expenses for each property.

• Explore multiple lender options side-by-side with clear, understandable terms.

• Map out a 1-3 year strategy to protect your cash flow and investment.

Don’t let a market shift undermine years of hard work and investment. By exploring alternatives and crafting a smart strategy, you can navigate this period of higher rates with confidence.

Ready to explore your options? Reach out today to schedule your confidential Portfolio Pressure Test. It’s time to move from worrying about your renewal to securing your investment’s future.

-

Canadian Jobs Growth Slowed Markedly in January as the Unemployment Rate Fell Sharply to 6.5%

Canadian Labour Force Survey for January was weaker than expected. Employment declined by 24,800 (-0.1%), and the employment rate decreased 0.1 percentage points to 60.8%. This followed only a small gain in December and was the first decline in the employment rate since August 2025.

In January, a decrease in part-time employment (-70,000; -1.8%) was partly offset by a gain in full-time work (+45,000; +0.3%). Compared with 12 months earlier, overall employment was up by 134,000 (+0.6%), driven by gains in full-time work (+149,000; +0.9%).

The number of private sector employees fell by 52,000 (-0.4%) in January, partly offsetting a net increase of 128,000 (+0.9%) in the last three months of 2025. There was little change in the number of public sector employees (+13,000; +0.3%) and self-employed workers (+14,000; +0.5%) in January.

The jobless rate fell by 0,3 percentage points to 6.5% in January, driven by a decline in the number of people searching for work. The unemployment rate in January was the lowest since September 2024, down 0.6 percentage points from the recent high of 7.1% recorded in August and September 2025.

The labour force participation rate—the proportion of the population aged 15 and older who were employed or looking for work—decreased 0.4 percentage points to 65.0% in January, following an increase of 0.2 percentage points in December. The decline in January was concentrated in Ontario, the hub of the auto sector, manufacturing generally, and steel production. Recent data also show that the number of entry-level positions has fallen sharply, likely due to artificial intelligence replacing these positions.

The unemployment rate fell across most major demographic groups in January, largely reflecting declines in the number of job searchers.

Infographic 2

Unemployment rate by age group, January 2026

Manufacturing jobs were hard hit by the tariffs and trade uncertainty.

The number of people working in manufacturing fell by 28,000 (-1.5%) in January, bringing employment down to levels last observed in August 2025. The decline in January was concentrated in Ontario. On a year-over-year basis, overall employment in manufacturing was down 51,000 (-2.7%).

Chart 3

Employment change by industry, January 2026

There were also fewer workers in educational services (-24,000; -1.5%) and public administration (-10,000; -0.8%) in January. Employment in both industries was little changed year over year.

On the other hand, employment increased in information, culture and recreation (+17,000; +2.0%) in January, continuing an upward trend that began in September 2025. On a year-over-year basis, employment in this industry was up 30,000 (+3.6%) in January.

Employment also rose in business, building and other support services (+14,000; +2.1%) in January, the first increase since October 2024. Employment in this industry had previously followed a downward trend through most of 2025. Compared with 12 months earlier, employment in business, building and other support services was down 38,000 (-5.3%) in January.

Bottom Line

The Bank of Canada has reiterated that its primary mandate is price stability, effectively leaving the task of closing the output gap to fiscal authorities. Fiscal support delivered through large capital-spending projects will be implemented too slowly to materially offset near-term weakness in activity. If layoffs persist at their recent pace and the United States were to withdraw from the Canada‑US‑Mexico Agreement, the case for an additional round of monetary easing would strengthen markedly.

Absent that downside scenario, the more plausible path is a slow and limited normalization of policy. Market pricing currently anticipates that the next move by the Bank of Canada will be to raise the overnight policy rate, but this is unlikely until 2027. If labour force weakness and higher mortgage costs associated with this year’s huge volume of mortgage renewals, in combination with AI-induced job losses, weaken the economy, the Bank of Canada might be willing to cut the overnight policy rate later this year. Uncertainty has already markedly weakened the housing market, despite the reduction in home prices and mortgage rates over the past year.

Dr. Sherry Cooper

-

Higher Rates, Tighter Cash Flow?How Rental Property Owners Can Regain Control Before Renewal

By Morning Lee, Mortgage Broker

For many rental property owners, the past few years were smooth sailing. Low interest rates kept mortgage payments manageable, cash flow steady, and long-term planning simple.

Now, as mortgage renewals approach in a higher-rate environment, many landlords are facing a difficult reality:

Payments are going up — but rents and expenses don’t always move with them.

If you own one or more rental properties and your renewal is coming soon, this is the moment that matters most.

Renewal Is No Longer “Just a Renewal”

In today’s market, renewal is not automatic and it is not neutral.

A higher rate at renewal can mean:

•Hundreds (or thousands) more in monthly payments

•Reduced or negative cash flow

•Pressure on personal finances

•Tough decisions made under time constraints

For owners with multiple properties, one renewal can affect the entire portfolio.

Doing nothing — or simply accepting the first renewal offer — can quietly lock you into years of unnecessary stress.

The Real Problem Isn’t the Rate — It’s Cash Flow

Many landlords focus only on interest rates.

But what actually keeps an investment alive is monthly cash flow.

At renewal, the right mortgage structure can:

•Reduce monthly payment pressure

•Improve stability across your portfolio

•Buy time to adjust rents, expenses, or strategy

•Protect your long-term investment plan

The wrong structure can do the opposite — even at a “reasonable” rate.

Strategic Options Many Rental Owners Overlook

Depending on your situation, there may be solutions that are not always obvious:

✔ Restructuring the Mortgage

Adjusting amortization, payment terms, or structure can significantly improve monthly cash flow — especially in a high-rate cycle.

✔ Using Equity More Efficiently

If your rental property has grown in value, equity can sometimes be structured to:

•Support cash flow

•Offset higher payments

•Create flexibility without selling assets

✔ Consolidating High-Cost Debt

Lines of credit, short-term financing, or fragmented loans can quietly drain cash flow. Proper consolidation can simplify and stabilize your finances.

✔ Planning Before Renewal Pressure Hits

Time equals options. The earlier you plan, the more control you have.

Why Work With Morning Lee

In a higher-rate market, experience and strategy matter more than ever.

With Morning Lee, the focus is not just on getting a mortgage — it’s on building a financing

solution that works with your rental portfolio, not against it.

What clients value most:

•A clear understanding of cash-flow challenges

•Portfolio-level thinking, not one-property decisions

•Access to multiple financing strategies

•Straightforward explanations, no lender bias

•Planning that looks beyond this renewal

The goal isn’t just approval.

The goal is sustainability and control.

Every Rental Portfolio Is Different — Your Solution Should Be Too

Some owners need:

•Lower monthly payments

•Short-term relief with long-term planning

•Flexibility for future renewals

•A bridge strategy while rents or income adjust

There is no one-size-fits-all solution — and that’s exactly why a proper review matters before renewal.

Final Thought

Higher rates don’t mean rental investing no longer works.

They mean financing decisions matter more than ever.

If your renewal is approaching and cash flow feels tighter than before, this is the time to review your options calmly — before pressure forces rushed decisions.

Morning Lee helps rental property owners navigate renewals with clarity, structure, and a long-term view.

-

Bank of Canada Holds Policy Rate Steady

The Bank of Canada once again held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation falling to 2.5%, the Governing Council sees the current overnight rate as appropriate, “conditional on the economy evolving broadly in line with the outlook published today. Inflation was 2.1% in 2025, and the Bank expects inflation to stay close to the 2% target over the projection period, with trade-related cost pressures offset by excess supply.”

According to the press release, “Economic growth is projected to be modest in the near term as population growth slows and Canada adjusts to US protectionism. In the projection, consumer spending holds up, and business investment gradually strengthens, with fiscal policy providing some support. The Bank projects growth of 1.1% in 2026 and 1.5% in 2027, broadly in line with the October projection. A key source of uncertainty is the upcoming review of the Canada-US-Mexico Agreement.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The Fed stood pat today, but is expected to cut rates three times in the second half of this year. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Data released yesterday showed that US consumer confidence plummeted in January to the lowest level in 12 years on more pessimistic views from Americans worried about the nation’s economy, inflation and a weakening labour market.

The Conference Board gauge decreased to 84.5 from an upwardly revised 94.2 last month, data released Tuesday showed. The figure was the lowest since May 2014 and fell short of all estimates in a Bloomberg survey of economists.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no single market the size of the US market to replace exports of steel and aluminum.“Employment weakened in the first half of 2025 as sectors hit hard by U.S. tariffs cut production and jobs,” Macklem said. “In recent months, overall employment has risen, led by hiring in services like health care, and slowing population growth is reducing the number of new entrants into the labour market.”

US tariffs have had a significant negative impact on Canadian exports. While the push for trade diversification is welcome, export growth is expected to be modest over the next two years.

“This restructuring, including more diversified trade and a more integrated internal market, will support some recovery in our productive capacity,” Macklem said. “But it will take some time.”

As outlined in its Monetary Policy Report (MPR), the top risk to the outlook is the CUSMA review. The bank highlights that Canada currently has an effective US tariff rate of 5.8%, thanks to the exemptions under the North American trade pact. It warned that an unfavourable outcome to negotiations could make Canadian exports less competitive.

“Faced with weaker demand, exporters would reduce production, investment and hiring,” the report said. “This would spill over into the broader economy, weighing on sectors such as services and putting Canadian GDP on a lower path.”

“Government spending on infrastructure is projected to rise, mainly reflecting commitments in provincial budgets,” the report said. “Additional federal capital transfers will also bolster infrastructure investment.”

In this environment, market-driven interest rates have risen. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement. In the meantime, PM Carney will continue to encourage trade deals in non-US countries.

Dr. Sherry Cooper

-

Housing Activity Fell in December, Rounding Out A Disappointing Year

Today’s release of December housing data by the Canadian Real Estate Association (CREA) showed the market ended 2025 with declining sales and prices due to ongoing economic uncertainty.

The number of home sales recorded over Canadian MLS® Systems declined 2.7% m/m in December. On an annual basis, transactions totalled 470,314 units last year, a 1.9% decrease from 2024, despite a series of Bank of Canada rate cuts.

“There doesn’t appear to have been much rhyme or reason to the month-over-month decline in home sales in December, which was simply the result of coincident but seemingly unrelated slowdowns in Vancouver, Calgary, Edmonton, and Montreal,” said Shaun Cathcart, CREA’s Senior Economist. “For that reason, it would be prudent for market observers to resist the temptation to trace a line from the end of 2025 into 2026. Rather, we continue to expect sales to move higher again as we get closer to the spring, rejoining the upward trend that was observed throughout the spring, summer, and early fall of 2025.”

New Listings

New supply declined by 2% on a month-over-month basis in December, marking a fourth straight monthly drop. Combined with a slightly larger decrease in sales activity in December, the sales-to-new-listings ratio eased to 52.3% from 52.7% in November. This remains close to the long-term average national sales-to-new listings ratio of 54.9%. Readings roughly between 45% and 65% are generally consistent with balanced housing market conditions.

There were 133,495 properties listed for sale on all Canadian MLS® Systems at the end of December 2025, up 7.4% from a year earlier but 9.9% below the long-term average for that time of year. Inventories have been falling since May 2025 owing to the mid-year rally in demand, meaning active listings could be back posting year-over-year declines around the time this year’s spring market gets going.

“While we remain in the quiet time of year for a little while longer, the spring market is now just around the corner, and it is expected to benefit from four years of pent-up demand, and interest rates that at this point are about as good as they are going to get,” said Valérie Paquin, CREA Chair. “Barring any further major uncertainty-causing events, that means we should see a more active market this year.”

There were 4.5 months of inventory on a national basis at the end of December 2025, up slightly from 4.4 months, which had been the measure since August. The long-term average for this measure of market balance is 5 months of inventory. Based on the measure of one standard deviation above and below that long -term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

Home Prices

The National Composite MLS ® Home Price Index (HPI) fell by 0.3% between November and December 2025. It was similar to the dip recorded in November and could reflect some sellers making price concessions to sell properties before the end of the year. Most of the overall price softening in December came from markets in Ontario’s Greater Golden Horseshoe region, which was hit hard by US tariffs.

The non-seasonally adjusted National Composite MLS® HPI was down 4% from December 2024. Under the surface, year-over-year declines are larger for condo apartments and townhomes, and smaller for one- and two-storey detached homes.

Bottom Line

Today’s data end a year that saw house prices drift lower despite falling interest rates, as a simmering trade war with Canada’s largest trading partner caused higher unemployment and considerable job uncertainty. Though US tariffs apply to a limited volume of Canadian goods, and the economy didn’t tip into a recession, the unpredictability of President Donald Trump’s trade policy has stoked a sense of economic insecurity.

In some regions, the price decline has now wiped out a sizable proportion of the gains homeowners saw during the torrid Covid market from 2020 to 2022, when overnight interest rates were reduced to a record-low 25 basis points. Back then, ultralow interest rates caused home prices to surge, particularly in smaller cities to which remote workers fled to take advantage of a lower cost of living.

Vancouver and Toronto remain by far the most expensive large cities. The benchmark price in Greater Vancouver was C$1.14 million in December. In the Toronto region, it was C$962,300 – down about 6% from a year earlier.

With many regional markets soft, sellers are now pulling back. New listings dropped 2% in December from the previous month, the fourth straight monthly decline. But the total number of homes on the market last month was still 7.4% higher than the previous year. That’s the equivalent of about 4.5 months of inventory.

We concur with the view that there is considerable pent-up demand among potential first-time buyers who will likely dip their toe in the market once winter passes. This year, we also see a record volume of refinances and renewals, which will increase monthly mortgage payments and dampen household purchasing power.

Dr. Sherry Cooper

What people say:

“As first-time buyers in Vancouver, we were overwhelmed. Morning Lee didn’t just find us the perfect Kitsilano condo within our budget, she patiently educated us every step of the way. Her negotiation skills were incredible – we got the place below asking in a competitive market! She made a stressful process feel empowering.”

Sarah T.,

Registered Nurse

Arjun P.,“Securing the right location for our expanding tech consultancy was critical. Morning Lee understood our business needs intimately, not just the square footage. She found us a strategic Gastown space with growth potential and expertly negotiated the lease terms. Her dual perspective on business and real estate is invaluable.”

Founder & CEO, NexGen Solutions

Elena R.,“Financing multiple investment properties can be complex. Morning Lee’s mortgage expertise is next-level. She secured us significantly better rates and terms than we thought possible, structuring the financing perfectly for cash flow. She doesn’t just get mortgages; she builds wealth strategies.”

Real Estate Investor

David L.,“I almost launched my e-commerce platform with costly mistakes. Morning Lee’s ‘Risk Free Startup Success’ framework (PRISMs Method) was my blueprint. Her consulting helped me validate my idea, set up efficient ops, and create a killer digital marketing launch plan. We hit profitability in Month 6 – her guidance was the game-changer.”

E-commerce Entrepreneur

Marcus W.,“We needed to refinance our manufacturing facility AND improve our bottom line. Morning Lee tackled both seamlessly. She secured optimal commercial financing, freeing up capital, then her profit consulting identified clear operational inefficiencies. Implementing her strategies boosted our profit margin by 30% within a year. A true business partner.”

Operations Director, Cascade Manufacturing

Priya S.,“Scaling my team felt chaotic until I worked with Morning Lee. Her consulting, rooted in the principles from ‘From Leadership to Success,’ transformed our culture. She helped define clear roles, implement effective communication channels, and develop a strategic roadmap everyone aligns with. Productivity and morale have soared. Essential leadership wisdom.”

Marketing Director, Bloom Creative Agency