Buying Property in Vancouver Residential – Vancouver Best Realtor – Morning Lee

Buying property in Vancouver is not an easy job, but I can make it easier for you. We have three different program options tailored for different people. I believe one of them will be a good fit for you.

Self Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and Subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Semi-Self Service Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Full Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and accepted offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement For You

- Funds are ready or will be ready

Benefit For You

- Full service for purchasing your dream home

This option is a traditional classic service. But most people don’t need all the services. Which is why we offer other options.

Self-Service Buyer Program for Buying Property in Vancouver

Buying Property in Vancouver is a very simple and easy job for some experienced and skilled people – for example, real estate investors, former Realtors, or those who have experiences buying properties in Vancouver, or those who own multiple properties. For these people, we offer only essential services, saving time for you and us. This way, you will receive a large cash bonus, buyer rebate, after closing, which comes from our buyer agent commission.

However, please note that some listing agents set conditions regarding the buyer agent’s commission. For example, if the buyer agent does not attend an open house or private showing, the commission may be reduced significantly—sometimes to as low as $500.

In such cases, either you must avoid those listings, or there will be no cash bonus (buyer rebate) available to you

For more information about our Self-Service Buyer Program, please contact us directly. contact us.

Semi-Self Service Buyer Program for Buying Property in Vancouver

Some buyers don’t need full service but may not feel entirely comfortable with the self-service buyer program. For those clients, we provide essential services along with a few additional supports. This approach still saves time, which is why you can also receive a cash bonus (buyer rebate).

That said, please understand the same limitations apply: some listing agents require the buyer agent’s presence at showings or open houses. If those conditions are not met, the buyer agent’s commission may be reduced to a small amount, such as $500. In those cases, either avoid such listings, or a rebate cannot be provided.

For more information about our Semi-Self-Service Buyer Program, please contact us directly. contact us.

Full Service Buyer Program for Buying Property in Vancouver

As the name suggests, the Full-Service Buyer Program includes all services typically provided by a buyer’s agent. This is especially suitable for newcomers or anyone who may not feel confident navigating the self-service or semi-self-service programs.

With this option, we handle everything for you—making the home-buying process as smooth and stress-free as possible.

For more information about our Full Service Buyer Program, please contact us directly. contact us.

If you need mortgage, please contact us for our mortgage servcie

Another website built by WealthDao Consulting. For E-Commerce Consulting, Digital Marketing Consulting, Profit Consulting, please visit WealthDao Consulting

-

Good News on the Inflation Front Will Keep the BoC on the Sidelines

The Consumer Price Index (CPI) held steady at 2.2% year over year in November, as core inflation continued to ease. Accelerating costs for food and some other goods were offset by slowing price growth for services.

In November, prices for services rose 2.8% year over year, compared with a 3.2% increase in October. Prices for travel tours declined 8.2% last month following a 2.6% increase in October. Monthly, these prices fell 12.0%, as lower demand for destinations in the United States put downward pressure on the index.

Prices for traveller accommodation fell to a greater extent on a year-over-year basis in November (-6.9%) than in October (-0.6%). The most significant contributor to the lower prices was Ontario (-20.2%), partially due to a base-year effect from a swift monthly increase in November 2024 (+11.0%), which coincided with a series of high-profile concerts in Toronto.

Lower prices for travel tours and traveller accommodation, in addition to slower growth for rent prices, put downward pressure on the all-items CPI.

Offsetting the slower growth in services on an annual basis were higher prices for goods, driven by increases in grocery prices and a smaller decline in gasoline prices. Excluding gasoline, the CPI rose 2.6% for the third consecutive month.

The CPI rose 0.1% month over month in November. On a seasonally adjusted monthly basis, the CPI increased 0.2%.

Grocery Price Inflation Highest Since the end of 2023Prices for food purchased from stores rose 4.7% year over year in November after increasing 3.4% in October. The increase in November was the largest since December 2023 (+4.7%). The main contributors to the acceleration in November 2025 were fresh fruit (+4.4%), led by higher prices for berries, and other food preparations (+6.6%).

In November, prices for fresh or frozen beef (+17.7%) and coffee (+27.8%) remained significant contributors to overall grocery inflation on an annual basis. Higher beef prices have been driven, in part, by lower cattle inventories in North America. Adverse weather conditions in growing regions have affected coffee prices, which have risen amid American tariffs on coffee-producing countries, contributing to higher prices for refined coffee.

On a monthly basis, grocery prices rose 1.9% in November, the largest month-over-month increase since January 2023.

Acting as a bit of a counterweight, shelter costs—the earlier inflation villain—continue to moderate. Owned accommodation expenses are now up just 1.7% y/y, the slowest pace in almost a decade amid sagging home prices. Rent inflation remains sticky, but did tick down to 4.7% y/y last month. Keep an eye on electricity prices, which have been a major issue in the US, where AI data centers consume large amounts of electricity. The cost of electricity jumped 1.5% in the month and is now up 3.4% y/y. Telephone services have also leapt recently, after falling heavily the past two years; they are now up 11.7% y/y, the fastest increase since 1982.

The good news is that inflation will average just over 2% for all of 2025, down from 2.4% last year and the lowest annual tally in five years. The less-good news is that this moderation was mainly due to the removal of the consumer carbon tax, which alone shaved about half a point off the annual average.

The main core inflation measures decelerated in November, with the BoC’s two measures both easing two ticks to 2.8% y/y (and both up just 0.1% m/m in seasonally adjusted terms). And, ex food & energy prices also rose just 0.1% m/m, cutting the annual rate three ticks to a moderate 2.4% y/y pace.

Bottom Line

This report confirms the Bank’s hold on the policy rate. Aside from food prices, inflation seems to be dissipating. The overall economy is in better-than-expected shape as the upward revisions in GDP since 2022 were largely the result of better than expected productivity growth–long a big concern for the Canadian economy.

The backdrop of better growth and lower inflation will keep the Bank of Canada on hold for most of 2026, as the next move in rates is likely to be a hike, but not until late next year. In the meantime, the biggest loser in the past year has been the housing market.

Today’s release of existing home sales by the Canadian Real Estate Association suggests particularly weak activity in Ontario, the region hardest hit by the tariff uncertainty. A cautious Bank of Canada will monitor the effect of rapidly rising food prices on inflation expectations. With any luck at all, core inflation will continue to decelerate, keeping the Bank on the sidelines for much of next year.

Hopefully, greater clarity on the Canada-Mexico-US agreement will be forthcoming in the New Year. Reduced uncertainty is the key ingredient required for a rebound in housing activity, particularly in the regions of Ontario and Quebec hardest hit by the tariffs.

Dr. Sherry Cooper

-

Bank of Canada Holds Policy Rate Steady

The Bank of Canada held the policy rate steady at 2.25%. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. With inflation hovering just above 2% and core inflation between 2.5% and 3%, the Governing Council sees the current overnight rate as “about right.”

According to the press release, “The Bank expects final domestic demand to grow in the fourth quarter, but with an anticipated decline in net exports, GDP will likely be weak. Growth is forecast to pick up in 2026, although uncertainty remains high and large swings in trade may continue to cause quarterly volatility.”

In the United States, economic growth is supported by strong consumption and a surge in AI investment. The US Federal Reserve is likely to cut its policy rate by 25 bps to 3.5%-3.75% as President Trump lobbies Chair Jay Powell for more dramatic rate cuts.

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. At the same time, Canada is working hard to establish alternative trade partners. Even the vast Chinese market cannot replace the US in terms of proximity and cost-effectiveness, given the high transport costs. China has stepped up its purchases of Canadian oil to record levels. There is no market the size of the US market to replace exports of steel and aluminum.

The US will also suffer economic impacts from withdrawing from the Canada-US-Mexico free trade deal. A renegotiation of the contract is likely to come before the end of next year. As of now, the US is signalling their desire to exit the agreement. We can only hope that cooler heads will prevail.

These are challenging times, the surprisingly strong economic data notwithstanding. Consumer and business confidence is down, and the housing market is still weak, especially in the Greater Goldeen Horseshoe.

In this environment, market-driven interest rates have risen sharply. The 5-year bond yield is once again attempting to break through 3%. The 2-year bond at 2.67% is well above the overnight rate, and the Canadian dollar is rising. Lenders have recently increased fixed mortgage rates, which will be more popular if people generally expect rates to rise.

The key to the outlook is the continuation of CUSMA. We will likely suffer several more months of uncertainty before we know the fate of the trade agreement.Dr. Sherry Cooper

-

Canadian headline inflation slowed to 2.2% y/y in October, down from 2.4% in September.

The Consumer Price Index (CPI) rose 2.2% on a year-over-year basis in October, down from 2.4% in September. The all-items CPI decelerated largely due to gasoline prices, which fell at a faster year-over-year pace in October (-9.4%) than in September (-4.1%). Excluding gasoline, the CPI rose 2.6% in October, matching the September increase. This was not enough of a decline to move the Bank of Canada off the sidelines, particularly given the recent strength in manufacturing sales, which surged 3.3% in September (estimated at 2.7%). Wholesale trade also surprised to the upside, 0.6% (estimated at 0.0%).

Slower growth in grocery prices further contributed to the CPI’s deceleration in October, which was moderated by surging cellular phone plan prices. Though grocery prices decelerated in October, prices remained elevated and have exceeded overall inflation for nine consecutive months.

Consumers paid more year over year in October for homeowners’ and mortgage insurance (+6.8%) and passenger vehicle insurance premiums (+7.3%). Among the provinces, prices rose the most in Alberta for both measures, with a 13.7% increase in homeowners’ home and mortgage insurance and a 17.8% increase in passenger vehicle insurance premiums.

Since October 2020, homeowners’ insurance and mortgage insurance prices have risen 38.9% nationally, while passenger vehicle insurance prices have risen 18.9%.The index for property taxes and other special charges, priced annually in October, rose 5.6% year over year, down from 6.0% in 2024.

The CPI rose 0.2% month over month in October. On a seasonally adjusted monthly basis, the CPI was up 0.1%.

In October, both the CPI median and the CPI trimmed mean came in cooler than economists had expected. The average of these metrics was 2.95% in October.The old measure of core—prices excluding food and energy—rose 0.3% m/m on an adjusted basis, boosting the yearly rate three full ticks to 2.7% y/y. A pop in cellular services was a significant driver there; in fact, the 7.9% y/y rise in all telephone services was the largest yearly increase since 1982. Still, a pullback in grocery prices, perhaps in part due to the rollback of retaliatory tariffs, helped moderate the Bank of Canada’s core measures. Median prices edged up just 0.1% m/m (s.a.), trimming the annual rate to 2.9%, while trim eased a tick to 3.0% y/y.

Rent perked up again to 5.2% y/y (from 4.8%), and remains the single most significant driver of inflation due to its heavy weight in the index.

Bottom Line

This report does little to change the BoC’s view that underlying inflation remains close to 2-1/2%; but, if anything, most underlying metrics have been stuck a bit above that, or have just crept up there. In other words, this report is just another reason to believe the Bank is moving to the sidelines in December.

Dr. Sherry Cooper -

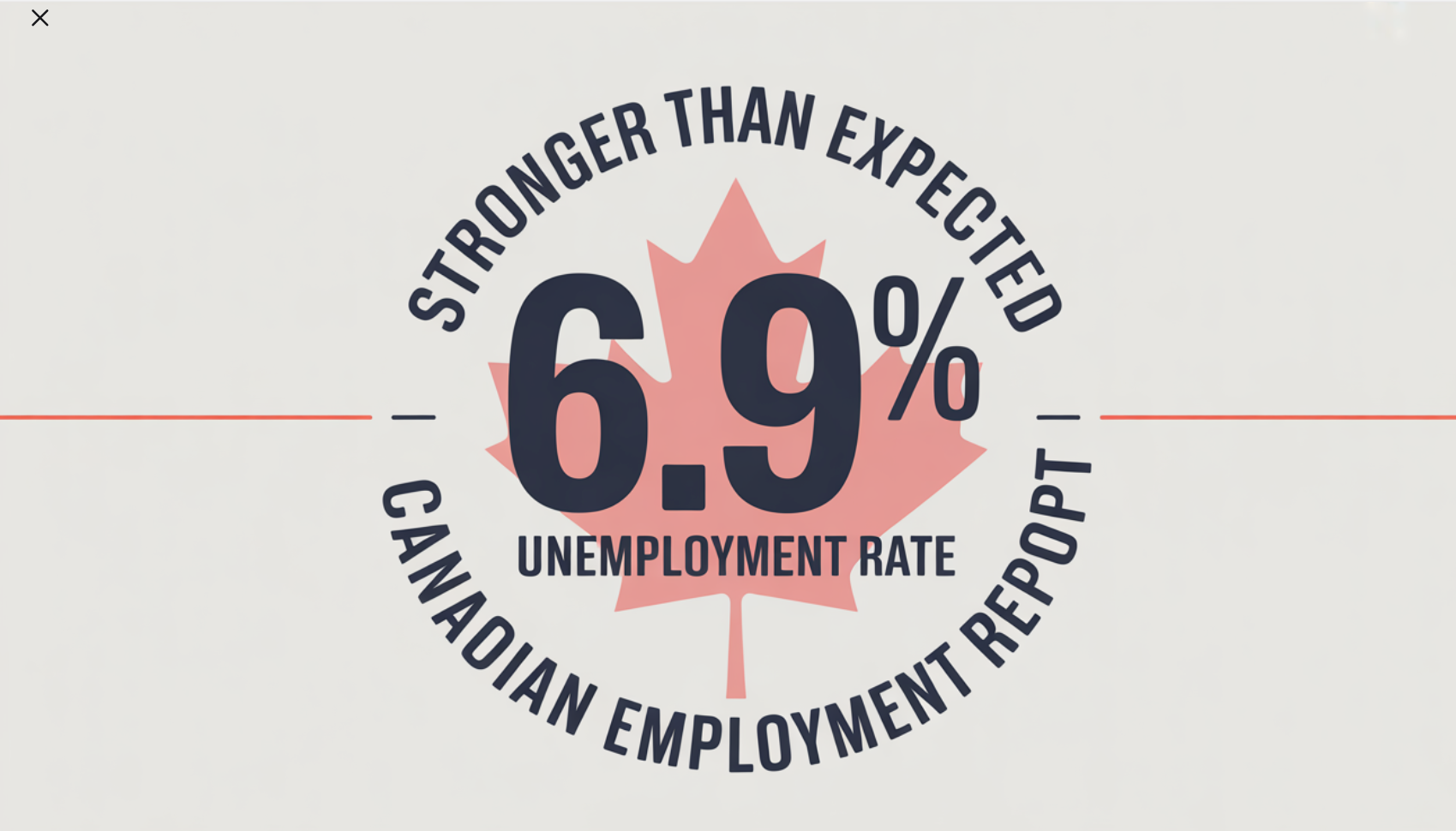

December BoC Rate Cut? October Labour Force Survey Much Stronger Than Expected

Labour Force Survey for October showed a stronger-than-expected net employment gain of 66,600, on the heels of September’s upside surprise. Cumulative gains in September and October (+127,000; +0.6%) have offset cumulative declines observed in July and August (-106,000; -0.5%).

Even more unexpected was the dip in the jobless rate from 7.1% in August and September to 6.9% last month. The Bank of Canada had already suggested that the overnight policy rate, at 2.25%, was low enough to spur growth and mute inflation.

The employment rate rose to 60.8%. The employment rate in October was unchanged year over year but remained below the recent high of 61.1% recorded in January and February 2025.

There were more people working in wholesale and retail trade (+41,000; +1.4%), transportation and warehousing (+30,000; +2.8%), information, culture, and recreation (+25,000; +3.0%), and utilities (+7,600; +4.6%). On the other hand, employment in construction declined by 15,000 (-0.9%).

Employment increased in Ontario (+55,000; +0.7%) and in Newfoundland and Labrador (+4,400; +1.8%), while it declined in Nova Scotia (-4,400; -0.8%) and Manitoba (-4,000; -0.5%).

Average hourly wages among employees increased 3.5% (+$1.27 to $37.06) on a year-over-year basis in October, following growth of 3.3% in September (not seasonally adjusted).

The employment increase in October was driven by part-time work (+85,000; +2.3%). This follows an increase in full-time work in September (+106,000; +0.6%). On a year-over-year basis, employment was up in both full-time work (+199,000; +1.2%) and part-time work (+101,000; +2.7%).

Private sector employment rose by 73,000 (+0.5%) in October, the first increase since June. There was little change in the number of public sector employees or self-employed workers in October.

Despite the employment increase in October, total actual hours edged down (-0.2%) in the month as an elevated number of employees lost work hours due to labour disputes occurring during the Labour Force Survey reference week (October 12 to 18).

An estimated 87,000 employees across the provinces lost work hours due to labour disputes during this period (not seasonally adjusted). This was particularly notable in Alberta, where a teachers’ strike and a subsequent lock-out led to the closure of most elementary and secondary schools in the province.

On a year-over-year basis, total actual hours were up 0.7% in October.

Even with the latest jobs report, the Canadian economy remains vulnerable to the unsettling US attitude towards the free trade agreement, which is slated to be renegotiated by July 2026. But Governor Tiff Macklem has said that fiscal stimulus would be more effective than monetary stimulus in response to tariff-generated weakness. Judging from this week’s federal budget 2025 announcements, fiscal stimulus will take considerable time to impact the overall economy.

The unemployment rate fell 0.2 percentage points to 6.9% in October. Prior to this decline, the unemployment rate had reached 7.1% in August and September, the highest level since May 2016 (excluding 2020 and 2021 during the COVID-19 pandemic).

Nearly one in five (19.8%) unemployed people in September had found work in October. This proportion (referred to as the job finding rate) was up from 12 months earlier (16.5%) but was lower than the average for the same months from 2017 to 2019 (24.6%) (not seasonally adjusted).

Bottom Line

The Bank of Canada has made it clear that it will focus on inflation and will leave closing the output gap to fiscal policy. By early next year, it will be clear to the Bank of Canada that fiscal stimulus in the form of significant capital spending projects is just too slow. I expect the Bank of Canada to take the overnight rate down to 2.0% in early 2026.Dr. Sherry Cooper

-

Federal Budget Revamp, FY 2025-2026

Today, Finance Minister François-Philippe Champagne presented his first budget. Mark Carney was elected Prime Minister with a mandate to transform Canada’s economy and reduce its dependence on trade with the United States. The Carney government’s inaugural budget emphasizes structural changes to strengthen the domestic economy and boost non-U.S. exports, and it will be funded by an increase in government debt.

Carney, a former central banker who took office in March, has committed to decreasing reliance on the U.S. by increasing military spending, accelerating infrastructure projects, speeding up housing construction, and enhancing business competitiveness. Given the current large deficits and a rising debt-to-GDP ratio, the government cannot afford higher long-term interest rates. Carney has promised to build a stronger Canada using domestic resources and labour, noting that only 40% of the steel used in Canada is produced domestically, and he intends to change that.

Champagne has cautioned that the public service will need to shrink as the government strives to balance the budget in the coming years. Carney also faces a political challenge in convincing some opposition members to support his budget or at least abstain from voting against it. His Liberal Party caucus is currently three seats short of a majority in the House of Commons, meaning it cannot pass the budget on its own.

Unemployment remains high, economic growth is weak, and exporters, along with business investment, are still struggling due to U.S. tariffs. Carney and Champagne must persuade citizens that jobs, real wages, and living standards will eventually improve if they can stimulate both domestic and foreign investment.

Last week, the Bank of Canada indicated that it is nearing the limit of monetary stimulus it can provide without triggering inflation. Governor Tiff Macklem has consistently stated that he sees fiscal policy as a more effective tool to counter the adverse effects of the trade war, which he perceives as a negative supply shock.

The chart above indicates that Canada not only had the lowest deficit-to-GDP ratio in the G-7 but also among all countries with a triple-A credit rating. However, the rate at which we are issuing net new debt is expected to accelerate over the next year or two. Canada needs to assure the bond market that we will maintain our triple-A credit rating to keep financing costs manageable.

Ottawa has divided the budget into two parts: the operating budget and the capital spending budget. The operating budget covers the costs of running the federal government, which includes salaries, wages, rent, and interest payments on the debt. Carney has urged government leaders to review their operating budgets and eliminate unnecessary costs, which include downsizing the federal workforce.

A similar approach is used in countries like the United Kingdom and New Zealand, as well as by some provinces here at home. In principle, this shift could enhance transparency by allowing a better understanding of how public funds are allocated between day‑to‑day program spending and long‑term investments intended to boost future growth.

The capital spending budget is more complex because it’s harder to determine which expenditures will enhance growth and productivity. For instance, while the government is increasing defence spending to meet our NATO obligations, not all of it will contribute to productivity growth.

Ottawa’s agenda highlights major infrastructure projects, defence initiatives, housing, significant undertakings like pipelines, enhanced ports, and the development of the Ring of Fire. Federal leadership believes there is a role for industrial policy, as well as measures aimed at broad deregulation and tax competitiveness.

This year’s federal budget projects a deficit of $78.3 billion—nearly double the Liberals’ projection a year ago—prioritizing capital project spending over services. The deficit is expected to decrease gradually to $56.6 billion by 2029-30. Only a year ago, the Liberals forecast a 2025 budget deficit of $42.2 billion, but that was before trade uncertainty and tariff inflation hit our shores with the inauguration of Donald Trump last January.

The budget presents both downside and upside scenarios. In the downside scenario, ongoing trade uncertainty could worsen the budgetary balance by $9.2 billion annually, while the upside scenario anticipates a $5 billion annual improvement contingent on easing trade uncertainties.

Finance Minister François-Philippe Champagne emphasized the need for “generational” investments, allocating $25 billion to housing, $30 billion to defence, and $115 billion to infrastructure over the next five years. He criticized proposals to cap the deficit at $42 billion, advocating instead for investments to drive future growth.

The 2025 budget introduces a new format that separates capital and operational spending, with capital investments accounting for 58% of this year’s combined deficit. This shift aims to catalyze $500 billion in private-sector investment. However, we should be skeptical that such animal spirits will materialize quickly, given the immense uncertainty about the future of the Canada-Mexico-US free trade agreement.

The budget pledges to balance operational spending in three years.

Ottawa has been running a “comprehensive expenditure review” to spend less on the day-to-day operations of the federal government. According to the budget, that plan will save $13 billion annually by 2028-29, for a total of $60 billion in savings and revenues over five years.

The budget promises more taxpayer dollars will go toward “nation-building infrastructure, clean energy, innovation, productivity and less on day-to-day operating spending.” This “new discipline” will help protect social benefits, the budget promises.

The public service will see a drop of about 40,000 positions over the coming years. The budget projects it will have 330,000 employees in 2028-29, down from the 368,000 counted last year.

To confront an anemic economic picture, the government says it’s “supercharging growth” and vows to “make Canada’s investment environment more competitive than the U.S.”

To that end, the budget introduces a “productivity super-deduction” tax measure that will allow companies to write off a larger share of capital investments more quickly.

There are also new measures specifically for writing off expenses for manufacturing or processing buildings, as well as a new capital cost allowance for liquefied natural gas (LNG) equipment and related buildings.

Build Baby Build

Fast-tracking nation-building projects: In close partnership with provinces, territories, Indigenous Peoples, and private investors, the government is streamlining regulatory approvals and helping to structure financing.Additional Cuts to Immigration

Selling it as Ottawa “taking back control” over an immigration system that has put pressure on Canada’s housing supply and health-care system, budget 2025 promises to lower admission targets.The new plan proposes to drastically reduce the target for new temporary resident admissions from 673,650 in 2025 to 385,000 in 2026.

The 2026-28 immigration levels plan would keep permanent resident admission targets at 380,000 per year, down from 395,000 in 2025.

Ending Some High-End Taxes

The government is also proposing to undertake a one-time measure to accelerate the transition of up to 33,000 work permit holders to permanent residency in 2026 and 2027.“These workers have established strong roots in their communities, are paying taxes and are helping to build the strong economy Canada needs,” the budget notes.

To fill labour gaps, the Liberals’ plan includes a foreign credential recognition action fund to work with the provinces and territories to improve transparency, timeliness and consistency of foreign credential recognition.

It would also launch a strategy to attract international talent, including a one-time initiative to recruit over 1,000 highly qualified international researchers to Canada.

In addition, there were billions of dollars in increased defence spending, the details of which are still sketchy.

Bottom Line

Nothing in this budget is surprising, as most of it has been telegraphed in recent weeks. The budget asserts that “the global trade landscape is changing rapidly, as the United States reshapes its economic relationships and supply chains around the world. The impact is profound—hurting Canadian companies, displacing workers, disrupting supply chains, and creating uncertainty that holds back investment. This level of uncertainty is greater than what we have seen in recent crises. Budget 2025 makes generational investments while maintaining Canada’s strong fiscal advantage—a foundation that allows us to invest ambitiously and responsibly, and build Canada’s economy to be the strongest in the G-7.”

Canada has the lowest net debt-to-GDP ratio among the G-7 and one of the smallest deficit-to-GDP ratios. Canada and Germany are the only two G-7 economies rated triple-A, a marker of strong investor confidence which helps keep our borrowing costs as low as possible. This is a time for bold actions to bolster Canada’s competitiveness. We have products the world needs. Hopefully, we can salvage a significant part of the trade agreement with the US, but the odds suggest we build the infrastructure necessary to trade our products worldwide.

Dr. Sherry Cooper