Buying Property in Vancouver Residential – Vancouver Best Realtor – Morning Lee

Buying property in Vancouver is not an easy job, but I can make it easier for you. We have three different program options tailored for different people. I believe one of them will be a good fit for you.

Self Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and Subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Semi-Self Service Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Full Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and accepted offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement For You

- Funds are ready or will be ready

Benefit For You

- Full service for purchasing your dream home

This option is a traditional classic service. But most people don’t need all the services. Which is why we offer other options.

Self-Service Buyer Program for Buying Property in Vancouver

Buying Property in Vancouver is a very simple and easy job for some experienced and skilled people – for example, real estate investors, former Realtors, or those who have experiences buying properties in Vancouver, or those who own multiple properties. For these people, we offer only essential services, saving time for you and us. This way, you will receive a large cash bonus, buyer rebate, after closing, which comes from our buyer agent commission.

However, please note that some listing agents set conditions regarding the buyer agent’s commission. For example, if the buyer agent does not attend an open house or private showing, the commission may be reduced significantly—sometimes to as low as $500.

In such cases, either you must avoid those listings, or there will be no cash bonus (buyer rebate) available to you

For more information about our Self-Service Buyer Program, please contact us directly. contact us.

Semi-Self Service Buyer Program for Buying Property in Vancouver

Some buyers don’t need full service but may not feel entirely comfortable with the self-service buyer program. For those clients, we provide essential services along with a few additional supports. This approach still saves time, which is why you can also receive a cash bonus (buyer rebate).

That said, please understand the same limitations apply: some listing agents require the buyer agent’s presence at showings or open houses. If those conditions are not met, the buyer agent’s commission may be reduced to a small amount, such as $500. In those cases, either avoid such listings, or a rebate cannot be provided.

For more information about our Semi-Self-Service Buyer Program, please contact us directly. contact us.

Full Service Buyer Program for Buying Property in Vancouver

As the name suggests, the Full-Service Buyer Program includes all services typically provided by a buyer’s agent. This is especially suitable for newcomers or anyone who may not feel confident navigating the self-service or semi-self-service programs.

With this option, we handle everything for you—making the home-buying process as smooth and stress-free as possible.

For more information about our Full Service Buyer Program, please contact us directly. contact us.

If you need mortgage, please contact us for our mortgage servcie

Another website built by WealthDao Consulting. For E-Commerce Consulting, Digital Marketing Consulting, Profit Consulting, please visit WealthDao Consulting

-

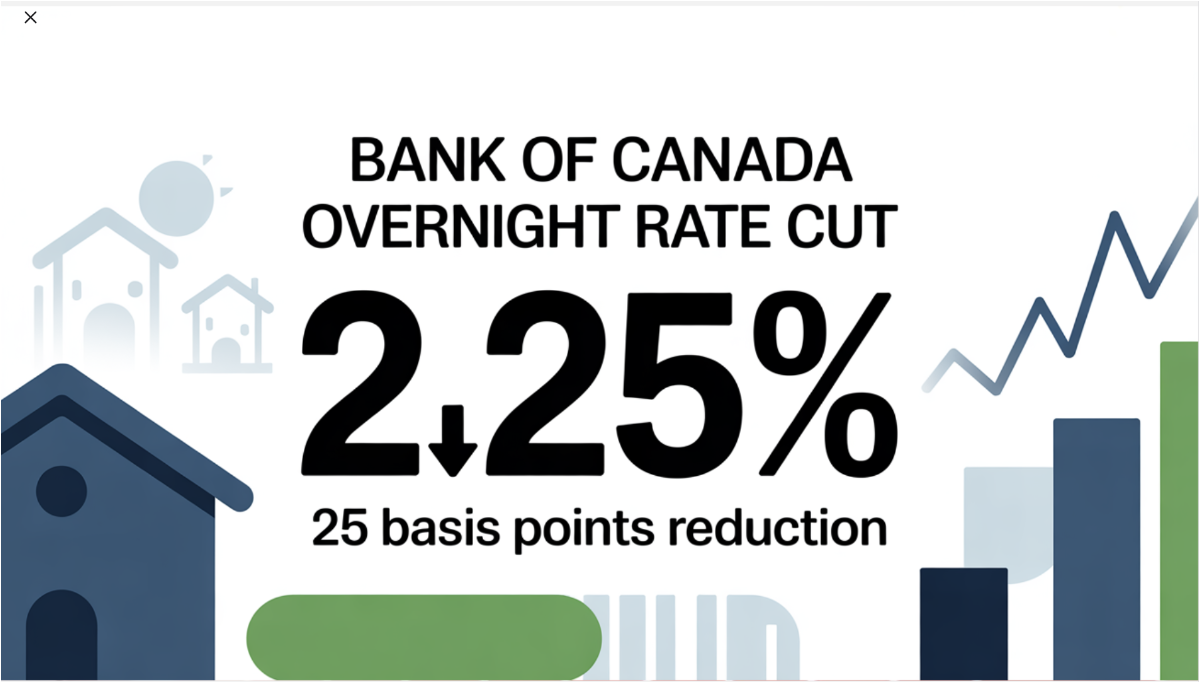

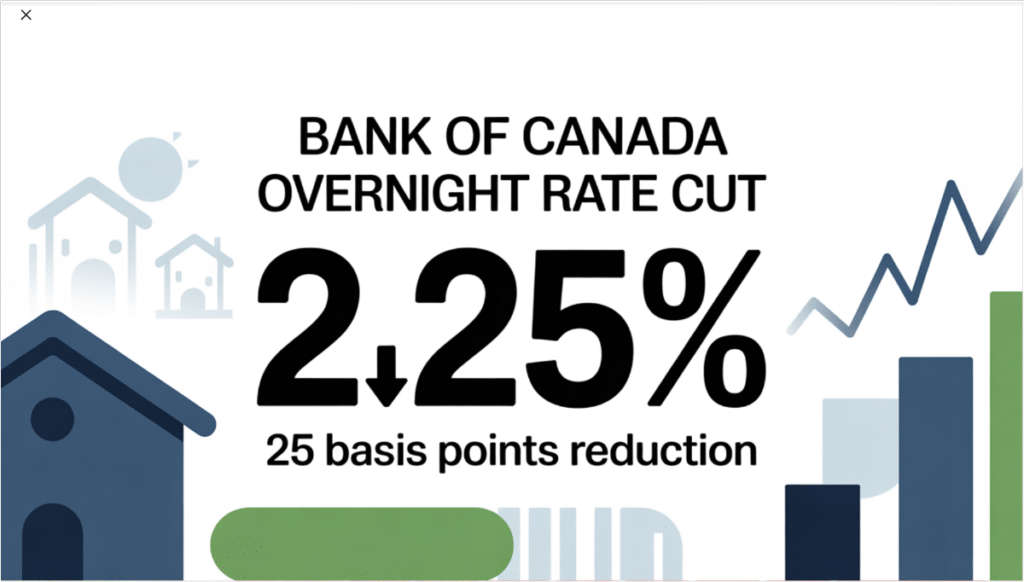

Bank of Canada Lowers Policy Rate to 2.25%

Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.25% as was widely expected. This is the bottom of the Bank’s estimate of the neutral overnight rate, where monetary policy is neither expansionary nor contractionary. The economy will grow at about a 0.5% pace in Q3, causing the Bank to cut rates again at the final meeting this year on December 10. The easing will then end, but rates will remain relatively subdued until more trade uncertainty is alleviated.

The Fed is widely expected to cut rates by 25 bps this afternoon as well.

Today’s Monetary Policy Report suggests that the significant decline in export growth will persist for some time. Layoffs in trade-dependent sectors have already slowed considerably, especially in Ontario, Quebec, and some softwood lumber businesses in several provinces. The central bank acknowledged that “because US trade policy remains unpredictable and uncertainty is still higher than usual, this projection is subject to a wider-than-normal range of risks.”

“In the United States, economic activity has been strong, supported by the boom in AI investment. At the same time, employment growth has slowed and tariffs have started to push up consumer prices. Growth in the euro area is decelerating due to weaker exports and slowing domestic demand. In China, lower exports to the United States have been offset by higher exports to other countries, but business investment has weakened. Global financial conditions have eased further since July and oil prices have been fairly stable. The Canadian dollar has depreciated slightly against the US dollar.”

“Canada’s economy contracted by 1.6% in the second quarter, reflecting a drop in exports and weak business investment amid heightened uncertainty. Meanwhile, household spending grew at a healthy pace. US trade actions and related uncertainty are having severe effects on targeted sectors, including autos, steel, aluminum, and lumber. As a result, GDP growth is expected to be weak in the second half of the year. Growth will get some support from rising consumer and government spending and residential investment, and then pick up gradually as exports and business investment begin to recover.”

Canada’s labour market remains soft, and job vacancies have declined sharply despite the September improvement in job growth. Job losses continue to mount in trade-impacted sectors, and hiring has been weak across the economy. The unemployment rate remained at 7.1%, well above the US rate of 4.3%. Slower population growth translates into fewer new jobs and less inflation pressure. On a per capita basis, the economy is already in a recession.

The Bank projects GDP will grow by 1.2% in 2025, 1.1% in 2026 and 1.6% in 2027. Quarterly, growth strengthens in 2026 after a weak second half of this year. Excess capacity in the economy is expected to persist and be gradually absorbed.

“CPI inflation was 2.4% in September, slightly higher than the Bank had anticipated. Inflation excluding taxes was 2.9%. The Bank’s preferred measures of core inflation have been sticky around 3%. Expanding the range of indicators to include alternative measures of core inflation and the distribution of price changes among CPI components suggests underlying inflation remains around 2.5%. The Bank expects inflationary pressures to ease in the months ahead and CPI inflation to remain near 2% over the projection horizon”.

“If inflation and economic activity evolve broadly in line with the October projection, the Governing Council sees the current policy rate at about the right level to keep inflation close to 2% while helping the economy through this period of structural adjustment. If the outlook changes, we are prepared to respond. Governing Council will be assessing incoming data carefully relative to the Bank’s forecast.”

Bottom Line

The Bank of Canada has shown its willingness to bolster the Canadian economy amid unprecedented trade uncertainty. While Canada is working hard to establish alternate trade partners, even China cannot replace the US in terms of proximity and cost-effectiveness, given the huge transport costs. China has stepped up its oil purchases to record levels, but larger oil flows east will require additional pipelines to BC. There is no market the size of the US market to replace exports of steel and aluminum. The US will also suffer from the economic impact of stepping away from the Canada-US-Mexico free trade deal. A renegotiation of the contract is likely to come before the end of next year. As of now, the US is signalling their desire to exit the agreement. We can only hope that cooler heads will prevail.

The auto industry is a case in point. Onshoring non-US auto production would require a 75% increase in US production and the construction of $50 billion in new factories. This would take years and significantly reduce the profitability of US auto companies.

Canada is the US’s number one supplier of steel and aluminum, with its competitively low hydroelectric costs. It will take time for the US to create the capacity to replace aluminum imports from Quebec.

Canada is the number one trading partner for 32 American states, many of which are lobbying Washington to end this CUSMA bashing.

It will take time for Canada to adjust to this new reality, which leads us to conclude that another cut in overnight rates is probable at the next decision date on December 10.

Dr. Sherry Cooper

-

Canadian Inflation Stronger Than Expected

The Consumer Price Index (CPI) rose 2.4% on a year-over-year basis in September, up from a 1.9% increase in August. The acceleration in headline inflation from 1.9% in August was also larger than the median projection in a Bloomberg survey of economists, which was 2.2%.

On a year-over-year basis, gasoline prices fell less in September (-4.1%) compared with August (-12.7%) due to a base-year effect, leading to an acceleration in headline inflation. Excluding gasoline, the CPI rose 2.6% in September, after increasing 2.4% in August.

A slower year-over-year decline in prices for travel tours (-1.3%) and a larger increase in prices for food purchased from stores (+4.0%) also contributed to the upward pressure in the all-items CPI in September.

The CPI rose 0.1% month over month in September. On a seasonally adjusted monthly basis, the CPI was up 0.4%.

Gasoline prices fell 4.1% year over year in September after a 12.7% decrease in August. The smaller year-over-year decline was primarily due to a base-year effect. In September 2024, prices fell 7.1% month over month due, in part, to lower crude oil prices amid growing concerns of weaker economic growth, particularly in China and the United States. In September 2025, gasoline prices rose 1.9% monthly following refinery disruptions and maintenance in the United States and Canada, which put upward pressure on prices.

On a year-over-year basis, prices for travel tours fell 1.3% in September following a 9.3% decline in August. Despite typically declining on a month-over-month basis in September, travel tour prices rose 4.6% in the month. This was a result of higher prices for destinations in Europe and some parts of the United States, as significant events in destination cities put upward pressure on hotel prices.

Consumers paid 4.0% more year over year for food purchased from stores in September, following a 3.5% increase in August. Faster price growth was driven by increased prices for fresh vegetables (+1.9% in September, compared with -2.0% in August) and sugar and confectionery (+9.2% in September, compared with +5.8% in August).

Year-over-year grocery price inflation has generally trended upward since its most recent low in April 2024 (+1.4%). Grocery items contributing to the general acceleration included fresh or frozen beef and coffee, both due, in part, to lower supply.

Tuition fees, priced annually in September, increased 1.7% in 2025 compared with a 1.8% increase in 2024. Aside from 2019, the 2025 increase was the smallest since 1976, when the index was unchanged (0.0%).

In 2025, students from Prince Edward Island (+4.7%) experienced the largest price increase. At the same time, students from Nova Scotia (+1.1%) and Ontario (+1.1%) had the smallest increase, coinciding with a freeze on tuition fees in both provinces.

Bank of Canada Deputy Governor Rhys Mendes recently warned that traders may be putting too much emphasis on its two “preferred” core inflation measures, the so-called trim and median gauges.

In September, both CPI-median and CPI-trim came in hotter than economists were expecting. The average of these metrics was 3.15% in September, while the three-month moving average accelerated to 2.7%.

Mendes said the central bank is weighing a broader suite of gauges that suggest underlying price pressures are closer to its 2% target.

Shelter inflation rose 2.6% on an annual basis, while CPI excluding food and energy was 2.4%. CPI excluding eight volatile components and indirect taxes was 2.8%, up from 2.6%.

CPI excluding taxes accelerated to 2.9% from 2.4% the previous month.The share of components within the consumer price index basket that are rising 3% and higher — another key metric that policymakers are watching closely — declined slightly to 38%.

All 10 Canadian provinces saw prices rising at a faster year-over-year pace in September compared with August. Quebec experienced the steepest price growth, reaching 3.3% last month.

Rent prices also accelerated nationally to 4.8%, led by a 9.8% increase in Quebec. Slower rent price growth of 1.8% in British Columbia moderated the national increase, the report noted.

Bottom Line

The report shows that underlying price pressures remain elevated, raising questions about how quickly the central bank can proceed with rate cuts to aid the tariff-hit economy.

Still, the acceleration in headline and most core measures was driven by a gasoline price base-year effect — a possible reason for analysts to look through the print.

Traders in overnight swaps pared bets on a rate cut next week, lowering the odds to about 65% from close to 80% before the report. The loonie jumped to the day’s high against the US dollar. Canadian debt fell across the curve, with the two-year yield rising about three basis points to a session high at 2.38%.

The ongoing trade war with the US drove the Bank of Canada to lower its policy rate by a quarter of a percentage point to 2.5% in September, marking the first cut in six months.

During their deliberations last month, some members of its governing council argued that more support would likely be needed given the softness in the economy, notably if the labour market weakened further.

Bank of Canada Governor Tiff Macklem recently described Canada’s labour market as “soft,” despite data showing the country added 60,400 jobs in September, which only partially reversed a decline of more than 100,000 positions over the previous two months.

The central bank will have to weigh recent economic weakness against concerns about firm core inflation over the past few months. The BoC will cut the overnight policy rate again by 25 bps to 2.25%, responding to its concern for the sectors hardest hit by tariffs, along with a housing market suffering from negative household psychology and overbuilding in the GTA and GVA.

Dr. Sherry Cooper

-

Canadian Home Sales Post Best September In Four Years

Today’s release of the September housing data by the Canadian Real Estate Association (CREA) showed a pullback on the housing front. The number of home sales recorded through Canadian MLS® Systems declined by 1.7% on a month-over-month basis in September 2025. Nevertheless, it was the best month of September for sales since 2021.

The slight monthly decline was the result of lower sales activity in Greater Vancouver, Calgary, Edmonton, Ottawa, and Montreal, which more than offset gains in the Greater Toronto Area and Winnipeg.

“While the trend of rising sales that began earlier this year took a breather in September, activity was still running at the highest level for that month since 2021, and that was true in July and August as well, said Shaun Cathcart, CREA’s Senior Economist. “With three years of pent-up demand still out there and more normal interest rates finally here, the forecast continues to be for further upward momentum in home sales over the final quarter of the year and into 2026.”

New Listings

New supply dropped 0.8% month-over-month in September. Combined with a slightly larger decline in sales activity, the sales-to-new listings ratio eased slightly to 50.7% compared to 51.2% in August. The long-term average for the national sales-to-new listings ratio is 54.9%, with readings roughly between 45% and 65% generally consistent with balanced housing market conditions.

There were 199,772 properties listed for sale on all Canadian MLS® Systems at the end of September 2025, up 7.5% from a year earlier but very close to the long-term average for that time of the year.

“While there are more buyers in the market now than at almost any other point in the last four years, sales activity is still below average and well below where the long-term trend suggests it should be,” said Valérie Paquin, CREA Chair. “As such, we expect things to continue to pick up steadily in the future.

There were 4.4 months of inventory on a national basis at the end of September 2025, unchanged from July and August and the lowest level since January. The long-term average for this measure of market balance is five months of inventory. Based on one standard deviation above and below that long-term average, a seller’s market would be below 3.6 months, and a buyer’s market would be above 6.4 months.

Home Prices

The National Composite MLS® Home Price Index (HPI) was again almost unchanged (-0.1%) between August and September 2025. Following declines in the first quarter of the year, the national benchmark price has remained mostly stable since April.

The non-seasonally adjusted National Composite MLS® HPI was down 3.4% compared to September 2024. Based on the extent to which prices fell off beginning in the fall of 2024, look for year-over-year declines to shrink in the fourth quarter of the year.

Bottom Line

Homebuyers are responding to improving fundamentals in the Canadian housing market. Supply has risen as new listings surged until May of this year. Additionally, the national benchmark average price is 3.5% lower than it was a year earlier. That decrease was smaller than in August.The view is nearly unanimous that the Federal Reserve will cut the overnight policy rate again by 25 basis points when it meets again on October 29.

The jury is out on the Bank of Canada’s next move. Their decision date is also October 29. While the stronger-than-expected labour market report might have dissuaded the Bank from easing, all eyes will be on the next CPI report on October 21.

With the Bank of Canada cutting the policy rate halfway through September and another 25-basis-point reduction expected by January, if not sooner, the CREA forecasts sales to rise by 7.7% in 2026.

“Interest rates were always going to be the thing that brought this thing back to life,” Cathcart said in an interview. “While that long-anticipated recovery has been delayed and dampened by trade uncertainty, the Bank of Canada is getting close to dipping out of the neutral range and into stimulative territory.

Dr. Sherry Cooper

-

Mortgage Rates Drop into the 3% Range, Reverse Mortgages Gain Popularity Among Homeowners 55+

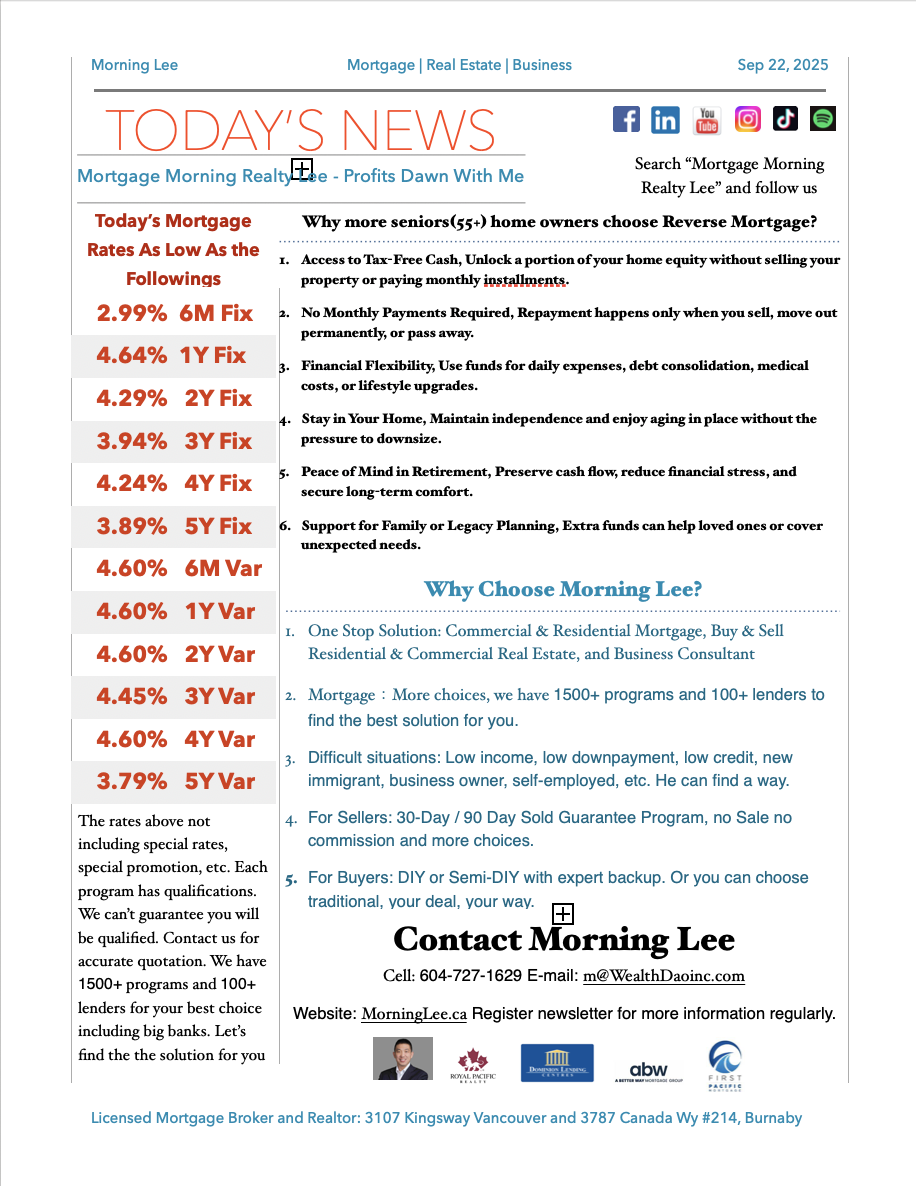

The latest Canadian mortgage rate data shows that mainstream lending products continue to trend lower, with many fixed and variable rates now entering the “3% range.” For example, the six-month fixed rate is as low as 2.99%, the three-year fixed rate stands at 3.94%, and the five-year variable rate has dropped to 3.79%. This creates a wide range of low-cost borrowing options for homeowners.

Against this shifting interest rate backdrop, reverse mortgages are seeing growing interest among homeowners aged 55 and older. This financial solution allows homeowners to convert their home equity into tax-free cash—without selling their property or being required to make monthly payments—while still retaining the right to live in their home.

-

Unlock Your Home’s Equity: Smart Strategies for 55+ Homeowners

As housing markets fluctuate, many homeowners over 55 find themselves in an interesting dilemma: they see opportunities in the current market but are reluctant to sell their primary residence in uncertain conditions. This is where innovative financial solutions can provide the flexibility and security needed to navigate these decisions.

The Downsize/Rightsize Strategy

For those looking to transition to a more suitable living arrangement without sacrificing financial stability, there’s a way to achieve the best of both worlds. Rather than selling your home immediately in a market you’re unsure about, you can access your home’s equity to purchase a new property while holding onto your existing home. This approach allows you to:

- Purchase a new property with the proceeds from a specialized financial product

- Sell your current home when the market conditions are more favorable

- Move into your new property at your own pace without pressure

This strategy is particularly valuable with financial products that feature low prepayment penalties, making it a viable option for many homeowners.

Vacation Homes and Investment Properties

The growing interest in second homes and vacation properties represents both a lifestyle choice and an investment strategy. By releasing equity from your principal residence, you can purchase additional properties either free and clear or in combination with traditional financing. The unique advantage of certain financial tools is that they don’t require mandatory principal and interest payments, which can significantly lower your overall Total Debt Service (TDS) ratio. This improved financial position has enabled many borrowers to purchase additional properties that were previously beyond their reach.

Creating Living Inheriences

Many homeowners want to help their children enter the real estate market but aren’t aware of options available to them. When liquid assets are limited and traditional financing isn’t an option, there are solutions that allow you to provide a living inheritance through your home’s equity. The proceeds from such strategies are typically tax-free and offer payment flexibility. In many scenarios, borrowing against your home equity represents a more cost-efficient solution than creating large tax burdens by gifting from taxable investments.

Understanding Reverse Mortgages

For Canadians 55 and older, reverse mortgages have become an increasingly popular way to access home equity without selling. These financial arrangements allow homeowners to convert up to 55% of their home’s value into tax-free cash while retaining ownership. The funds can be received as a lump sum or regular payments, and repayment typically occurs only when the homeowner sells, moves out, or passes away.

This approach to accessing home equity doesn’t affect government retirement benefits like OAS or GIS, and provides financial flexibility that can enhance retirement living. However, it’s important to consider that interest rates on these products are typically higher than traditional mortgages, and they do reduce the equity available to heirs.

Is This Approach Right For You?

While accessing home equity can provide financial flexibility, it’s important to consider:

- Your long-term housing goals and lifestyle needs

- The impact on your overall financial picture and estate plans

- Current market conditions and timing considerations

- Alternative options that might better suit your specific situation

For those interested in learning more about how home equity solutions might work for their specific situation, MorningLee.ca offers additional insights in their article “Reverse mortgages: 55+? A cushion against the rising cost of living.”