Buying Property in Vancouver Residential – Vancouver Best Realtor – Morning Lee

Buying property in Vancouver is not an easy job, but I can make it easier for you. We have three different program options tailored for different people. I believe one of them will be a good fit for you.

Self Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and Subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Semi-Self Service Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Full Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and accepted offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement For You

- Funds are ready or will be ready

Benefit For You

- Full service for purchasing your dream home

This option is a traditional classic service. But most people don’t need all the services. Which is why we offer other options.

Self-Service Buyer Program for Buying Property in Vancouver

Buying Property in Vancouver is a very simple and easy job for some experienced and skilled people – for example, real estate investors, former Realtors, or those who have experiences buying properties in Vancouver, or those who own multiple properties. For these people, we offer only essential services, saving time for you and us. This way, you will receive a large cash bonus, buyer rebate, after closing, which comes from our buyer agent commission.

However, please note that some listing agents set conditions regarding the buyer agent’s commission. For example, if the buyer agent does not attend an open house or private showing, the commission may be reduced significantly—sometimes to as low as $500.

In such cases, either you must avoid those listings, or there will be no cash bonus (buyer rebate) available to you

For more information about our Self-Service Buyer Program, please contact us directly. contact us.

Semi-Self Service Buyer Program for Buying Property in Vancouver

Some buyers don’t need full service but may not feel entirely comfortable with the self-service buyer program. For those clients, we provide essential services along with a few additional supports. This approach still saves time, which is why you can also receive a cash bonus (buyer rebate).

That said, please understand the same limitations apply: some listing agents require the buyer agent’s presence at showings or open houses. If those conditions are not met, the buyer agent’s commission may be reduced to a small amount, such as $500. In those cases, either avoid such listings, or a rebate cannot be provided.

For more information about our Semi-Self-Service Buyer Program, please contact us directly. contact us.

Full Service Buyer Program for Buying Property in Vancouver

As the name suggests, the Full-Service Buyer Program includes all services typically provided by a buyer’s agent. This is especially suitable for newcomers or anyone who may not feel confident navigating the self-service or semi-self-service programs.

With this option, we handle everything for you—making the home-buying process as smooth and stress-free as possible.

For more information about our Full Service Buyer Program, please contact us directly. contact us.

If you need mortgage, please contact us for our mortgage servcie

Another website built by WealthDao Consulting. For E-Commerce Consulting, Digital Marketing Consulting, Profit Consulting, please visit WealthDao Consulting

-

Mortgage Rates Drop into the 3% Range, Reverse Mortgages Gain Popularity Among Homeowners 55+

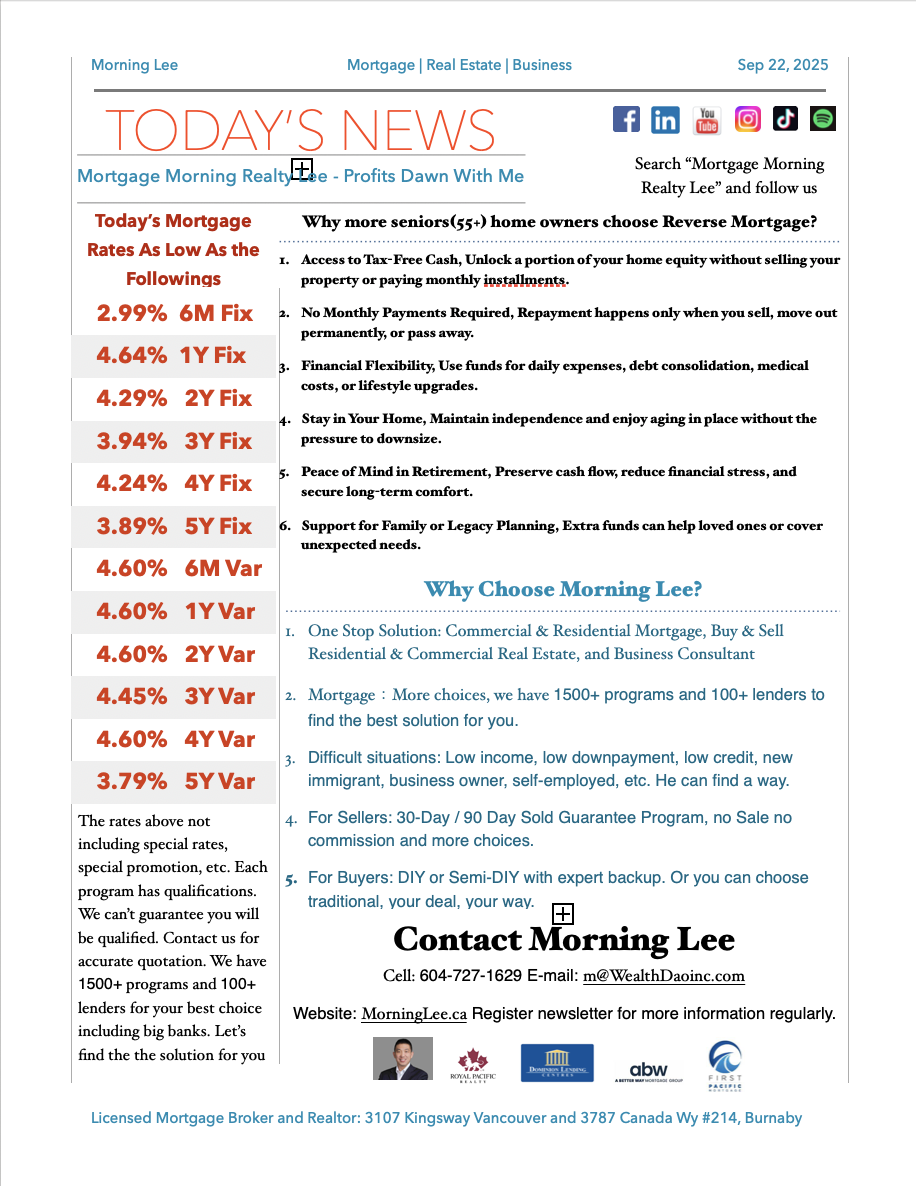

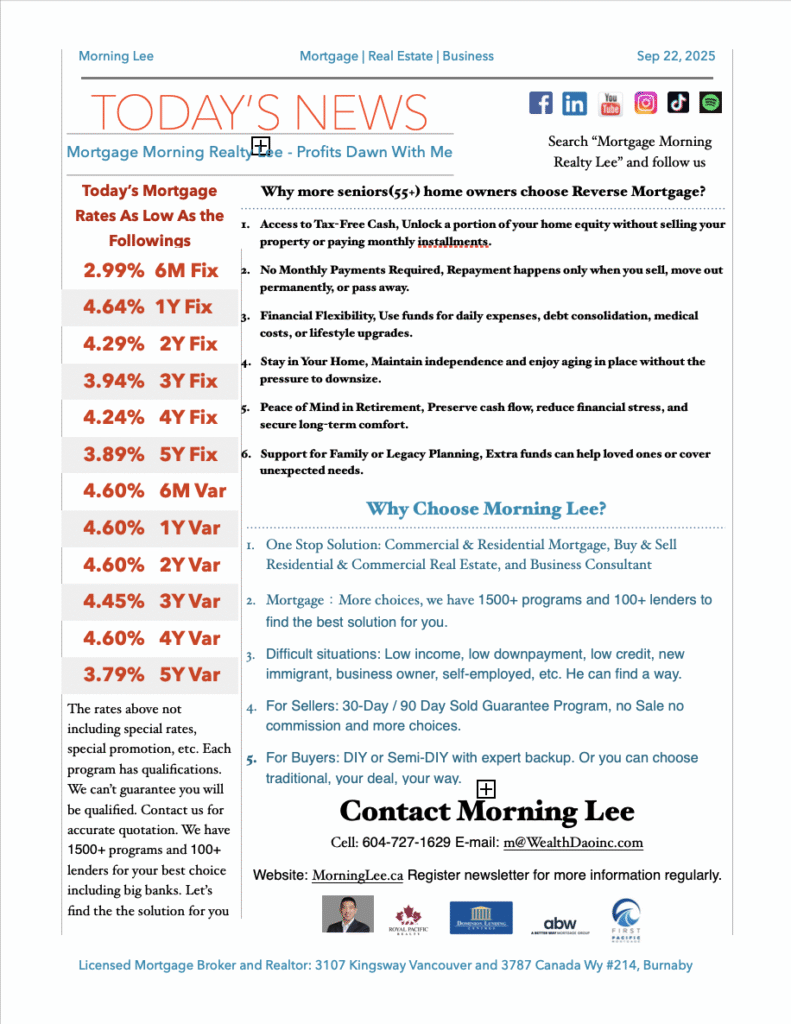

The latest Canadian mortgage rate data shows that mainstream lending products continue to trend lower, with many fixed and variable rates now entering the “3% range.” For example, the six-month fixed rate is as low as 2.99%, the three-year fixed rate stands at 3.94%, and the five-year variable rate has dropped to 3.79%. This creates a wide range of low-cost borrowing options for homeowners.

Against this shifting interest rate backdrop, reverse mortgages are seeing growing interest among homeowners aged 55 and older. This financial solution allows homeowners to convert their home equity into tax-free cash—without selling their property or being required to make monthly payments—while still retaining the right to live in their home.

-

Unlock Your Home’s Equity: Smart Strategies for 55+ Homeowners

As housing markets fluctuate, many homeowners over 55 find themselves in an interesting dilemma: they see opportunities in the current market but are reluctant to sell their primary residence in uncertain conditions. This is where innovative financial solutions can provide the flexibility and security needed to navigate these decisions.

The Downsize/Rightsize Strategy

For those looking to transition to a more suitable living arrangement without sacrificing financial stability, there’s a way to achieve the best of both worlds. Rather than selling your home immediately in a market you’re unsure about, you can access your home’s equity to purchase a new property while holding onto your existing home. This approach allows you to:

- Purchase a new property with the proceeds from a specialized financial product

- Sell your current home when the market conditions are more favorable

- Move into your new property at your own pace without pressure

This strategy is particularly valuable with financial products that feature low prepayment penalties, making it a viable option for many homeowners.

Vacation Homes and Investment Properties

The growing interest in second homes and vacation properties represents both a lifestyle choice and an investment strategy. By releasing equity from your principal residence, you can purchase additional properties either free and clear or in combination with traditional financing. The unique advantage of certain financial tools is that they don’t require mandatory principal and interest payments, which can significantly lower your overall Total Debt Service (TDS) ratio. This improved financial position has enabled many borrowers to purchase additional properties that were previously beyond their reach.

Creating Living Inheriences

Many homeowners want to help their children enter the real estate market but aren’t aware of options available to them. When liquid assets are limited and traditional financing isn’t an option, there are solutions that allow you to provide a living inheritance through your home’s equity. The proceeds from such strategies are typically tax-free and offer payment flexibility. In many scenarios, borrowing against your home equity represents a more cost-efficient solution than creating large tax burdens by gifting from taxable investments.

Understanding Reverse Mortgages

For Canadians 55 and older, reverse mortgages have become an increasingly popular way to access home equity without selling. These financial arrangements allow homeowners to convert up to 55% of their home’s value into tax-free cash while retaining ownership. The funds can be received as a lump sum or regular payments, and repayment typically occurs only when the homeowner sells, moves out, or passes away.

This approach to accessing home equity doesn’t affect government retirement benefits like OAS or GIS, and provides financial flexibility that can enhance retirement living. However, it’s important to consider that interest rates on these products are typically higher than traditional mortgages, and they do reduce the equity available to heirs.

Is This Approach Right For You?

While accessing home equity can provide financial flexibility, it’s important to consider:

- Your long-term housing goals and lifestyle needs

- The impact on your overall financial picture and estate plans

- Current market conditions and timing considerations

- Alternative options that might better suit your specific situation

For those interested in learning more about how home equity solutions might work for their specific situation, MorningLee.ca offers additional insights in their article “Reverse mortgages: 55+? A cushion against the rising cost of living.”

-

Bank of Canada Lowers Policy Rate to 2.5%

Today, the Bank of Canada lowered the overnight policy rate by 25 bps to 2.5% as was widely expected. Following yesterday’s better-than-expected inflation report, the Bank believes that underlying inflation was 2.5% year-over-year.

Through the recent period of tariff turmoil, the Governing Council has closely monitored the risks and uncertainties facing the Canadian economy. Three developments triggered the Bank’s rate cut. Canada’s labour market softened further. Upward pressure on underlying inflation has diminished, and there is less upside to risk to future inflation with the removal of most retaliatory tariffs by Canada.

Considerable uncertainty remains. However, with a weaker economy and less upside risk to inflation, the Governing Council deemed that a reduction in the policy rate was appropriate to better balance the risks going forward.

“The Bank will continue to assess the risks, look over a shorter horizon than usual, and be ready to respond to new information.”

Today’s press release suggests that the global economy has slowed in response to trade disputes. In the US, business investment has been substantial, primarily driven by expenditures on Artificial Intelligence. However, consumers are cautious, and employment gains have slowed. It is nearly a certainty that the Federal Reserve will lower its overnight policy rate this afternoon.

“Growth in the euro area has moderated as US tariffs affect trade. China’s economy held up in the first half of the year, but growth appears to be softening as investment weakens. Global oil prices are close to their levels assumed in the July Monetary Policy Report (MPR). Financial conditions have continued to ease, with higher equity prices and lower bond yields. Canada’s exchange rate has been stable relative to the US dollar.”

Canada’s economy contracted in the second quarter, posting a growth rate of -1.6%. Exports fell by 27% in Q2 following a surge in exports in advance of tariffs in Q1. Business investment also fell in Q2. “In the months ahead, slow population growth and the weakness in the labour market will likely weigh on household spending.”

Employment has declined in the past two months. “Job losses have largely been concentrated in trade-sensitive sectors, while employment growth in the rest of the economy has slowed, reflecting weak hiring intentions. The unemployment rate has moved up since March, hitting 7.1% in August, and wage growth has continued to ease.”

Bottom Line

The Bank of Canada was pretty tight-lipped about future rate cuts, but given the current trajectory, we expect another rate cut when they meet again this fall. The next BoC decision date is October 29, and the central bank wraps up the year on December 10. We expect at least one more rate cut this year, ending the year with a policy rate of 2.0%-2.25%. This should help boost interest-sensitive spending, most particularly housing, where there is considerable pent-up demand.

The Bank will move cautiously, but with the Fed cutting rates again later this year, this gives the BoC cover. While some have questioned the Bank’s easing in the face of 3% core inflation, other inflation measures suggest that underlying inflation is roughly 2.5%. The economic and labour market slowdown bodes well for another rate cut.

Traders in overnight swaps continue to price in another cut from the central bank this cycle, and put the odds at about a coin flip that they’ll ease again in October.The central bank’s communications suggest that while it has resumed monetary easing to support the ailing economy, it is leery of cutting interest rates too quickly, given the potential inflation risks posed by the surge in global protectionism and tariffs.

Dr. Sherry Cooper

-

Can a 50-Year Amortization Really Fix Housing Affordability?

The housing conversation in Vancouver and Toronto has taken a fresh turn. With prices stubbornly high, the latest debate is whether extending mortgage amortizations to 50 years could make ownership more attainable. On paper, stretching payments over a longer period reduces monthly obligations, giving first-time buyers a chance to step in. But does it truly solve the affordability crisis?

Supporters highlight that aligning monthly payments with incomes offers short-term relief. A couple eyeing an $800,000 home might see their monthly payment drop by thousands if stretched over 50 years rather than 25. That breathing room could be the difference between renting indefinitely and finally buying.

Critics, however, caution against the hidden costs. A half-century loan means paying interest that could double or even triple the original principal. And the deeper issue remains untouched: limited supply and unrelenting demand keep prices high. Extending the clock doesn’t change that fundamental imbalance.

For buyers and homeowners, the question becomes less about policy experiments and more about practical solutions available today. Consider strategies like rate holds that secure current interest levels for up to 120 days, or insured mortgage products that lower down payment requirements for qualified buyers. Homeowners with existing equity can explore refinancing, creating flexibility without waiting for Ottawa to make the next move. Families are also increasingly turning to innovative tools like reverse mortgages, which allow those 55+ to unlock home equity. For example, this piece on Reverse mortgages: 55+? A cushion against the rising cost of living explains how senior homeowners are using property wealth to offset rising expenses or even support their children’s first purchase.

These are not abstract policy debates—they are actionable options that real families are already using to navigate today’s market. The conversation about 50-year amortizations reflects a shared anxiety about affordability, but the solutions may be closer than most people think.

If you’re wondering what mix of strategies might work for your situation, MorningLee.ca is a place to start exploring.

-

Weak August Jobs Report in Canada Bodes Well for a BoC Rate Cut

Today’s Labour Force Survey for August was weaker than expected, indicating an excess supply in the labour market and the economy. Employment fell by 66,000 (-0.3%) in August, extending the decline recorded in July (-41,000; -0.2%). The employment decrease in August was mainly due to a decline in part-time work (-60,000; -1.5%). Full-time employment was little changed in August, following a decrease in July (-51,000; -0.3%).

The employment rate—the proportion of the working-age population who are employed—fell 0.2 percentage points to 60.5% in August, the second consecutive monthly decline. The employment rate has been on a downward trend since the beginning of the year, falling 0.6 percentage points from January to August.

The number of self-employed workers fell by 43,000 (-1.6%) in August. Self-employment has trended down in recent months, offsetting gains recorded in the second half of 2024 and in early 2025.

The private sector lost 7,500 jobs last month, while the public sector shed 15,000. Regionally, the provinces of Ontario, Alberta and British Columbia led losses.

Those who were unemployed in July continued to face difficulties finding work in August. Just 15.2% of those who were unemployed in July had found work in August, lower than the corresponding proportion for the same months from 2017 to 2019 (23.3%) (not seasonally adjusted).

The participation rate—the proportion of the population aged 15 and older who were employed or looking for work—fell by 0.1 percentage points to 65.1% in August.

From May to August, the Labour Force Survey (LFS) collects labour market information from students who attended school full-time in March and who intend to return to school full-time in the fall.

The unemployment rate for returning students stood at 16.9% in August, similar to the rate observed 12 months earlier (16.3%) (not seasonally adjusted).For the summer of 2025 overall (the average from May to August), the unemployment rate for returning students aged 15 to 24 was 17.9%. This was the highest since the summer of 2009 (18.0%), excluding the pandemic year of 2020. The unemployment rate for returning students has increased each summer since 2022 (when it was 10.4%).

The unemployment rate among returning students in the summer of 2025 was higher for men (19.2%) than for women (16.8%).

Employment decreased in the professional, scientific, and technical services sector in August (-26,000; -1.3%), following five months of little change. Despite the monthly decline, employment in the industry was up 36,000 (+1.8%) compared with 12 months earlier.

Employment in transportation and warehousing fell by 23,000 (-2.1%) in August, offsetting a similar-sized increase in July. On a year-over-year basis, employment in the industry was little changed in August.

Employment change by industry in August 2025

Fewer people were working in manufacturing in August, down 19,000 (-1.0%). Compared with the recent peak of January 2025, employment in manufacturing has declined by 58,000 (-3.1%).

On the other hand, employment rose in construction (+17,000; +1.1%) in August, offsetting most of the decline in July (-22,000; -1.3%). Employment in construction has recorded little net variation since the beginning of the year, and the increase in August was the first since January.

Employment in Ontario decreased by 26,000 (-0.3%) in August. Compared to the recent peak in February 2025, employment in the province decreased by 66,000 (-0.8%) in August. The unemployment rate in Ontario declined by 0.2 percentage points to 7.7% in August, as the number of people searching for work decreased.

Since the beginning of the year, regions of Southern Ontario have faced an uncertain economic climate, brought on by the threat or imposition of tariffs, including on motor vehicle and parts exports. Across Canada’s 20 largest census metropolitan areas, the highest unemployment rates in August were in Windsor (11.1% compared with 9.1% in January), Oshawa (9.0% compared with 8.2% in January) and Toronto (8.9% compared with 8.8% in January) (three-month moving averages).

In British Columbia, employment decreased by 16,000 (-0.5%) in August, marking the second consecutive monthly decline. Losses in the month were mainly among core-aged men (-13,000; -1.2%). The unemployment rate in British Columbia rose 0.3 percentage points to 6.2%.

In Alberta, employment fell by 14,000 (-0.6%) in August, also the second consecutive monthly decrease. The most significant declines in the month were in manufacturing and in wholesale and retail trade. The unemployment rate in Alberta rose 0.6 percentage points to 8.4% in August, the highest rate since August 2017 (excluding 2020 and 2021).

Unemployment rate by province and territory, August 2025

Unemployment rates highest in southern Ontario census metropolitan areas

Employment also declined in New Brunswick (-6,500; -1.6%), Manitoba (-5,200; -0.7%), and Newfoundland and Labrador (-3,200; -1.3%) in August. Meanwhile, Prince Edward Island experienced an employment gain of 1,100 (+1.2%).

Employment held steady for a second consecutive month in Quebec in August. The number of people looking for work increased by 24,000 (+9.0%), pushing the unemployment rate up 0.5 percentage points to 6.0%.

Total hours worked were little changed in August (+0.1%) and were up 0.9% compared with 12 months earlier.

Average hourly wages among employees increased 3.2% (+$1.12 to $36.31) on a year-over-year basis in August, following growth of 3.3% in July (not seasonally adjusted).

Bottom Line

The two-year government of Canada bond yield fell about four bps on the news, while the loonie weakened. Traders in overnight swaps fully priced in a quarter-point rate cut by the Bank of Canada by year-end, and boosted the odds of a September cut to about 85%.

The Bank of Canada has made it clear that it will focus on inflation more than on increasing slack in the economy, and a September cut may still hinge on the consumer price index release, which is due a day before the rate decision.

The August US nonfarm payrolls report was also released this morning, showing that job growth stalled while the unemployment rate rose slightly to 4.3%. Several sectors, including information, financial activities, manufacturing, federal government and business services, posted outright declines in August. Job growth was concentrated in the healthcare and leisure and hospitality sectors.

Markets expect the Fed to cut rates by 25 basis points on September 17. Fed Chair Jay Powell has been under massive pressure from the White House to do so. Barring a meaningful rise in August core inflation measures, the Fed will resume cutting rates.

Dr. Sherry Cooper