Buying Property in Vancouver Residential – Vancouver Best Realtor – Morning Lee

Buying property in Vancouver is not an easy job, but I can make it easier for you. We have three different program options tailored for different people. I believe one of them will be a good fit for you.

Self Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and Subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Semi-Self Service Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and Accepted Offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement for you

- You can arrange your own travelling to open houses and showings

- Familiar with internet

- Know local laws very well

- Know real estate market very well

- Know the community very well

- Funds are ready or will be ready

Benefit For You

- Cash Bonus, buyer rebate, To You after Closing

Full Service Buyer Program

Services include the followings

- First Time Consulting

- Open House Showing

- Arranging Private Showing

- General Consulting

- Offer Strategy Consulting

- Writing an offer

- Negotiating and accepted offer

- Subjects Consulting and subjects removal

- Completion Consulting

- Possession Consulting

Requirement For You

- Funds are ready or will be ready

Benefit For You

- Full service for purchasing your dream home

This option is a traditional classic service. But most people don’t need all the services. Which is why we offer other options.

Self-Service Buyer Program for Buying Property in Vancouver

Buying Property in Vancouver is a very simple and easy job for some experienced and skilled people – for example, real estate investors, former Realtors, or those who have experiences buying properties in Vancouver, or those who own multiple properties. For these people, we offer only essential services, saving time for you and us. This way, you will receive a large cash bonus, buyer rebate, after closing, which comes from our buyer agent commission.

However, please note that some listing agents set conditions regarding the buyer agent’s commission. For example, if the buyer agent does not attend an open house or private showing, the commission may be reduced significantly—sometimes to as low as $500.

In such cases, either you must avoid those listings, or there will be no cash bonus (buyer rebate) available to you

For more information about our Self-Service Buyer Program, please contact us directly. contact us.

Semi-Self Service Buyer Program for Buying Property in Vancouver

Some buyers don’t need full service but may not feel entirely comfortable with the self-service buyer program. For those clients, we provide essential services along with a few additional supports. This approach still saves time, which is why you can also receive a cash bonus (buyer rebate).

That said, please understand the same limitations apply: some listing agents require the buyer agent’s presence at showings or open houses. If those conditions are not met, the buyer agent’s commission may be reduced to a small amount, such as $500. In those cases, either avoid such listings, or a rebate cannot be provided.

For more information about our Semi-Self-Service Buyer Program, please contact us directly. contact us.

Full Service Buyer Program for Buying Property in Vancouver

As the name suggests, the Full-Service Buyer Program includes all services typically provided by a buyer’s agent. This is especially suitable for newcomers or anyone who may not feel confident navigating the self-service or semi-self-service programs.

With this option, we handle everything for you—making the home-buying process as smooth and stress-free as possible.

For more information about our Full Service Buyer Program, please contact us directly. contact us.

If you need mortgage, please contact us for our mortgage servcie

Another website built by WealthDao Consulting. For E-Commerce Consulting, Digital Marketing Consulting, Profit Consulting, please visit WealthDao Consulting

-

Helping Family Members Buy Homes: A Living Inheritance Through Reverse Mortgage

For many families, supporting the next generation in buying real estate has become both a dream and a challenge. Housing prices keep climbing, down payments feel heavier than ever, and traditional financing doesn’t always offer the flexibility people need. This is where a little-known tool can make a big difference: using a reverse mortgage as a form of living inheritance.

A living inheritance simply means parents or grandparents provide financial support while they are still alive, instead of waiting until an estate is transferred. For families, this approach can be life-changing. Imagine helping your child secure the down payment for a first home, or giving them the freedom to invest in a property they couldn’t otherwise reach—without needing to sell your own investments or create an unexpected tax bill.

Here’s how it works. Many homeowners are asset-rich but cash-poor. They may not have liquid assets, or may not qualify for a traditional mortgage or a home equity line of credit (HELOC). A reverse mortgage opens another door: it allows homeowners to release equity directly from their primary residence. The funds are tax-free and, most importantly, payment-optional. That means no mandatory monthly principal and interest obligations, keeping financial stress low.

Why does this matter? Because gifting from taxable investments often triggers capital gains tax and reduces long-term savings. By borrowing against the home, families can often lower their overall cost while still passing on meaningful support. It’s not about spending the house; it’s about using existing equity as a financial tool, so parents can help their children today while still enjoying the home they love.

This strategy is increasingly seen as a way to balance personal retirement needs with the desire to give. Instead of selling off investments or downsizing too soon, a reverse mortgage can act as a flexible, cost-efficient cushion that aligns family goals with financial reality.

For those curious about practical examples, the concept is explored further in Reverse mortgages: 55+? A cushion against the rising cost of living,

When it comes to real estate decisions—whether buying, selling, or planning financing options—it helps to know all the tools available. MorningLee.ca is where knowledge and opportunity meet.

-

Turning Home Equity Into Opportunity: Why More Canadians Are Exploring Reverse Mortgages

For many homeowners, the family house is more than just a roof overhead—it is often their largest single asset. Over time, as mortgages are paid down and property values rise, the equity in a home can quietly grow into a powerful financial tool. Increasingly, Canadians are discovering ways to unlock that equity to achieve goals that once seemed out of reach: buying a vacation property, helping adult children enter the market, or strengthening retirement income.

Reverse Mortgage Basics

A reverse mortgage is designed specifically for homeowners aged 55 and older. Unlike a traditional mortgage, it does not require mandatory monthly principal or interest payments. Instead, repayment is deferred until the borrower sells the home, moves, or passes away. The loan amount is determined by several factors including the homeowner’s age, property value, and location. Because there are no mandatory payments, borrowers often see their Total Debt Service ratio (TDS) reduced—an important factor when lenders evaluate overall borrowing capacity.

For those who want to dig deeper into how reverse mortgages can cushion against rising living costs, a detailed overview is available here: Reverse mortgages: 55+? A cushion against the rising cost of living.

Applications Beyond Retirement

Traditionally, reverse mortgages have been seen mainly as a retirement planning tool. But in today’s real estate market, some homeowners are leveraging them for broader purposes. For example, funds released from a principal residence can be used to:

- Purchase a second home or vacation property, either outright or in combination with a traditional mortgage.

- Invest in a rental property to generate supplemental income.

- Support lifestyle choices such as downsizing at the right time without rushing to sell in a slower market.

Because reverse mortgages do not impose the same monthly repayment obligations, homeowners may find themselves eligible for additional borrowing opportunities that would otherwise be out of reach.

Balancing Investment and Risk

Using home equity as leverage can open doors, but it comes with important considerations. Tax implications—such as capital gains on second properties or reporting rental income—need careful planning. Market risks, including price fluctuations and potential vacancies, also play a role. On the other hand, for those with a long-term horizon, real estate remains a tangible asset that can diversify overall retirement strategy.

A Smarter Approach to Real Estate Planning

What makes these strategies appealing is flexibility. Some homeowners choose to hold onto their existing property while purchasing a new one, postponing the sale until market conditions align with their goals. Others appreciate the low prepayment penalties available in certain reverse mortgage products, giving them freedom to adjust plans as life changes.

Real estate decisions—whether buying, selling, or financing—are rarely one-size-fits-all. They require careful evaluation of financial position, lifestyle goals, and long-term outlook. For many Canadians, reverse mortgages have quietly become a tool worth considering in that equation.

To explore more insights and options tailored to your situation, visit MorningLee.ca.

-

Tariff Turmoil Takes Its Toll

Statistics Canada released Q2 GDP data, showing a weaker-than-expected -1.6% seasonally adjusted annual rate, in line with the Bank of Canada’s forecast, but a larger dip than the consensus forecast. The contraction primarily reflected a sharp decline in exports, down 26.8%, which reduced headline GDP growth by 8.1 percentage points. Business fixed investment was also weak, contracting 10.1%, mainly due to a 32.6% decline in business equipment spending.

Exports declined 7.5% in the second quarter after increasing 1.4% in the first quarter. As a consequence of United States-imposed tariffs, international exports of passenger cars and light trucks plummeted 24.7% in the second quarter. Exports of industrial machinery, equipment and parts (-18.5%) and travel services (-11.1%) also declined.

Amid the counter-tariff response by the Canadian government to imports from the United States (which has now been rescinded), international imports declined 1.3% in the second quarter, following a 0.9% increase in the previous quarter. Lower imports of passenger vehicles (-9.2%) and travel services (-8.5%; primarily Canadians travelling abroad) were offset by higher imports of intermediate metal products (+35.8%), particularly unwrought gold, silver, and platinum group metals.

Export (-3.3%) and import (-2.3%) prices fell in the second quarter, as businesses likely absorbed some of the additional costs of tariffs by lowering prices. Given the larger decline in export prices, the terms of trade—the ratio of the price of exports to the price of imports—fell 1.1%.

But the report was not all bad news. Consumer resilience was also evident. Household consumption spending accelerated in Q2. Personal spending rose 4.5% compared to 0.5% in Q1. Government spending also notably contributed to growth.

An improvement in housing activity also added to economic activity. Residential investment grew at a firm rate of 6.3%, compared to a decline of 12.2% in the first quarter of the year.

Final domestic demand rose 3.5% annualized, reflecting resilience and perhaps Canadians’ boycott of US travel or US products. However, income growth was up just 0.7% year-over-year (at an annual rate), which pulled the savings rate down one percentage point to 5.0%, potentially hampering consumers’ ability to continue their spending.

Inventories of finished goods and inputs to the production process increased by 26.9%, reflecting the Q1 stockpiling of goods that would be subject to future tariffs.

While Q2 was soft, June GDP was arguably more disappointing at -0.1% m/m, two ticks below consensus. Manufacturing was the surprise, falling 1.5%. Services were mixed, with gains in wholesale and retail offsetting some broader weakness. The July flash estimate was +0.1% (on the firmer side, given some of the soft data thus far), but the June figure makes it clear that the final print can be quite different.

The Bank had Q2 GDP at -1.5% in their July Monetary Policy Report, so the miss was minor. And, the strength in domestic demand highlights the economy’s resilience. One negative is that Q3 is tracking softer than their +1% estimate (closer to +0.5%), but it’s still very early, and things can change materially.

Bottom Line

The odds are no better than even for the Bank of Canada to cut rates when they meet again on September 17. There are two key data releases before then — the August Labour Force Survey, released August 5, a week from today, and the August CPI release on September 16. We would have to see considerable weakness in both reports to trigger a Canadian rate cut next month.

A Fed rate cut is far more likely, as telegraphed by Chair Jay Powell at the annual Jackson Hole confab. The battle between the White House and the Fed has intensified with President Trump’s firing of Governor Lisa Cook, the first Black woman on the Board and a Biden appointee. If Trump were to succeed, it would enable him to appoint a majority of the Federal Reserve Board, potentially allowing him to dictate monetary policy.

Trump wants significantly lower interest rates in the US, but even if he succeeds, only shorter-term rates would decline. The loss of Fed independence could lead to higher, longer-term interest rates, which could likely result in higher fixed mortgage rates in Canada. Moreover, inflation pressures could intensify, leading to continued upward pressure on bond yields and diminishing the potential appeal of floating-rate mortgage loans.

Dr. Sherry Cooper

-

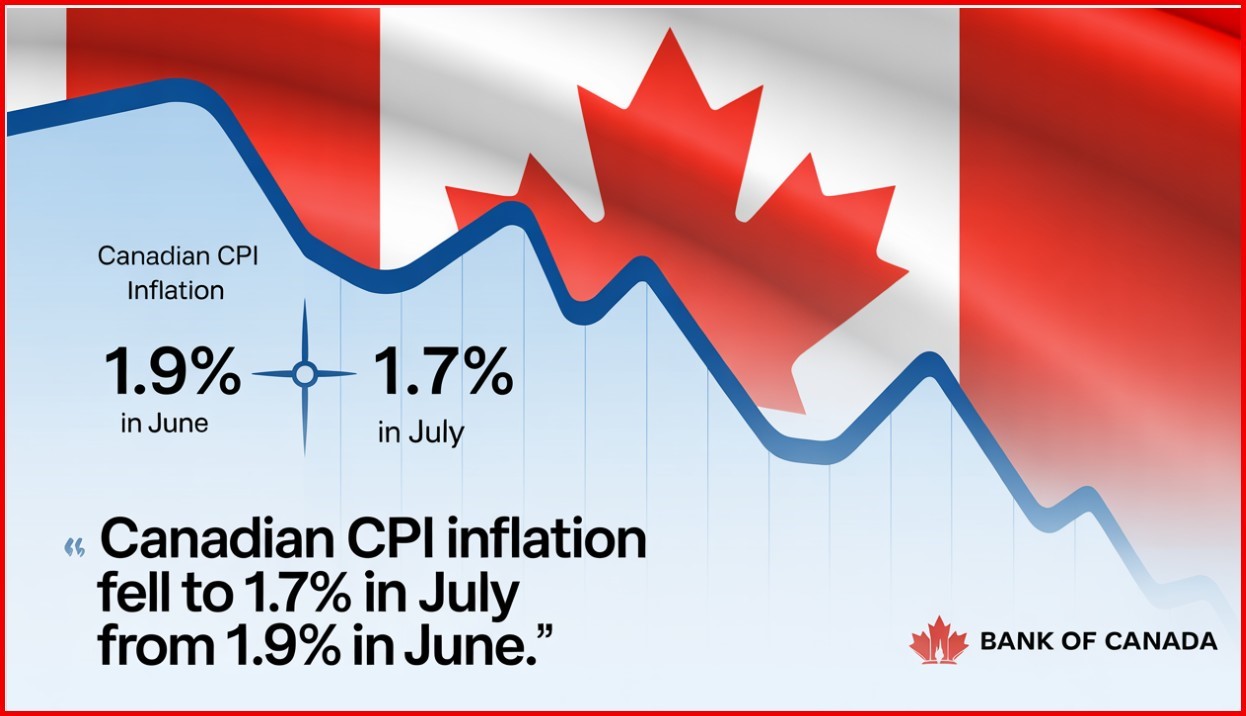

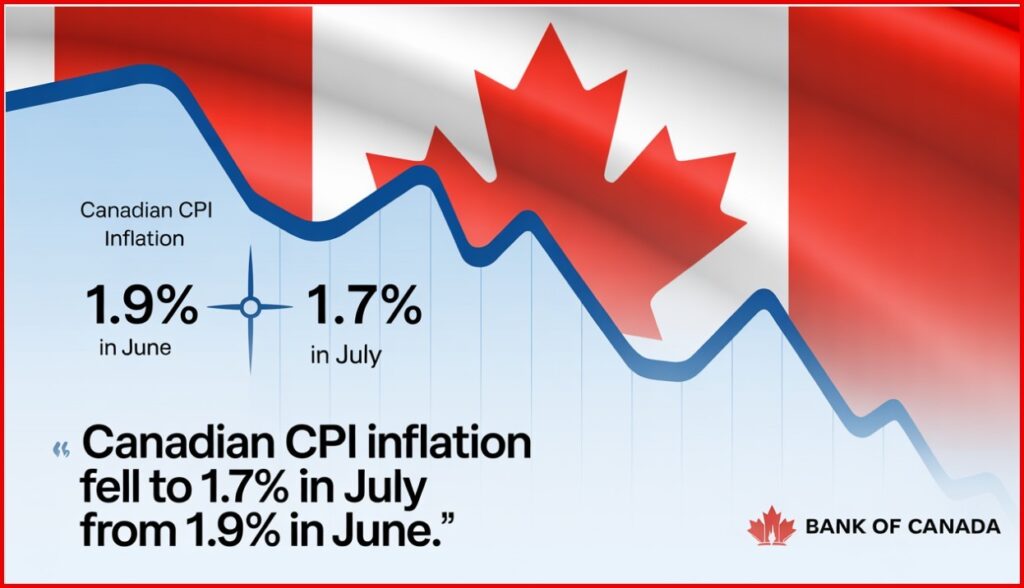

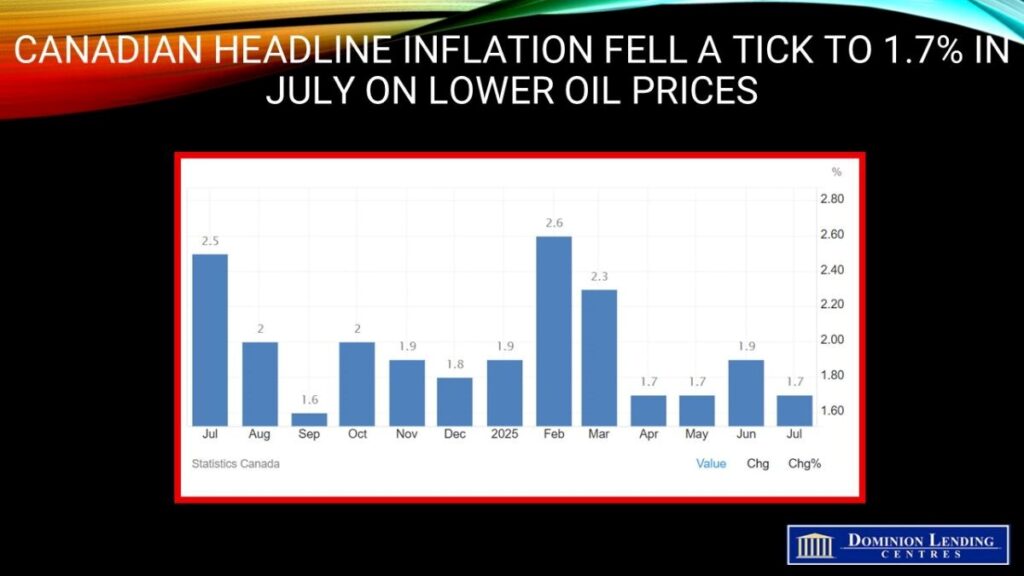

CPI Report Shows Headline Inflation Cooling, But Core Inflation Remains Troubling

Canadian consumer prices decelerated to 1.7% y/y in July, a bit better than expected and down two ticks from June’s reading.

Gasoline prices led the slowdown in the all-items CPI, falling 16.1% year over year in July, following a 13.4% decline in June. Excluding gasoline, the CPI rose 2.5% in July, matching the increases in May and June.Gasoline prices fell 0.7% m/m in July. Lower crude oil prices, following the ceasefire between Iran and Israel, contributed to the decline. In addition, increased supply from the Organization of the Petroleum Exporting Countries and its partners (OPEC+) put downward pressure on the index.

Moderating the deceleration in July were higher prices for groceries and a smaller year-over-year decline in natural gas prices compared with June.

The CPI rose 0.3% month over month in July. On a seasonally adjusted monthly basis, the CPI was up 0.1%.

In July, prices for shelter rose 3.0% year over year, following a 2.9% increase in June, with upward pressure mostly coming from the natural gas and rent indexes. This was the first acceleration in shelter prices since February 2024.

Prices for natural gas fell to a lesser extent in July (-7.3%) compared with June (-14.1%). The smaller decline was mainly due to higher prices in Ontario, which increased 1.8% in July after a 14.0% decline in June.

Rent prices rose at a faster pace year over year, up 5.1% in July following a 4.7% increase in June. Rent price growth accelerated the most in Prince Edward Island (+5.6%), Newfoundland and Labrador (+7.8%) and British Columbia (+4.8%).

Moderating the acceleration in shelter was continued slower price growth in mortgage interest cost, which rose 4.8% year over year in July, after a 5.6% gain in June. The mortgage interest cost index has decelerated on a year-over-year basis since September 2023.

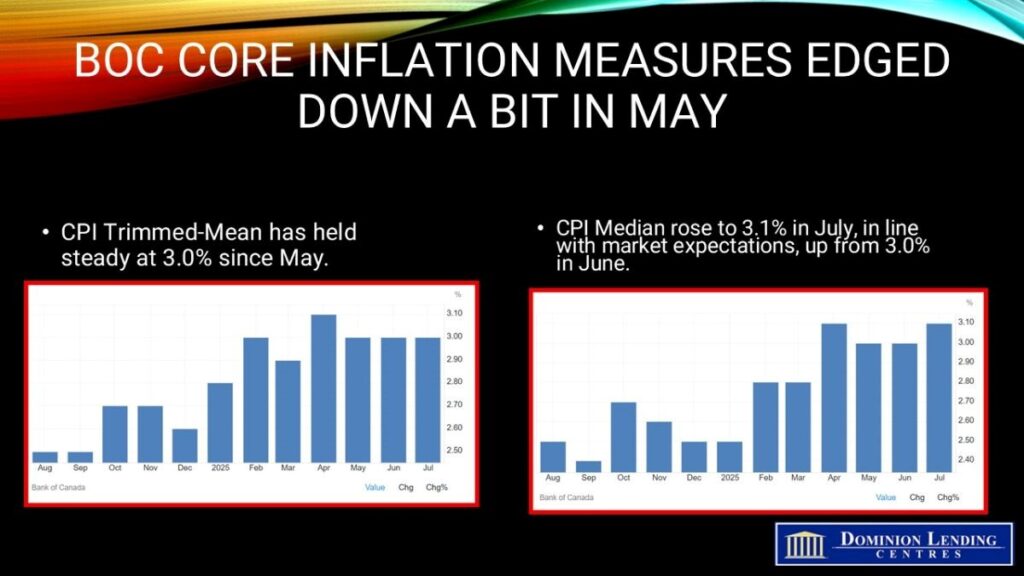

The Bank of Canada’s two preferred core inflation measures accelerated slightly, averaging 3.05%, up from 3% in May, and above economists’ median projection. Traders see the continued strength in core inflation as indicative of relatively robust household spending.

There’s also another critical sign of firmer price pressures: The share of components in the consumer price index basket that are rising by 3% or more — another key metric the central bank’s policymakers are watching closely — expanded to 40%, from 39.1% in June.

CPI excluding taxes eased to 2.3%, while CPI excluding shelter slowed to 1.2%. CPI excluding food and energy dropped to 2.5%, and CPI excluding eight volatile components and indirect taxes fell to 2.6%.

The breadth of inflation is also rising. The share of components with the consumer price index basket that are increasing 3% and higher — another key metric that the bank’s policymakers are following closely — fell to 37.3%, from 39.1% in June.

Bottom Line

With today’s CPI painting a mixed picture, the following inflation report becomes more critical for the Governing Council. The August CPI will be released the day before the September 17 meeting of the central bank. There is also another employment report released on September 5.

Traders see roughly 84% odds of a Federal Reserve rate cut when they meet again on Sept 17–the same day as Canada. Currently, the odds of a rate cut by the BoC stand at 34%. Unless the August inflation report shows an improvement in core inflation, the Bank will remain on the sidelines.

Dr. Sherry Cooper -

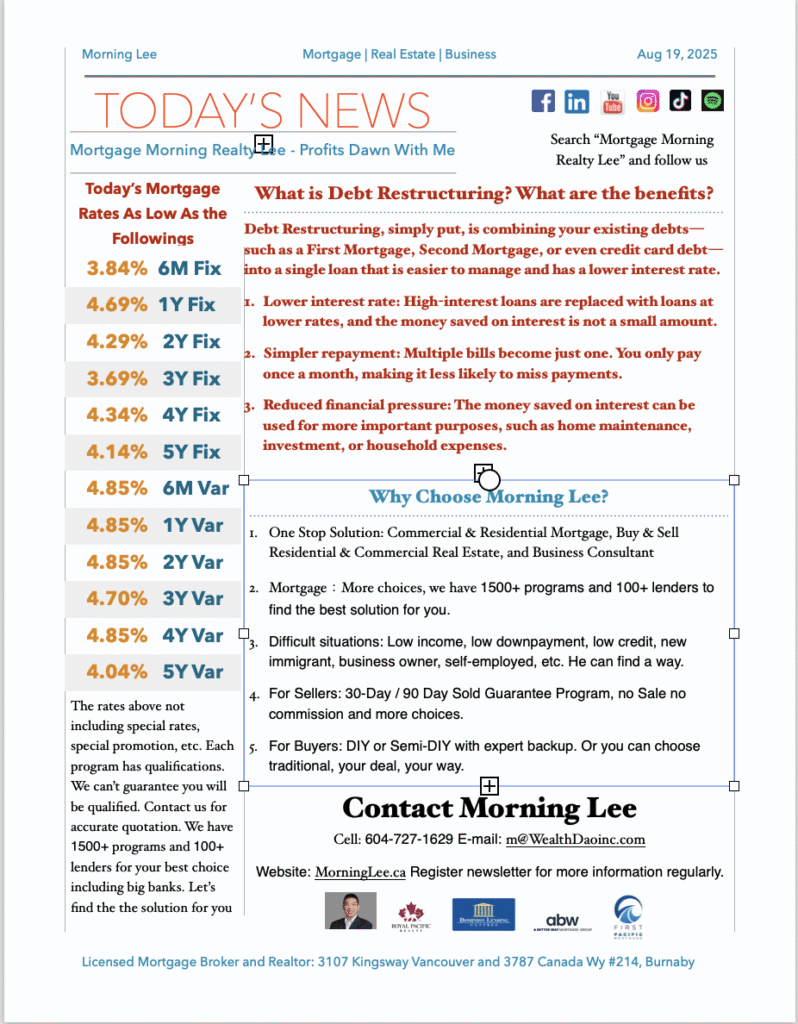

Today’s Lowest Rates Up and Down at The Same Time

The 3-year fixed rate has hit a new low at 3.69%, but the 5-year lowest fixed rate has gone up. The upward and downward pressures are still fiercely competing.

If you are considering a loan in the near future, you need to pay close attention to rate changes and seize the timing to lock in a contract that is favourable to you.

If your current rate is relatively high, 5% or even over 6%, you need to carefully calculate and compare: the penalty for breaking your current contract versus the money saved by switching to a lower rate — which one is more cost-effective. An extra surprise may even make you scream!

Even banks say no, for low income, low credit, low down pay, Morning will find a way, for you.