Mortgage Morning, Realty Lee – Profits Dawn with Me

Realtor, Mortgage Broker, Business Consultant

As a licensed Realtor and Mortgage Broker, with 30+ years experiences in business, real estate, and mortgage, definitely I can help you achieve your goal regarding Realty Mortgage and business.

Morning Lee – Investor / Profit Coach

Mortgage

We have different services for different requirement

Real Estate

We have different Programs For Different Situations.

- Sell Vancouver Residential Property: Single Family Home / Single House, Town House / Town Home, Apartment / Condo, Duplex / Triplex / Fourplex

- Sell Vancouver Commercial Property: Warehouse, Office, Retail Store, Industrial, Plaza / Strip Mall, Multi-Family Building, Office Building

- Sell Vancouver Business

- Buy Vancouver Residential Property

- Buy Vancouver Commercial Property

- Buy Vancouver Business

Business

Our business Consulting service focus on the following

Contact Us here if you need any help for Mortgage, Realty & Business

-

Reverse mortgages: 55+? A cushion against the rising cost of living

Did you know?

A reverse mortgage can be a flexible tool for a senior to offset the rising cost of living, to borrow more than a bank may be willing to lend for a traditional mortgage, and to provide emergency funds for long-term care.

Scenario

Judith is a 75-year-old and living on Steeles Avenue in North York, Toronto. She’s lived in her home for over 40 years, and she and her late husband raised their family there. Given the location, she figures her older home is worth about $2 million. There’s also been speculation that there may someday be approval for condo development, which could cause the land value to skyrocket.

Judith receives the maximum CPP pension of about $1,300 per month (a combination of her own retirement pension and a survivor pension for her late husband) and gets nearly the maximum OAS pension—another $700 or so each month. That equates to about $2,000 of monthly pension income from the federal government. She also has a small defined benefit pension from the UK government that fluctuates year to year based on the exchange rate.Beyond that, she’s been drawing down a savings account from a modest inheritance from her parents and a small life insurance policy paid out when her husband passed away a few years ago.

Judith’s financial options to help cushion the impact of inflation:

- Credit card

- HELOC

- Sell her home and move into an apartment or retirement home, and invest into GICs to cover her monthly costs.

Solution

Judith decides a reverse mortgage might be a good fit for her—but not yet. She can use the $100,000 secured line of credit from the bank for now, but if she wants to stay in her home, eventually a reverse mortgage might be the best borrowing option. She’s willing to pay interest, and besides, she’s hopeful her home value will rise, tax-free, despite the interest she may pay.

More importantly, depleting the value of her estate seems unfounded. If she sells her home and rents, she’ll be spending a portion of her children’s inheritance either way. Her kids are supportive of her doing what she wants, which is to maintain the status quo.

Judith thinks a lot about what she would want to happen if her health deteriorated. She’d rather not count on help from her kids, preferring to pay for her costs herself.

A reverse mortgage could provide her with roughly $900,000 that could be accessed all at once, advanced as scheduled monthly payments like a pension, or borrowed on an as-needed basis. She may not need to borrow much to supplement her spending in her 80s, but having access to a large part of her home equity appeals to her.

Plus, if a developer does buy along her street to make way for condos, her home value may appreciate significantly.

Ready to Get Started?

If you’d like to learn more about how a reverse mortgage may similarly suit your needs, I’d be happy to help answer any quesitons you may have – with no obligations. Contact Us now.

-

CPI Report Shows Headline Inflation Cooling, But Core Inflation Remains Troubling

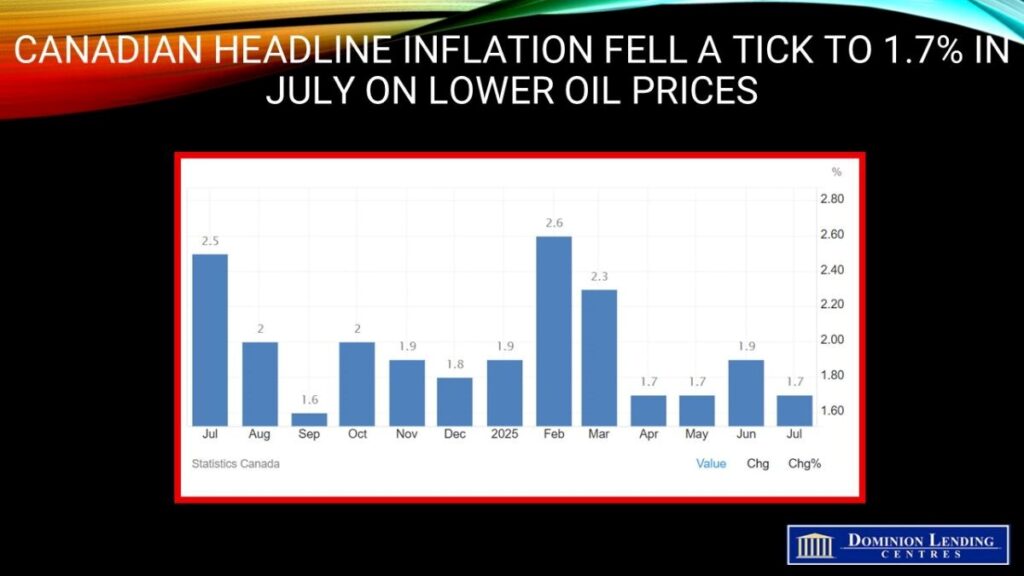

Canadian consumer prices decelerated to 1.7% y/y in July, a bit better than expected and down two ticks from June’s reading.

Gasoline prices led the slowdown in the all-items CPI, falling 16.1% year over year in July, following a 13.4% decline in June. Excluding gasoline, the CPI rose 2.5% in July, matching the increases in May and June.Gasoline prices fell 0.7% m/m in July. Lower crude oil prices, following the ceasefire between Iran and Israel, contributed to the decline. In addition, increased supply from the Organization of the Petroleum Exporting Countries and its partners (OPEC+) put downward pressure on the index.

Moderating the deceleration in July were higher prices for groceries and a smaller year-over-year decline in natural gas prices compared with June.

The CPI rose 0.3% month over month in July. On a seasonally adjusted monthly basis, the CPI was up 0.1%.

In July, prices for shelter rose 3.0% year over year, following a 2.9% increase in June, with upward pressure mostly coming from the natural gas and rent indexes. This was the first acceleration in shelter prices since February 2024.

Prices for natural gas fell to a lesser extent in July (-7.3%) compared with June (-14.1%). The smaller decline was mainly due to higher prices in Ontario, which increased 1.8% in July after a 14.0% decline in June.

Rent prices rose at a faster pace year over year, up 5.1% in July following a 4.7% increase in June. Rent price growth accelerated the most in Prince Edward Island (+5.6%), Newfoundland and Labrador (+7.8%) and British Columbia (+4.8%).

Moderating the acceleration in shelter was continued slower price growth in mortgage interest cost, which rose 4.8% year over year in July, after a 5.6% gain in June. The mortgage interest cost index has decelerated on a year-over-year basis since September 2023.

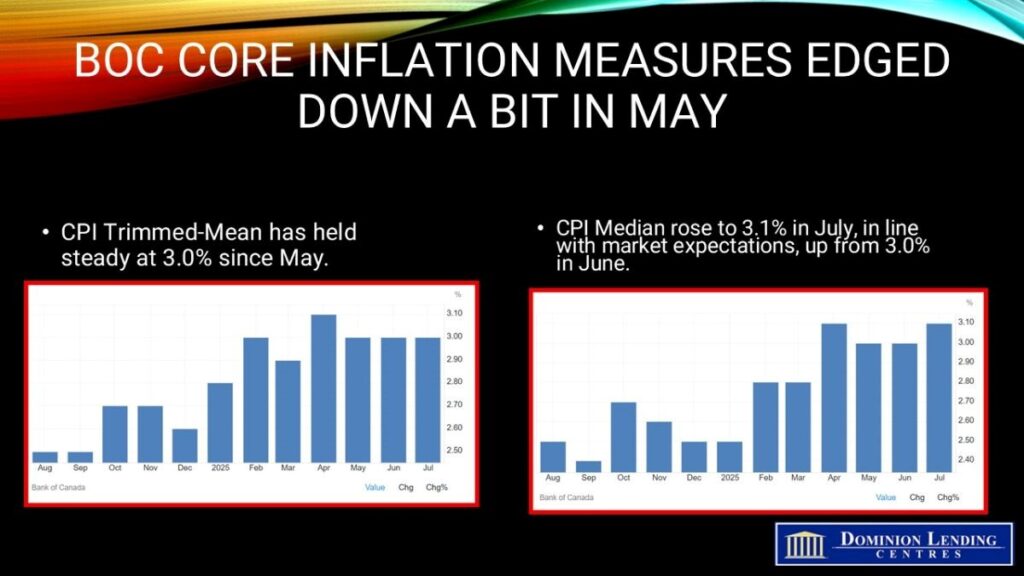

The Bank of Canada’s two preferred core inflation measures accelerated slightly, averaging 3.05%, up from 3% in May, and above economists’ median projection. Traders see the continued strength in core inflation as indicative of relatively robust household spending.

There’s also another critical sign of firmer price pressures: The share of components in the consumer price index basket that are rising by 3% or more — another key metric the central bank’s policymakers are watching closely — expanded to 40%, from 39.1% in June.

CPI excluding taxes eased to 2.3%, while CPI excluding shelter slowed to 1.2%. CPI excluding food and energy dropped to 2.5%, and CPI excluding eight volatile components and indirect taxes fell to 2.6%.

The breadth of inflation is also rising. The share of components with the consumer price index basket that are increasing 3% and higher — another key metric that the bank’s policymakers are following closely — fell to 37.3%, from 39.1% in June.

Bottom Line

With today’s CPI painting a mixed picture, the following inflation report becomes more critical for the Governing Council. The August CPI will be released the day before the September 17 meeting of the central bank. There is also another employment report released on September 5.

Traders see roughly 84% odds of a Federal Reserve rate cut when they meet again on Sept 17–the same day as Canada. Currently, the odds of a rate cut by the BoC stand at 34%. Unless the August inflation report shows an improvement in core inflation, the Bank will remain on the sidelines.

Dr. Sherry Cooper -

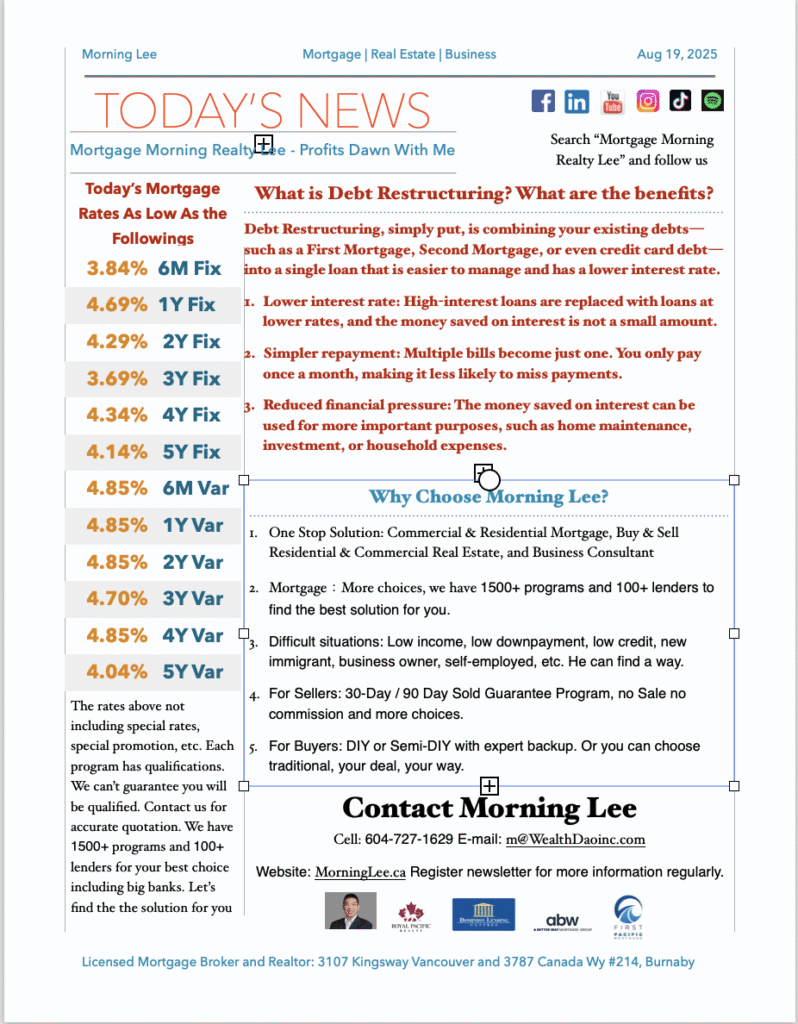

Today’s Lowest Rates Up and Down at The Same Time

The 3-year fixed rate has hit a new low at 3.69%, but the 5-year lowest fixed rate has gone up. The upward and downward pressures are still fiercely competing.

If you are considering a loan in the near future, you need to pay close attention to rate changes and seize the timing to lock in a contract that is favourable to you.

If your current rate is relatively high, 5% or even over 6%, you need to carefully calculate and compare: the penalty for breaking your current contract versus the money saved by switching to a lower rate — which one is more cost-effective. An extra surprise may even make you scream!

Even banks say no, for low income, low credit, low down pay, Morning will find a way, for you.

-

Owning $10 million in real estate but denied a loan—how to turn rejection into a powerful tool

Imagine Investor A, holding seven properties with a total value $10+ million. They spot a rare opportunity: sellers urgently offloading prime real estate at below-market price. But when they approach traditional banks for a loan, they hit a wall.

The Dilemma

Despite looking like a financial winner, reality bites:- Self-employment income nearly zero due to market changes

- Loans only $2 million, net assets $8 million

- Primary residence worth $2.2 million, mortgage $200k

- Rental income covers mortgage with positive cash flow, but after daily expenses and maintenance, disposable cash is limited

- Excellent credit score and history

Yet, major banks refused their applications. Why? Income too low, debt too high, and unable to pass standard stress tests.

Breaking the Gridlock

Investor A came to us, and we break it through by thinking differently. While banks focus on regular income, we realized Investor A’s wealth was “locked in walls.” Six solutions emerged by us:1. Reverse Mortgage (Primary Residence, Age 55+)

- Benefits:

- No income verification.

- Flexible credit requirements.

- No down payment required.

- Access up to ~50% of your home equity.

- Funds received as monthly payments, lump sum, or instalments.

- Minimal fees, almost none.

- Fast approval.

- Drawbacks:

- Only available for primary residences (not investment properties).

- Maximum Cash Available: ~$1 million

2. “Enhanced” Reverse Mortgage (Primary Residence, No Age Requirement)

- Benefits:

- No age requirement.

- No income verification.

- Flexible credit requirements.

- No down payment required.

- Access up to 60% of your home equity.

- Funds received as monthly payments, lump sum, or instalments.

- Fast approval.

- Cancel anytime without penalty.

- Drawbacks:

- Only available for primary residences (not investment properties).

- Higher fees.

- Maximum Cash Available: ~$1.2 million

3. First Mortgage Home Equity Line of Credit

- Benefits:

- Access up to 75% of home equity.

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Pay interest only on amounts drawn; no payment if unused. Access funds freely and flexibly.

- Drawbacks:

- Higher fees.

- Requires terminating existing first mortgage.

- Maximum Cash Available: ~$6 million

4. First Mortgage Home Equity Mortgage

- Benefits:

- Access up to 75% of home equity.

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Lower fees than a First Mortgage HELOC.

- Drawbacks:

- Requires terminating existing first mortgage.

- Monthly payments required.

- Maximum Cash Available: ~$6 million

5. Second Mortgage Home Equity Line of Credit

- Benefits:

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Access up to 75% of home equity.

- Pay interest only on amounts drawn; no payment if unused. Access funds freely and flexibly.

- Does not require terminating existing first mortgage.

- Drawbacks:

- Higher fees.

- Maximum Cash Available: ~$6 million

6. Second Mortgage Home Equity Loan

- Benefits:

- No income verification.

- No age requirement.

- Flexible credit requirements.

- Access up to 75% of home equity.

- Does not require terminating your existing first mortgage.

- Lower fees than a Second Mortgage HELOC.

- Drawbacks:

- Monthly payments required.

- Maximum Cash Available: ~$6 million

Investor A opted for a mix of all six, leveraging each solution’s strengths while minimizing drawbacks according to the banks policies and his own situation like title, balance, interest rate, etc .

The Result

Investor A secured a $5 million credit line with two remarkable features:- Off loaded the cash pressure— and interest applies only when money is used

- Ready to close good deals any time and immediate access to funds when needed – won’t miss any good opportunities to build up more wealth.

From nearly depleted cash reserves, Investor A now had millions ready to seize undervalued properties, paying cash instantly. No income verification, no stress tests, no mandatory monthly payments—like turning their property into a giant credit card that only charges when used.

Practical Impact

Opportunities came faster than expected. Sellers in a slow market offered below-market prices with room to negotiate. While others waited for bank approvals, Investor A could pay in cash, creating a competitive edge. The secret wasn’t having money—it was unlocking dormant assets to capitalize on timing and market gaps.Key Takeaway

Banks have rules, but asset value is undeniable. When income-based paths fail, check the “walls” you’ve built—every brick could be emergency cash or a lever to unlock opportunities. Investor A’s transformation? From chasing bank loans to letting assets speak for themselves.Assess your own available funds immediately: Evaluate available credit limit.

For buyers, sellers, or anyone navigating property financing, understanding alternative funding strategies can make the difference between watching opportunities slip away or seizing them confidently.

Explore more insights and strategic approaches at MorningLee.ca:Case Study: How Debt Restructuring Can Save You Thousands

For a safer, smarter property purchase, conduct real estate due diligence for comprehensive property inspections and risk assessments.

-

Canadian Homebuyers Return in July, Posting the Fourth Consecutive Sales Gain

Today’s release of the July housing data by the Canadian Real Estate Association (CREA) showed good news on the housing front. Following a disappointing spring selling season, National home sales were up 3.8% in July from the month before, with Toronto seeing transactions rebound 35.5% since March. However, the total number of Toronto sales remains low by historical standards.

On a year-over-year basis, total transactions have risen 11.2% since March.

There is growing confidence that the Canadian economy will resiliently weather the tariff trauma. The Canadian dollar is up, and longer-term interest rates have edged downward in the past ten days. Traders are now anticipating a rate cut by the Federal Reserve in September.

Tuesday’s release of the Canadian CPI will provide another data point for the Bank of Canada. Economic growth has held up, in large part because much of the pain from tariffs has been confined to industries singled out for levies, including autos, steel and aluminum.

Shaun Cathcart, the real estate board’s senior economist, said, “With sales posting a fourth consecutive increase in July, and almost 4% at that, the long-anticipated post-inflation crisis pickup in housing seems to have finally arrived. The shock and maybe the dread that we felt back in February, March and April seem to have faded,” as people become less concerned about their future employment.

New Listings

New supply was little changed (+0.1%) month-over-month in July. Combined with the notable increase in sales, the national sales-to-new listings ratio rose to 52%, up from 50.1% in June and 47.4% in May. The long-term average for the national sales-to-new listings ratio is 54.9%, with readings roughly between 45% and 65% generally consistent with balanced housing market conditions.

There were 202,500 properties listed for sale on all Canadian MLS® Systems at the end of July 2025, up 10.1% from a year earlier and in line with the long-term average for that time of the year.

“Activity continues to pick up through the transition from the spring to the summer market, which is the opposite of a normal year, but this has not been a normal year,” said Valérie Paquin, CREA Chair. “Typically, we see a burst of new listings right at the beginning of September to kick off the fall market, but it seems like buyers are increasingly returning to the market.

There were 4.4 months of inventory on a national basis at the end of July 2025, dropping further below the long-term average of five months of inventory as sales continue to pick up. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

Home Prices

The National Composite MLS® Home Price Index (HPI) was unchanged between June and July 2025. Following declines in the first quarter of the year, the national benchmark price has remained mostly stable since May.

The non-seasonally adjusted National Composite MLS® HPI was down 3.4% compared to July 2024. This was a smaller decrease than the one recorded in June.

Based on the extent to which prices fell off in the second half of 2024, look for year-over-year declines to continue to shrink in the months ahead.

Bottom Line

Homebuyers are responding to improving fundamentals in the Canadian housing market. Supply has risen as new listings surged until May of this year. Additionally, the benchmark price was $688,700, 3.4% lower than a year earlier. That decrease was smaller than in June, and the board expects year-over-year declines to continue shrinking, it said in a statement.While many expect the Fed to ease in September, I’m not sure it will happen. The producer price index came in hotter than expected this week. Fed action will depend mainly on the personal consumption expenditures index (PCE), the Fed’s favourite measure of inflation, which will be out on August 29.

US stagflation worries have emerged with the release of the July employment report, which showed considerable weakness, enough to get the head of the Bureau of Labour Statistics fired. The likelihood of a BoC cut will increase if the Fed begins a series of easing moves as the administration is demanding.

Dr. Sherry Cooper

What people say:

“As first-time buyers in Vancouver, we were overwhelmed. Morning Lee didn’t just find us the perfect Kitsilano condo within our budget, she patiently educated us every step of the way. Her negotiation skills were incredible – we got the place below asking in a competitive market! She made a stressful process feel empowering.”

Sarah T.,

Registered Nurse

Arjun P.,“Securing the right location for our expanding tech consultancy was critical. Morning Lee understood our business needs intimately, not just the square footage. She found us a strategic Gastown space with growth potential and expertly negotiated the lease terms. Her dual perspective on business and real estate is invaluable.”

Founder & CEO, NexGen Solutions

Elena R.,“Financing multiple investment properties can be complex. Morning Lee’s mortgage expertise is next-level. She secured us significantly better rates and terms than we thought possible, structuring the financing perfectly for cash flow. She doesn’t just get mortgages; she builds wealth strategies.”

Real Estate Investor

David L.,“I almost launched my e-commerce platform with costly mistakes. Morning Lee’s ‘Risk Free Startup Success’ framework (PRISMs Method) was my blueprint. Her consulting helped me validate my idea, set up efficient ops, and create a killer digital marketing launch plan. We hit profitability in Month 6 – her guidance was the game-changer.”

E-commerce Entrepreneur

Marcus W.,“We needed to refinance our manufacturing facility AND improve our bottom line. Morning Lee tackled both seamlessly. She secured optimal commercial financing, freeing up capital, then her profit consulting identified clear operational inefficiencies. Implementing her strategies boosted our profit margin by 30% within a year. A true business partner.”

Operations Director, Cascade Manufacturing

Priya S.,“Scaling my team felt chaotic until I worked with Morning Lee. Her consulting, rooted in the principles from ‘From Leadership to Success,’ transformed our culture. She helped define clear roles, implement effective communication channels, and develop a strategic roadmap everyone aligns with. Productivity and morale have soared. Essential leadership wisdom.”

Marketing Director, Bloom Creative Agency